What is an EMI Scheme?

An EMI scheme (Enterprise Management Incentives) is one of the UK tax-efficient share option plans. It focuses on growing companies that want to reward and incentivise their employees flexibly.

It has been very popular among small to mid-sized UK businesses in the UK, where it is seen as a key reason behind the country’s success as a hub for start-ups.

In this EMI scheme explained article, we’ll explain the following items. Skip to the relevant section:

- How does an EMI work?

- EMI scheme example (+EMI tax calculation)

- Are EMI schemes worth it?

- EMI qualifying conditions

- What happens when an EMI disqualifying event occurs

- Setting up an EMI scheme

How does an EMI work?

EMIs work by giving employees the option (i.e. the right) to buy shares in your company at an agreed price after meeting certain requirements, e.g. performance and/or service period. The agreed price can be the AMV at the time of grant or a discounted value.

When your company succeeds and the share value increases, staff can sell their shares at a (hopefully high) profit in a tax-advantaged way. Check the example below to see how EMI tax is calculated and how much tax can be saved.

EMI scheme example (+EMI tax calculation)

1. At the time of grant:

Your employee, Lewis, is granted an EMI option to acquire a 3% shareholding in your company for its market value of £15,000.

2. At the time of exercise:

After 4-year vesting, he exercises the option when the shares are worth £150,000.

(when exercise price = AMV at grant)

Note: Income Tax or National Insurance would be paid if a participant was given a discount on the market value, but this is only applied to the difference between the exercise price paid by the participant paid and the share value at the grant date.

3. At the time of sale:

Lewis eventually sells the shares for £200,000. He has to pay CGT within that tax year on the gain which is the difference between sale proceeds and exercise price:

From 6 April 2019 onwards, the holding period from the date of grant will be extended to 2 years from 1 year. If the 2-year holding period is met, participants will only need to pay 10% CGT when selling the EMI shares. If not, participants will need to pay 20% CGT.

See the comparison below to see how much tax your employees can save.

4. EMI scheme Tax vs Unapproved option scheme Tax

| Approved scheme (EMI) | Unapproved scheme | |

|---|---|---|

| Shareholder | Lewis, on £60K | Elizabeth, on £60K |

| Share value at grant (Exercise Price) | £15,000 | £15,000 |

| Share value at exercise date (4 year after grant date) | £150,000 | £150,000 |

| Taxable earnings at exercise | N/A | £135,000 (£150,000 – £15,000) ➜ income tax rate: 40% |

| Sale price (2 years after exercise date) | £200,000 | £200,000 |

| Gain | £185,000 (£200,000 – £15,000) ➜CGT: 10% |

£50,000 (£200,000 – £150,000) ➜CGT: 20% |

| Tax Summary | Exercise: £0 Sale: £185,000 x 10% = £18,500 ➜Total: £18,500 |

Exercice: £135,000 x 0.4 =£54,000 Sale: £50,000 x 20% = £10,000 ➜Total: £64,000 |

So, Lewis ended up paying £45,500 less in tax than Elizabeth.

Are EMI schemes worth it?

Benefits of EMI for employers:

Attract and retain talent:

it is often used to attract key talent because these sorts of businesses can’t match the salaries at more established enterprises. The generous tax benefits and terms from HMRC make EMIs less of a financial risk for employees to take less salary vs more share options.

It offers the potential for large profits if the business becomes successful.

Improve productivity:

A lot of studies have proven that employee-owners generally have lower turnover and absenteeism, more company pride and loyalty and greater willingness to work hard, and make more suggestions to improve performance.

Corporation tax relief:

The relief is the difference between the agreed original share value at the time of the award and the market value at the time the option is exercised (Source: UK)

Flexible in the scheme design:

Unlike all-employee share schemes, an EMI scheme can be offered only to the most valuable groups. You as an employer can also decide exercise price (i.e. purchase price), the number of EMI options to be granted, vesting criteria, termination rules etc

Our EMI platform allows you to easily create a scheme design, add participants, grant options, approve option exercises and more in one seamless system. Talk to us

Benefits of EMI for employees:

Build wealth:

At the larger level, an EMI share scheme allows employees to build their financial portfolio more efficiently than through regular income and have a more diversified financial portfolio

EMI Tax benefits:

As explained, there is no tax at grant. At exercise, no income tax is due if the exercise price is equal to or greater than AMV at grant. If you sell the shares, you may be liable to CGT but the rate is typically lower than your income tax rate. (Learn more EMI tax benefits here)

So far so good! Does an EMI scheme seem to be a good plan for your business? If it seems so, you now should carefully check if you can qualify for it

EMI qualifying conditions

There are some straightforward conditions that your company and employees have to meet in order to qualify for an EMI and thus receive the benefits. Check out our full list of EMI qualifications or the key requirements below to see if you qualify for it:

EMI scheme requirements – Companies:

- Have assets of £30 million or less.

