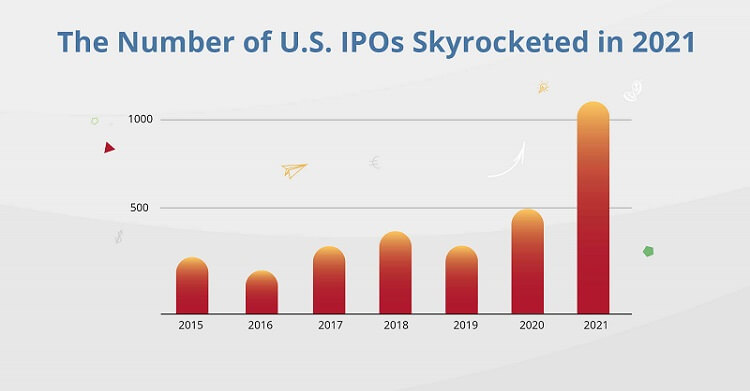

An IPO occurs when a private company initially offers shares of its stock for public sale. It also means a new beginning in a company’s life as a public company. In 2021, the number of companies listed on U.S. exchange increased rapidly that the tally of IPOs hit an annual record just six months into the year.

In this article, we explain what an IPO is, the pros and cons, the process, and how we can support you during your IPO. Skip to the relevant section below:

- What is an IPO?

- Pros and Cons of an IPO

- Process: How does an IPO work?

- How can you judge whether your IPO was a success or not?

- How can Global Shares support you on your journey to an IPO?

- FAQs about an IPO

What is an IPO?

IPO, or initial public offering, refers to the process by which a private company can go public by sale of its stocks to the public. It could be a young company trying to generate some needed revenue or an established company that decides to be listed on an exchange.IPO Examples:

Uber (2019), Airbnb (2020), Monday.com (2021)

The process provides the company with access to raising a lot of money, allowing it to grow and expand. It can take months to complete – the average is 6-9 months, and can cost you 10.5% of gross proceeds on average.

The journey from private to public also means that you’re governed by and bound to an entirely new set of rules and regulations. Public companies don’t just have to answer to investors, you now have an entire group of activist shareholders watching your every move.

Pros and Cons of an IPO

To IPO or not to IPO?

The most important thing to remember about going public is that you don’t have to. A company can continue to operate as a private entity indefinitely, should they choose. Despite the numerous benefits of becoming an IPO, smaller businesses may face several disadvantages that may make them think twice.

Advantages of Going Public

- Fundraising: One of the reasons why companies go public is that they can raise capital quickly from the entire investing public for growth, mergers and acquisitions, or other corporate purposes.

- Increasing Public Awareness: IPO helps increase a company’s exposure, prestige, and public image, which can help the company’s sales and profits.

- Providing Exit Opportunity for Early Stakeholders: IPOs are a way for early stakeholders to transfer their share of a private company by selling their equity to public investors (i.e. cash out of their holdings).

Note: Shareholders are likely restricted from selling their shares in the open market for 90 – 180 days after an IPO (i.e. IPO lock-up period) to help stabilize the stock’s price after the IPO. - Attracting and Retaining Employees: Employers can offer stock benefits to retain employees and attract more talented workers. To make the process of going public as painless as possible, it’s important to consider implementing one or changing your existing employee equity plan during the transition period.

Ready to try our Demo?

Learn more about how to implement or transition your share plan as smoothly as possible.

Request a Demo

Disadvantages of Going Public

- High Costs: Going public can be an expensive and time-consuming process. A company must be able to pay for the generation of financial reporting documents, audit fees, investor relations departments, and accounting oversight committees.

- Less Control Over the Company: Unlike private companies who own 100% control, public companies lose some control over final decisions once the stock is made available to the public.

- Loss of Privacy Rights: A public corporation must make extensive disclosures about business and financial conditions, and other internal matters. These reports will also be available to competitors.

- New Obligations: A public company takes on significant new obligations, such as filing quarterly and annual financial reports with the SEC, keeping shareholders and the market informed.

Other Things to Consider:

- Examine the market’s position: You need to make sure that the market is still hot for your type of product or service, and that the price of your stock is likely to go in the right direction.

- What your company looks like as a public company: Some questions are: What’s the direction of your company at the moment? What are the milestones you’re trying to achieve in the future? Can you achieve these better as a public company? Is the company able to comply with strict regulations, as well as manage complex relationships with public shareholders?

