Today, offering employees benefits like a medical and dental insurance plan is almost expected and can’t really make you stand out against the competition.

What about letting them own shares of your business through an ESPP (employee stock purchase plan)? More than 80% of US tech companies such as Adobe and Salesforce offer an ESPP to attract top talent.

This ”Understanding ESPP” guide explains what an ESPP is and how it helps both employers and employees achieve their goals. Skip to the relevant section below:

- What is an ESPP?

- How does an ESPP work?

- How are ESPP stocks taxed?

- ESPP pros and cons for employers

- ESPP pros and cons for employees

- Other similar plans to an ESPP

- FAQs about ESPPs

What is an ESPP?

An ESPP, employee stock purchase plan, is an employee ownership plan that allows participants to purchase stock in their companies at a discount – often between 5-15% off the fair market value (FMV). The way they do this is by making contributions directly from employees’ paychecks. Their accumulated contributions are used to buy company shares at the purchase date.

There are two types of ESPP – Qualified and Non-qualified. The term ‘qualified’ refers to a tax-advantageous status. The tax events will be explained in the ‘’How are ESPP stocks taxed?’’ section.

How does an ESPP Work?

This is the basic sequence of events and some terms associated with an ESPP:

- Offering Period: Once you enroll in the ESPP, you’ll be eligible to participate in the upcoming offering period and will be able to purchase company shares at an agreed discount for the length of that offering period.

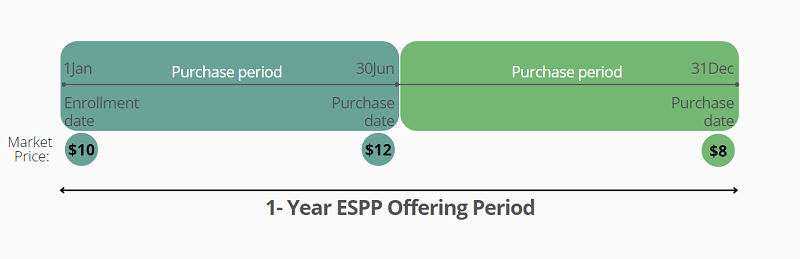

An ESPP offering period is commonly either 12 months or 24 months. - Purchase Period: Within an offering period, there are a series of purchase periods in which you set aside money to purchase the shares. The length of a purchase period is usually 6 months.

- Purchase Date: Typically at the end of the purchase period, on which you officially purchase the shares.

- Purchase Price: The price you purchase the shares on the purchase date (pre discount)

Quite commonly, to make an ESPP more attractive, your company possibly offers you a ‘’lookback’’ feature in addition to the discount offered. The ESPP lookback feature allows you to purchase the share price of either A: the initial date of the offering period (1/1/2021) or B: the purchase date (6/30/2021), whichever is lower.An Example of ESPP with/without Lookback

Initial Price: $10

Price on Purchase Date: $12

Company Discount: 15%

| With Lookback | Without Lookback |

|---|---|

| Purchase Price: $10 | Purchase Price: $12 |

| Actual Purchase Price: $10 – $1.5 (discount) = $8.5 / share | Actual Purchase Price: $12 – $1.8 (discount) = $10.2 / share |

Explanation:

If you are allowed to ‘’look back’’, you will be able to purchase the shares at a discount off $10 instead of $12 as $10 is lower than $12. If the price on the purchase date is lower, for example, €8, then you will purchase the shares at a 15% discount off the price of €8 [instead of $10 at the beginning].

So, as an employer considering offering an ESPP, having this feature in the plan can help boost your enrolment rates.

Difference between qualified ESPP & non-qualified ESPP

Sometimes, it can be hard to wrap your head around tax implications. Here, we use different scenarios and explain them in plain English to allow you to understand ESPP tax events easily.

As mentioned, there’re two main classes of ESPPs – Qualified ESPPs and non-qualified ESPPs. Under a qualified plan, you do not owe any taxes when you purchase shares. Under a non-qualified ESPP, when the shares are purchased, the excess of FMV of the shares at the time of purchase over the purchase price is taxed as ordinary income.