- Offer up to a maximum of £250,000 of share value per employee and £3 million for the whole company.

- Is not owned by another entity.

- Have fewer than 250 full-time employees.

- Offer options that must be exercisable within 10 years.

- Is not in any of the ‘excluded activities’ including banking, insurance, farming, property, legal services, hotels and care homes, and shipbuilding.

EMI scheme requirements – Employees:

- Work at least 25 hours per week for the company.

- Own less than 30% of the company.

- Learn more here

So, what happens when an EMI disqualifying event occurs?

An EMI disqualifying event is a change or development that can disqualify an option from EMI relief. This type of event can be related to the company or its employees.

If a disqualifying event occurs, option holders will have 90 days from the time of the event to exercise any options in the EMI scheme to maintain the EMI tax benefits. If the EMI option is not exercised within 90 days, there will be a tax charge on exercise ( on the increase in value of the shares between the date of the disqualifying event and the date of exercise). Check our full EMI disqualifying event list.

Relating to the company

If an EMI disqualifying event involves the company, it means you will no longer be able to issue EMI options to new or current employees. Some examples are:

- Hire more than 249 employees

- Have assets over £30m

- Is not independent anymore

- no longer meets the trading activities requirement

Relating to employees

If an EMI disqualifying event involves the employees, it means the employees will no longer be able to participate in the EMI scheme. Some examples are:

- Work less than 25 hours per week

- Own more than 30% of the company shares

- Leave the company

The onus is on the individual companies to continually analyse their plans, inform HMRC of any changes and therefore minimise the risks of participants not receiving the rewards they had been promised.

Setting up an EMI scheme

- Do you qualify for EMI (business, employees and options)?

Go back to the ‘’EMI qualifying conditions’’ section to check the scheme requirements.

- Get an HMRC-approved EMI valuation

Although getting an HMRC-approved EMI valuation isn’t compulsory, it’s wise to do so because it can make sure the tax benefits of the EMI scheme will apply, provided all other processes and formalities are followed.Otherwise, you could run the risk of being refused by HMRC to grant the relevant tax benefits when it comes to benefitting from the share options. You’d want your EMI valuation as low as possible so the exercise price can be low enough to maximise the gain when the shares are sold (Gain = Sale price minus exercise price).

Apply here ➜

(Note: Approved EMI Scheme valuations will remain valid for 90 days from the date HMRC approves it.)

- Conclude the scheme rules & agreements with employees

Once you have your valuation, you can conclude your share option rules and agreements with employees. e.g Vesting schedule, types of options, number of shares being granted, if the employee leaves, can they still exercise their shares?

- Issue share options

You should do it within 90 days of the valuation since the approved EMI valuation remains valid for 90 days from the date HMRC approves it.

Our EMI platform allows you to easily create a plan, set vesting criteria and termination rules, add participants, grant options and more. Talk to us

Contact Us

5. Register the scheme with HMRC

Check the next section

Register EMI scheme with HMRC

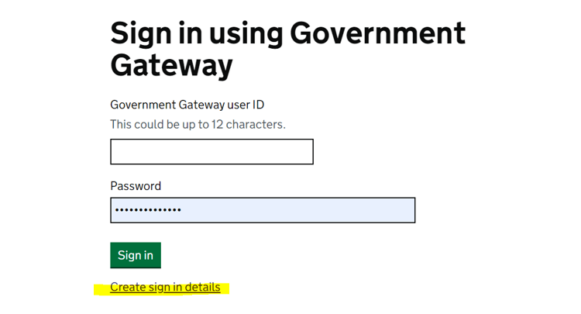

- Sign in to HMRC online services:

You’re required to create a Government Gateway user ID and password if you don’t have them.

