Commonly used in the USA, Employee Stock Purchase Plans (ESPPs) are widely regarded as one of the most simple and straightforward equity compensation strategies available to businesses today.

There are two major types of ESPP: 1) Qualified ESPP offering tax advantages and 2) Non-qualified ESPP offering flexibility. Before we highlight the distinctions between them, we need to first be clear on the core characteristics of ESPPs.

What is an ESPP?

- The company makes an offer under the plan to its employees.

- There will usually be a maximum percentage of salary that can be used for the purpose of building the savings pot.

- Employees will decide the amount of their net salary to be allocated to the pot.

- At the end of the purchase period, the accumulated contributions are used to purchase shares for the employees, with the agreed discount applied.

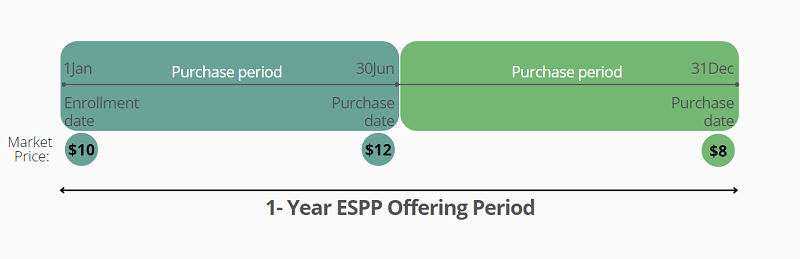

An example of a Lookback Clause

Initial Price: $10

Price on Purchase Date: $12

Discount: 15%

With Lookback | Without Lookback |

|---|---|

Purchase Price: $10 | Purchase Price: $12 |

Actual Purchase Price:

$10 – $1.5 (discount) = $8.5 / share | Actual Purchase Price:

$12 – $1.8 (discount) = $10.2 / share |

Qualified vs Non-qualified ESPP

Now, we can have a look at the key difference between the two types.

An ESPP qualified plan is designed and operates according to Internal Revenue Section (IRS) 423 regulations, whereas a non-qualified ESPP does not meet those criteria.

This means that there is more flexibility in how a non-qualified plan can be designed, but a qualified plan is treated more favorably on taxation as there’s no taxable event when shares are purchased. Indeed, the term ‘qualified’ is used to refer to its tax-advantageous status.

Qualified ESPP | Non-Qualified ESPP |

|---|---|

Contribution made with after-tax dollars | Contribution made with after-tax dollars |

Designed and operates according to Internal Revenue Section (IRS) 423 regulations | Does not meet IRS criteria |

Discount ranges from 0% to 15%, with 15% most used | May offer a discount of more than 15% from the current FMV of the stock |

Approved by shareholders | Not required |

More favorably on taxation | Less favorably on taxation |

Less Flexible | Flexible |

No matter whether you decide to roll out a qualified ESPP or a non-qualified ESPP, you can easily set it up in our equity admin section.

A Closer at Qualified ESPP - Qualifying & Disqualifying Dispositions

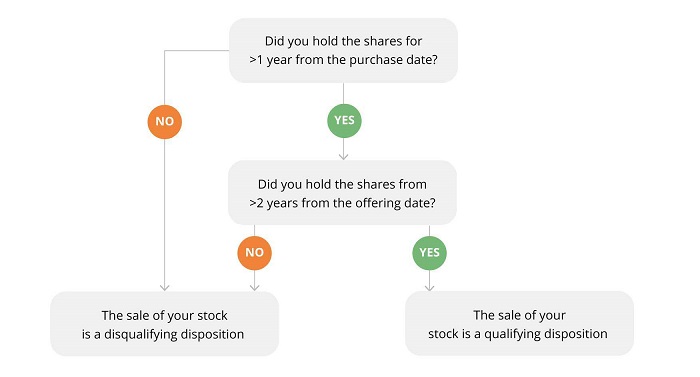

I know what you’re probably thinking, “There are different types of Qualified ESPP, too?” The answer is yes. There’re two classifications of sales for qualified ESPPs: qualifying and disqualifying dispositions.