- Public vs Private company: The table below can help you understand the key differences between the two types of companies

| Public Company | Private Company | |

|---|---|---|

| Definition | Sells its registered shares to the general public | Sells its privately held shares to a few investors |

| Trading | Stocks traded on stock exchanges | Stocks traded by a few private investors |

| Reporting Requirements | Required to file quarterly earnings reports (among other things) with SEC | Not required to disclose financial information to anyone |

| Control | Has less control over final decisions | Owns 100% control |

| Source of Funds | Sale of its shares | Private investors e.g. venture capitalists |

| Advantages | Taps into the market by selling more shares | Not required to answer to any stockholder |

| Disadvantages | Adheres to many new regulations | Hard to find more sources of capital |

| Examples | Facebook, Uber, Airbnb, etc | Mars, Fidelity Investments, Bloomberg etc |

| Public Company | Private Company | |

|---|---|---|

| Definition | Sells its registered shares to the general public | Sells its privately held shares to a few investors |

| Trading | Stocks traded on stock exchanges | Stocks traded by a few private investors |

| Reporting Requirements | Required to file quarterly earnings reports (among other things) with SEC | Not required to disclose financial information to anyone |

| Control over Co. | Has less control over final decisions | Owns 100% control |

| Source of Funds | Sale of its shares | Private investors e.g. venture capitalists |

| Advantages | Taps into the market by selling more shares | Not have to answer to any stockholder. |

| Disadvantages | Adheres to many new regulations | Hard to find more sources of capital |

| Examples | Facebook, Uber, Airbnb, etc | Mars, Fidelity Investments, Bloomberg etc |

So, before deciding whether to go public or not, companies must evaluate all the potential advantages and disadvantages that will arise. This usually happens during the early process as the company works with an investment bank to weigh the pros and cons of a public offering and determine if it is in the best interest of the company for that period.

What are the Steps in the IPO Process?

How does an IPO work? Once you make the decision to IPO, you will go through an extensive IPO process. This section will break down the steps to going public, which can take anywhere from six months to over a year to complete.

1. Assemble your IPO Team

IPO teams are formed comprising underwriters, attorneys, certified public accountants (CPAs), and Securities and Exchange Commission (SEC) experts.

- Underwriters (i.e. investment bank): Underwriters play a critical role in IPO. They guide the documentation and due diligence process, set valuation metrics and parameters, distribute shares to investors, and ultimately stabilize trading in the aftermarket.

- Attorneys: They will guide you about the risks and regulations of the IPO transaction, including publicity and disclosure. And they will help you understand the roles of the key regulators, e.g. SEC.

- Accountants: They make your business look better in the eyes of investors and ensure you comply with all guidelines and regulations related to IPO.

2. Conduct Due Diligence & Submit Filings

During this phase, the underwriting team will conduct background research into the company. This ensures that there are no surprises prior to or during the IPO launch that could affect share pricing.

During this workflow, the underwriters will also initiate the registration process with the SEC and complete supporting documents for the IPO.

Serving as the center of every IPO, the S-1 registration statement is the primary document for filing an IPO. It requires information about your business and finances as well as an investment prospectus that allows investors to make informed decisions about whether to invest in the company.

The registration process can be slowed down by several factors such as ‘’Cheap Stock’’ issues (i.e. equity awards issued to employees before an IPO at a value significantly less than the estimated IPO price range provided by the company). To avoid unnecessary disputes, companies should start getting frequent 409A valuations as the IPO approaches to ensure the valuations are in order.

S-1 Filing Timeline:

1. Significant time is needed to fill out the S1 form (Estimated time: over 970 hours on average). It’s then filed with the SEC.

2. It takes the SEC about 30 days to provide initial comments on your S-1 filing.

3. Generally, your responses to their questions range from two weeks (second filing) to a week or less (subsequent filings).

NOTE: You are required to file the initial submission and all amendments on a confidential basis with the SEC no later than 15 days before starting a roadshow.

3. Get your Employees on Board When You IPO

Whether you have an employee stock plan in place or not, it’s important to know the benefits of implementing one or modifying your existing employee equity plan now, pre-IPO.

Early-stage employees and key executives need to be rewarded for their investment in the company’s journey and you also need to buy in from newer employees on the new journey your company will be on. Public companies mean maturity and responsibility and you will want your employees to be on the path with you.

You need to review everything that relates to an equity compensation plan if you have one, and you need to seriously consider introducing one if you don’t. Things to examine include management systems, payroll, HR, accounting, tax, and financial reporting. You will also need a compliance review across your plans and especially so if you have employees across multiple jurisdictions.

It’s appropriate for a public company to review, adjust and enhance existing compensation plans.

4. Go on IPO Roadshow / Marketing

At this stage, while the SEC is reviewing all the documents submitted, the company and underwriters are marketing the shares to institutional investors during the IPO roadshow to generate interest and estimate the demand for the shares.

5. Pick your stock price for IPO

It is important to set your share price (i.e., the price at which the shares will be sold by the issuing company) correctly. As well as the earlier concerns about too low or too high, you need to consider the general principle of giving yourself some wiggle room.

Remember: Under-promise and Over-deliver.

There is no single right answer to how to determine an IPO offer price. It usually can depend on several factors, including company valuation, how much capital the company hopes to raise, roadshow outcomes and market conditions.

