Sometimes the perfect VC strategy is simple; leave well enough alone. When businesses have strong, skilful leaders and a company structure that allows them to deliver on their strategy, you can simply monitor progress from afar.

However, if the company doesn’t have that level of maturity, it can be up to you as the VC to provide the support necessary to grow it at scale. How can you do this? Let’s look at a couple of ways you could approach this with a new addition to your portfolio.

Building companies

Most VCs have experience in building companies that many founders won’t. The greatest added value you can bring, particularly to those inexperienced founders, is knowing what questions to ask, and the people that can answer them. This is particularly true in niche industries where you have operated before.

It’s not just about money anymore. Fledgling startups may need help with everything from recruitment strategies to international expansion, strategy development, setting up partnerships or M&As. A VC usually has a wealth of connections that can help in all of these areas.

VCs build networks or, more accurately, networks of experience and expertise. Bringing these into a new company (right from the due diligence process onwards) will help build it from the ground up, with strong foundations.

Build trust

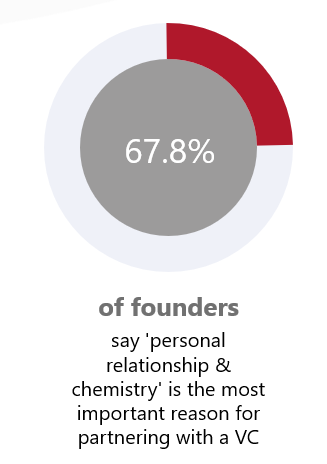

Should founders trust you as their VC? It’s a must.

At the beginning of any relationship, trust will be in the balance and, during the relationship, those levels of trust will be a key determining factor of whether it was successful or not. Great VCs are setting clear expectations with their founders – the level of support they will get, and the support you can’t provide. Communication is key, as is transparency. Expectations should be clear from day one.

Be active on the board

One of the most common ways for a VC to get involved in the strategic direction of a company is by taking a seat on the board. Often how this works in practice is the VC comes to the quarterly meeting, sits for a board meeting, chips in their thoughts, and then jump on a plane for their next meeting.

If you find this story familiar, you’ll know how little value this adds to the company. A key member of the Board is someone who gets a real kick out of helping the company they’ve invested in succeeding. Listening and problem solving and helping to strategise, while at the same time learning about the business on a much deeper level, will be one of your key contributions to the growing business.

Impart investor knowledge

Early investor VCs should be the trusted advisor on how to approach potential future investors, and what traps to avoid. Bringing this expertise to the table breeds confidence in the founders, allowing them to be more comfortable during the whole process. You have been there, done that and know what funding decision-makers want. Imparting that advice is hugely valuable as the company grows and scales.

“The right investor will add value by helping you complete your next round of fundraising by connecting you to their VC community network,” says Sunny Dhillon, a partner at Signia Ventures. “If you happen to be the belle of the ball and spoiled for choice among investors at the next stage, your current investor can provide insights into your options.”

Help them exit in the right way

This is also true when it comes to advising founders when it’s best to exit a company. With start-ups being gobbled up by multinationals at a daily rate, this has become a frequent challenge founders face – when and how do we get off the train?

Investors usually have plenty of exit experience so should have plenty of knowledge to share with founders so that they can help them achieve an optimal result.

Giving advice on things like post-merger integration and even deal terms and pricing can go a long way.

Help raise capital

Helping raise capital is one of the areas that VCs can come into their own

Everyone loves being part of a trend, and investors are no different. A big role of an investor, whether they were an angel investor or someone who gets involved later, is to act as a cheerleader for the company.

At every networking opportunity, you can tell the company’s story to potential new backers and bring more on board (unless they want to keep it all to themselves) and inject new capital. When actively recruiting investors, it’s incumbent on you as the VC to thoroughly vet their credentials and how they will add value themselves.

Bring in outside consultants and new ideas

You can’t know everything about every business in every sector, but you will have a great deal of experience in applying trusted methods to grow businesses. Seeing success in one firm and being able to share that knowledge with another is something extremely valuable. Many fingers in many pies can add a lot of depth to a VC’s experience.

If you’re outside your comfort zone for whatever reason, however, and won’t be able to get up to speed, bringing in outside consultants can help build the company with true industry expertise.

Inherently, an outside consultant won’t have the same level of drive as you in making the business successful, but they can provide insights into what is happening within the business. Without this insight, any advice you can give is undercut by a lack of experience.

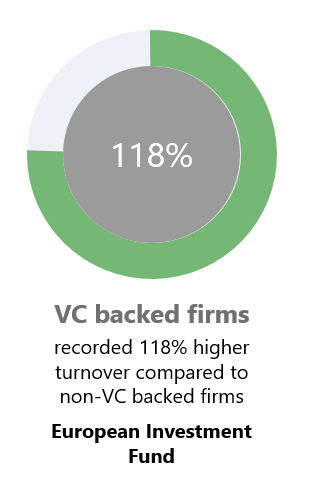

Use venture capital to attract human capital

Attracting top talent to an early-stage startup can be a tough (and sometimes expensive) business. With a top-quality VC, however, that can be less of a challenge.

And the ‘top-quality’ is important.

In a Harvard Business School study, it was found that ‘the same startup receives significantly more interest from potential employees if it was funded by a top-tier VC. In contrast, highlighting the fact that a startup was funded recently has no effect. The results provide direct evidence of the certification role played by VCs and their impact on the labour market.’

Top VCs help attracts better talent. This is simply because they have a more extensive list of contacts, more ability to persuade, and more credibility when selling the narrative to a potential employee.

Executive coaching

One of the problems with giving advice is that sometimes you’re not the best person to give it to. For the modern CEO, executive coaching is a way to tackle problems with the ego (mainly) left at the door. Many VC firms now bring executive coaching to the table as a value add, helping the founders navigate those tricky and stressful opening phases when growing a company. Leadership courses and emotional wellness are other areas that are growing traction as VCs like you seek to avoid founder burnout or unsustainable work practices.

Investing is not just writing a cheque

There are great investors who simply act as pickers – they choose a great looking business through an in-depth process, back that company financially and sit back to watch the returns. This type of investing has its upside – you can have more of them to spread the risk – but it does have its downsides too.

If you invest in a company that needs support and then don’t provide that support, your investment is lost before it even had a chance. By first choosing investments where you can add value, and then adding that value through the avenues outlined above, strong businesses will emerge.

Please Note: This publication contains general information only and Global Shares is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. The Global Shares Academy is not a substitute for professional advice and should not be used as such. Global Shares does not assume any liability for reliance on the information provided herein.