The following ‘’Qualified vs Disqualified ESPP’’ table helps you quickly understand their meaning. If you’re interested in understanding more about these two types, head over to our ‘’Qualified & Non-Qualified ESPPs’’ blog.

| Qualified ESPP | Non-Qualified ESPP |

|---|---|

| Contribution made with after-tax dollars | Contribution made with after-tax dollars |

| Designed and operates acc. to Internal Revenue Section (IRS) 423 regulations | Does not meet IRS criteria |

| Discount ranges from 0% to 15%, with 15% most used | May offer a discount of more than 15% from the current FMV of the stock |

| Approved by shareholders | Not required |

| More favorably on taxation | Less favorably on taxation |

| Less Flexible | Flexible |

No matter if you decide to roll out a Qualified ESPP or a Non-qualified ESPP, you can easily set it up in our software. Want to see how it works? Contact us today for a free demo.

How are ESPP stocks taxed?

So far so good. Let’s look at qualified ESPPs further.

There’re two classifications of sales for qualified ESPPs: qualifying and disqualifying dispositions. They cause different tax events.

When selling the shares, the discount that you received when the shares are bought is considered additional compensation to you, so you have to pay taxes on them as your regular/ordinary income.

You also have to pay taxes on any additional profits when you sell your shares. The ESPP tax treatment in the US is varied depending on whether your stock sale is a qualifying disposition (QD) or a disqualifying disposition (DD).

It’s time to look at an example:

- Initial price in the offer: $20

- Price on the purchase date: $25

- Discount: 15%

- Actual purchase price: $17 (= 20 x 85%)

- Sales price: $50

- No. of shares: 100

- Sales commission: $10

| Ordinary Income | Capital Gains | |

|---|---|---|

| DD: <1 year after purchase date OR <2 years after offering date | ($25 – $17) x 100 = $800 | Short Term Capital Gains: $4990 – $2500 = $2490^ |

| QD: >1 year after purchase date AND >2 years after offering date | ($20 x 15%) x 100 = $300 | Long Term Capital Gains: $4990 – $2000 = $2990# |

^Total Sales Price minus Commission: ($50 x 100) – $10 = $ 4990

Cost [Total Actual Price + Ordinary Income]: $17 x 100 + $800 = $2500

Short-Term Capital Gains: $4990 – $2500 = $2490

#Total Sales Price minus commission : $50 x 100 – $10 = 4990

Cost [Total Actual Price + Ordinary Income: $17 x 100 + $300 = $2000

Long Term Capital Gains : $4990 – $2000 = $2990

A QD is usually attractive because you can get ESPP tax advantages as the long term capital gains tax rates are usually lower than your ordinary income tax rate. But, this strategy requires you to hold your shares for at least one year after you purchase them. If the gains are significant at the moment, waiting to sell to reap the ESPP tax advantages could have a large impact on your stock portfolio.

Is an ESPP worth it for employers?

Here are the key pros and cons of ESPPs for employers:

Help Employee Retention

ESPP programs typically run over a number of years, and the total amount of stock employees accumulate over the lifetime of the plan. Seeing is believing, and an employee who sees the financial benefit of their investment after the first six months is more likely to commit and remain invested in the company in the long run.

Attract and recruit top talent

Offering one could make your company more attractive, help you land top recruits and deliver on your people priorities.

Create an ownership culture in your company

An ESPP offers employees a way to gain ownership in their company. When employees hold company stock, they will think and act in the long term interest of the company and have a greater stake in the success of the company, which can be a powerful motivator.

Despite its benefits, having a plan in place can increase HR, accounting and administrative workload. You also need to create a comms plan to let your employees know about the ESPP benefits and keep them engaged. So, why not let an expert take care of everything from participant enrollment to trading and above board.

We, Global Shares, can take away the headache of managing your ESPPs thanks to our award-winning software platform and our team of 300 equity professionals. We’re trusted by hundreds of companies across a multitude of industries in more than 100 countries across the world.

Is an ESPP worth it for employees?

From the employee perspective, here are the key pros and cons of ESPPs:

Turbo-Charge your Savings

Since you are buying shares for a discount and then selling them for a normal price, you can earn money with this ‘’buy low and sell high’’ approach.

ESPPs offer you an easy and cost-efficient reward for pursuing a disciplined savings plan and allow you to make short term financial decisions such as buying a home and also increases your long term financial wealth for retirement.

LookBack Feature – You’re allowed to further increase your return

As mentioned in section 2, if your plan has an ESPP lookback feature, the company discount is then applied to the lower of 1) the price at the start of the offering period or 2) on the purchase date.

Flexible – You’re allowed to withdraw

Participation is voluntary, so companies commonly allow you to withdraw, even in the middle of an offering period. Most plans also allow you to withdraw during the purchase period.