Most companies are on the side of caution and underprice – this way there is more demand (and a rising share price) on the offer day.

Facebook IPO Story:

Initially, the company was planning to open with stocks ranging from $28 to $35 per share. However, by the time of the IPO, they changed their plan. The company decided to sell each share at $38 – well above the range they had decided on, and increased the number of shares by 25%.

It led to scores of lawsuits against the company. The shares ended at a low of $17 by the end of the year.

6. Go Public on the Stock Exchange

On the day of IPO, the underwriter will release the initial shares to the public market.

7. IPO Performance and Pacing Yourself

There are two phases that follow the initial offer – stabilization, then transition to market competition.

- Stabilization: It’s a process done by the underwriter to iron out order imbalances through strategic purchasing of shares. This is essential, but it can only occur for a short window of time.

- Transition to Market Competition: The transition to market competition is also performed by the underwriter who can reveal the company’s estimated earnings and valuation. From then on out, your company is fully public.

What’s More…

On your road to an IPO, it’s easy for employers to get distracted by the enormity of the task. You must strike the right balance between managerial focus on the IPO and the daily operations of the company. Things like:

- Keep control of your business: The IPO may be the most important transaction in your company’s history to date, but it’s often only one step along the path to market leadership. So, it’s important to keep an eye on your business to avoid serious decision-making mistakes.

- IPO Communications: A well-thought communication effort, from the earliest moments in the IPO journey, to flotation and beyond, can help to defuse doubt, anxiety, and unsubstantiated speculation. Once the IPO process has been initiated, it’s necessary to explain to employees that they need to be careful about what they say in public settings to avoid innocent comments made to outside parties or journalists.

How can you judge whether your IPO was a success or not?

So, you’ve done it. You’ve officially taken your company public. Now, the question you want to know is: Was my IPO a success? There are two metrics for determining if an IPO was a success – market capitalization and market pricing.

- Market capitalization is the share price multiplied by the total number of the company’s outstanding shares. It needs to be greater than or equal to industry competitors, within 30 days of the IPO.

- Market Pricing is the difference between the offering price and the market capitalization after 30 days. It needs to be less than 20%.

Successful or not, your company is now public. Now, it’s just a matter of leveraging all the new opportunities that your IPO has brought your company.

How can Global Shares Support you on your Journey to an IPO?

At Global Shares, this is a process we are very familiar with. If you’re considering an IPO, or just daydreaming about the day your startup goes public, we can help.

If you’re a private company, you need to have the best equity management – software and administration – if you want to make the transition as smooth as possible.

We can help with online share trading and enable your plan participants and employees to purchase, sell and exercise pre-IPO and then shift to direct to market transactions and share/fund disbursement through Global Shares once pubic. We provide a platform where employees can log in and see the value of what they own in their own currency.

Through Global Shares, you can also communicate with plan participants, gather data, and organize grants, releases, and more.

You can carry out proxy voting and record and track results. You can synchronize data between your system and our platform and create up-to-the-minute reports. We also provide live share price feeds and foreign exchange rates once you IPO.

Contact us today for a no-obligation demo with our team, who’ve walked this path with some of the world’s biggest companies.

FAQs about IPO

Why do companies go public?

Going public helps a company raise substantial capital to invest in future operations, expansion, or acquisitions.

How long does the IPO process take?

It will typically take 6 -9 months for the company to complete its public debut if an IPO is well organized.

What are the steps in the IPO process?

The 7-step IPO process includes 1. Assemble your IPO Team, 2. Conduct Due Diligence & Submit Filings, 3. Get your Employees on Board When You IPO, 4. Go on IPO Roadshow, 5. Picking your stock price, 6. Go Public on the Stock Exchange, 7. IPO performance & pacing yourself

What is an S1 Filing?

Serving as the center of every IPO, S-1 registration statement is the primary document for filing an IPO. It requires information about your business and finances as well as an investment prospectus that allows investors to make informed decisions about whether to invest in the company. Significant time and effort are needed to fill out the S1 form, with the OMB Office estimating an average time of over 970 hours.

IPO vs Direct Listing: What is the difference?

Direct listings eliminate the need for an IPO roadshow or IPO underwriter, which saves the company time and money. It also gives shareholders the opportunity to sell their stake in the company as soon as it goes public (i.e. no lock-up periods).

However, there are risks associated with it because there is no guarantee that the shares will sell and it can be more difficult to protect against volatility.

What does an investment bank do in an IPO?

An investment bank (the underwriter) guides the documentation and due diligence process, sets valuation metrics and parameters, distributes shares to investors, and ultimately stabilizes trading in the aftermarket.

How is the IPO price determined?

This can depend on several factors, including company valuation, how much capital the company hopes to raise, road show outcomes and market conditions.

Please Note: This publication contains general information only and Global Shares is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. The Global Shares Academy is not a substitute for professional advice and should not be used as such. Global Shares does not assume any liability for reliance on the information provided herein.