Does it matter to know the type of sale of your ESPP shares? Yes again because they can have quite different tax implications. Use the flow chart below to quickly help you identify if the sale of your shares is an ESPP qualifying disposition or an ESPP disqualifying disposition.

ESPP Qualifying Disposition: Under this plan, employees purchase stock at a discount from the fair market value, yet do not owe taxes on that discount at the time of purchase.

A qualifying disposition occurs when employees hold their shares for a period of at least two years from the offering date AND at least one year from the purchase date. When you sell your shares after the holding period, the discount is taxed as ordinary income, and the rest of the gains is taxed at the long-term capital gains rate which is usually lower.

ESPP Disqualifying Disposition: Under this plan, you do not owe taxes at the time of purchase. Unlike the plan above, a disqualifying disposition occurs when employees don’t meet the holding period – EITHER hold their shares for a period of fewer than two years from the offering date OR less than one year from the purchase date.

When you sell your shares right away, the short-term gains are taxed typically higher.

• • • Situation 1: Disqualifying Disposition (DD)• • •

Information | – | Initial Price in the offering period

(Start from 01/01/2020) | $20 |

|---|---|

Price on the Purchase Date (06/30/2020) | $25 |

Discount | 15% |

Actual Purchase Price | $17 |

Sales Price (01/20/2021) | $50 |

No. of Shares | 100 |

Sales Commission | $10 |

First, you will pay ordinary income tax on the difference between the actual purchase price ($17) and the price on the purchase date ($25). It is sometimes called ‘’Bargain Element’’

Also, you need to pay taxes on short-term capital gains for any additional profits.

Total Sales Price minus Commission: ($50 x 100) – $10 = $ 4990

Cost [Total Actual Price + Amount in Part A]: $17 x 100 + $800 = $2500

In this scenario, the tax rates on any gains are typically at ordinary income tax rates which are typically higher. You won’t get tax advantages. Now, let’s look at the qualifying disposition situation where you can enjoy ESPP tax benefits.

• • • Situation 2: Qualifying Disposition (DD)• • •

This is a QD situation because you sold your shares at least 1 year from the purchase date AND at least 2 years from the ESPP offering date.

Information | – | Initial Price in the offering period

(Start from 01/01/2017) | $20 |

|---|---|

Price on the Purchase Date (06/30/2017) | $25 |

Discount | 15% |

Actual Purchase Price | $17 |

Sales Price (01/20/2020) | $50 |

No. of Shares | 100 |

Sales Commission | $10 |

- Discount offered by the company : ($20 x 15%) x 100 = $300

- The gain between the actual purchase price (with the discount applied) and the final sale price minus commission : ($50 – $17) x 100 – $10 = $3290

Also, you will need to pay taxes on your ESPP long term capital gains for the gain in excess of the discount received, if any.

Since you held the shares for a long period of time before selling, you can enjoy a lower long-term capital gains tax rate. Congratulations!

Which One is Best - Qualified vs Non-qualified ESPP?

It isn’t possible to objectively rank one form of an ESPP above the other. Qualified and non-qualified can be similar, but they also diverge, and those points of difference don’t necessarily make one better than the other, they simply make them different.

From an employer perspective, the positive outcomes associated with ESPPs are broadly the same, whether qualified or non-qualified. Namely, an ESPP promotes employee ownership and will also help your retention rate.

From an employee perspective, an ESPP can generate substantial returns, which, it goes without saying, will always be attractive. Employees sometimes are attracted by an ESPP qualified plan because the tax isn’t due when they purchase their stock. Their ESPP long term capital gains can also be taxed at a lower rate.

However, a non-qualified plan offers more flexibility, but the relatively less friendly tax regime can make it a harder sell among employees on day one.

If you’ve been curious about all the benefits of ESPPs or employee ownership – or you want to understand how they can help your company specifically, contact Global Shares today. Our experts will walk you through how we can help you with ESPP management, and see which plan is best for you.