Tax Benefits

As mentioned, if you hold your shares for a certain period of time, you will reap the benefits of tax-advantaged treatment as the profit is taxed as capital gains (taxed at lower rates than ordinary income) when selling the ESPP shares.

Despite a number of benefits, there is a limit on ESPP max. contribution. Under a Section 423 plan, the IRS limits purchases to $25,000 worth of stock value (based on the fair market value on the offering date) for each calendar year in which the offering period is effective.

For example, the maximum no. of shares to purchase would be 2500 if the stock price on the offering date was $10. ($25,000 ÷ $10)

Other similar plans to an ESPP

Offering employee ownership schemes to your employees is beneficial to both employers and employees. Besides ESPP, there are other similar plans on the market. It’s worth spending some time comparing them to find the best one for your business.

ESOP vs ESPP : ESOPs (Employee stock ownership plans) like ESPPs are one of the most popular employee benefit plans, offering employees ways to grow their savings and build wealth. These two plans are a good way to attract good candidates when cash is limited. They can also increase employee morale and retention.

Unlike an ESPP, ESOP employees don’t purchase shares using their own money. Rather, the ESOP company allocates stock ownership to employees via an ESOP trust, which holds/sells the stock on employees’ behalf. Typically the ESOP employees won’t receive a distribution (or ESOP benefits) until leaving employment. At that time, the employee is taxed on the value of the stock.

ESOPs also have significant tax benefits to founders, including tax-deductible contributions and dividends. Compared to ESOPs, ESPPs however don’t require a huge cost to establish and are considered an ‘’immediate award’’ to employees.

RSU vs ESPP: Also as an employee benefit, RSU (Restricted Stock Units) provide an incentive for employees to stay with a company for the long term

Unlike an ESPP, you don’t have to pay for RSU. Rather, the shares of stock are granted by the company at a particular grant price. The shares will vest at some date in the future, at which point you will take ownership of the actual shares. At that time, you have to pay taxes.

Besides vesting, selling your RSU can have tax consequences:

Public companies: Similar to the case of ESPPs, you can sell yours at any time. If you want to enjoy tax benefits, consider holding shares for over a year before selling because it qualifies as a long-term capital gain that will be taxed less.

Private companies: Your shares can’t be easily sold. You’ll likely hope for your company to have a liquidity event such as IPO or SPAC.

FAQs about ESPPs

How does an ESPP work?

An ESPP (employee stock purchase plan) allows employees to use after-tax wages to acquire their company’s shares, usually at a discount of up to 15%. Quite commonly, companies offer a ‘’lookback’’ feature in addition to the discount offered to make the plan more attractive. The lookback feature allows you to purchase the share price of EITHER the initial date of the offering period OR the purchase date, whichever is lower, to further increase the return.

Is an ESPP worth it?

The plan is valuable for both employers and employees. For employers, the plan can help attract and retain top talent. For employees, it is a valuable tool for accumulating wealth with a discount and a lookback feature. However, it is not 100% profit guaranteed. We can still lose money on ESPP if the stock price goes down.

Is an ESPP pre tax or post tax?

ESPP shares are post-tax. To put it differently, your shares are purchased with money that you’ve already paid taxes. You are not taxed until the ESPP is sold.

What is a disqualifying disposition ESPP?

An ESPP mainly has two types – Qualifying Disposition and Disqualifying Disposition. A disqualifying disposition occurs when ESPP shares are sold less than 2 years after the offering date. The disqualifying disposition is flexible because you can sell your shares right away after purchasing them but you won’t get ESPP tax advantages as your short-term capital gains will be taxed typically higher.

What happens to my ESPP when I leave a company?

The situation highly depends on your leaver status – Good leaver or Bad leaver. Read this article to find out more.

What is the difference between an ESOP and ESPP?

ESOPs (Employee stock ownership plans) like ESPPs are one of the most popular employee benefit plans. Unlike an ESPP, ESOP employees don’t purchase shares using their own money. Typically, they receive a distribution (or ESOP benefits) at retirement.

Request a free demo

If you’ve been curious about all the benefits of ESPPs or employee ownership – or you want to understand how they can help your company specifically, contact us today for a free demo. Our experts will walk you through the entire process, and see which plan is best for you.

Please Note: This publication contains general information only and Global Shares is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. The Global Shares Academy is not a substitute for professional advice and should not be used as such. Global Shares does not assume any liability for reliance on the information provided herein.