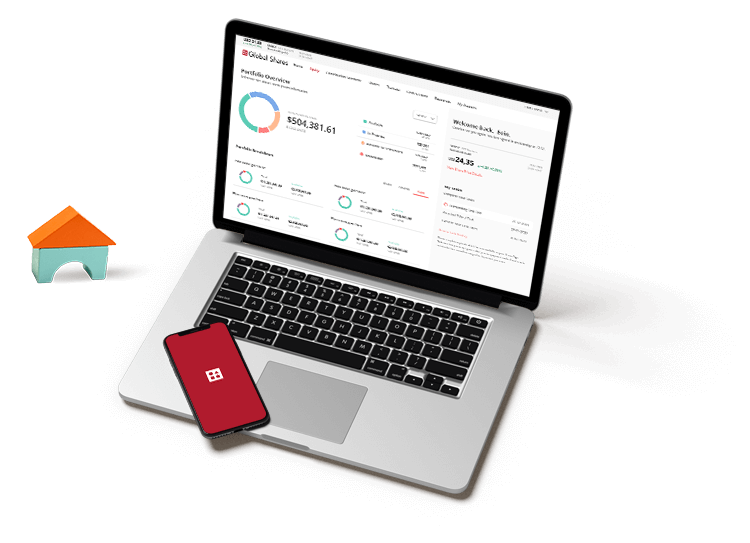

Trusted By Businesses Worldwide

What is an LTIP?

Long Term Incentive Plans (LTIPs) are programs that provide a potential award to key employees above and beyond their basic salary. An LTIP offers incentives and bonuses over fixed long-term periods, usually from three to five years.

Sharing in growth

An executive’s investment of time, energy and experience in a company is instrumental to its success. An LTIP values an employee’s contribution to the growth of an organization and allows them to reap the rewards of this success, as if they were owners.

We’ve got your LTIPs covered

- Stock Option Plans (SOPs)

- Incentive Stock Options (ISOs)

- Warrants

- Stock Appreciation Rights (SARs)

- Restricted Stock Units (RSUs)

- Restricted Stock Awards (RSAs)

- Performance Stock Units (PSUs)

- Deferred Stock

- Phantom Stocks

- Non-Qualified Stock Options

Tailored for You

LTIPs are flexible in their design and so can be created specifically for your company’s needs, goals and existing capabilities. Establishing an LTIP that fits with your business’s philosophy from the get-go is key. Set out performance periods and a rewards system that aligns with strategic plans and goals. Talk to us about building an LTIP that works for you, or let our team manage your existing LTIP, seamlessly.

Why LTIPs?

LTIPs are designed to help achieve predetermined performance goals. Having them in place can focus employees on targets and aim them at propelling the company forward to success.

The opportunity to own and share in the wealth of a company is a big incentive when it comes to attracting top talent.

LTIPs boost employee retention with their ‘golden handcuffs’ effect. Given that conditions include continued employment, LTIP awards encourage employees to stay with a company.

Ready to learn more?

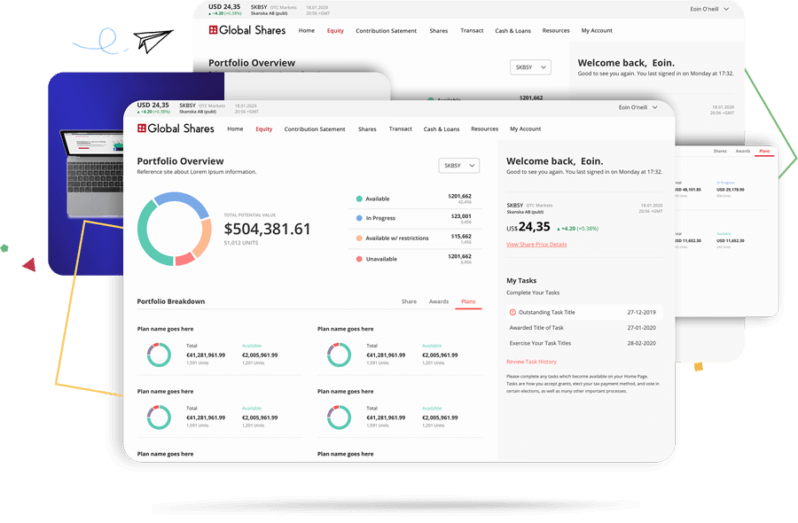

Get in touch today for a no-obligation demo with one of our experts.

Read More

-

Create your long-term incentive plan step by step

April 23, 2024

-

Long-term incentive plans for private companies

March 12, 2024

-

7 LTIP best practices

March 12, 2024