- Add corporation tax & PAYE:

You must add a tax to your business tax account to manage it online. If you don’t have an account with HMRC online services for PAYE, check out this video to learn how to do it step by step. Note, it may take a few weeks to set this up

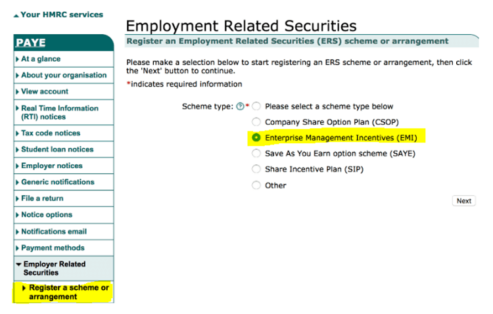

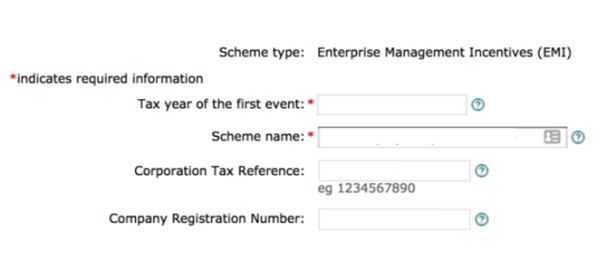

- Register a scheme in PAYE: Once you’re in the PAYE system, select ‘’Register a Scheme or arrangement’’, then ‘’ Enterprise Management Initiatives (EMI).’’

- Enter the details: Now, you need to enter the details for your scheme, namely tax year, scheme name, corporate tax reference and company registration number.

- View the summary and confirm: After typing in all details, you can click ‘’Next’’ to view the summary of your scheme. If all details are correct, click ‘’Confirm’’ to go to the declaration page.

- Declare the information provided is correct: Tick the declaration checkbox and click ‘Next’ to confirm your EMI scheme registration.

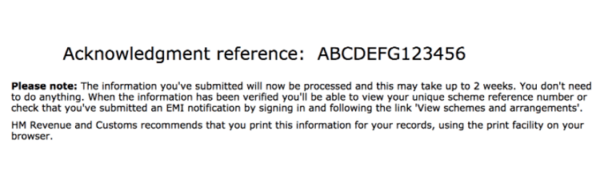

- Done & Wait for the scheme reference no: Congrats! You’ve registered the scheme. Within 7 days of registering your scheme, you’ll receive a scheme reference number. You’ll need to log into ERS online services and ‘View schemes and arrangements’ to see your reference number. When you have it, you can notify HMRC about the grant (step 8).

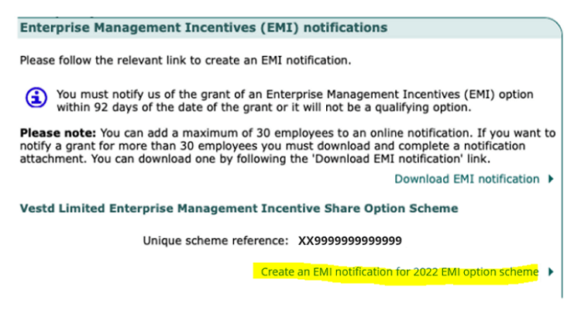

- Notify HMRC within 92 days:

Now, you need to submit an EMI notification within 92 days of the date of the EMI option grant, or you risk losing any tax benefits for you and your employees (i.e. a disqualifying event). You go do it by logging back into your HMRC account with the same Government Gateway user ID and password. Once you’re in the ERS system, select ‘’In Year Notification’’ and enter the date the options were granted. Next, you’ll see ‘’Create an EMI notification for [your scheme name]’’. Click on it to continue

- Enter the details: Next, you’ll need to provide some basic information about your scheme, e.g.

– tax year for notification

– option issue date

– employer company details

– EMI share details

– employee details

- View the summary and confirm

- Declare the information provided is correct

- Done

Enterprise Management Incentives Schemes, Simplified

For small and growing company’s an EMI is a brilliant way of attracting, retaining and motivating top talent that may otherwise be out of your financial reach.

However, as with all tax-advantageous incentive plans, there are risks attached. The HMRC needs to ensure that the right companies are benefiting from the scheme and getting the technicalities right can be the difference between a successful plan and an unsuccessful one.

We at Global Shares have gone down this road with clients many times and thus can provide you with all that you need to know about how to set up an EMI scheme for the first time.

Taking advantage of our experts and using our enterprise incentive management software, you can rest assured that you are having all the benefits on offer and continue to do so as you grow as a company.

Please Note: This publication contains general information only and Global Shares is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. The Global Shares Academy is not a substitute for professional advice and should not be used as such. Global Shares does not assume any liability for reliance on the information provided herein.