Trusted by businesses worldwide

-

Solutions for

Private Companies

Learn how our award-winning technology and expert equity professionals can work for your business as it grows.

-

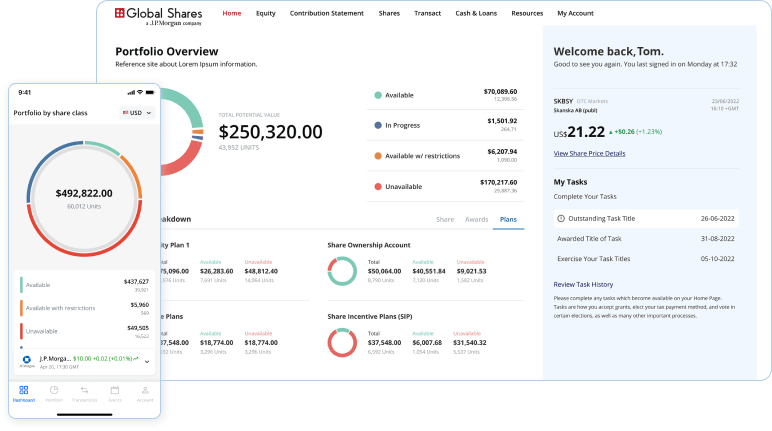

Solutions for

Public Companies

Our customizable global platform integrates all your employee stock plan data in one easy-to-use dashboard.

4.8 out of 5 rating

Based on customer reviews

Academy

Learn everything there is to know about employee ownership through our curated library of blogs, podcasts, webinars, eBooks and more.