GLOBAL SHARES EXECUTION SERVICES LIMITED PILLAR III DISCLOSURES

ACCORDING TO PART SIX OF REGULATION (EU) 2019/2033 OF THE EUROPEAN PARLIAMENT AND OF THE COUNCIL ON THE PRUDENTIAL REQUIREMENTS OF INVESTMENT FIRMS

YEAR ENDED 2022

(UPDATED ON 5 APRIL 2023)

TABLE OF CONTENTS

- INTRODUCTION

1.1. Company information

1.2. Classification and prudential requirements

1.3. Scope of application

1.4. Pillar III Regulatory framework

1.5. Frequency

1.6. Location of publication

1.7. Verification - RISK MANAGEMENT OBJECTIVES AND POLICIES

2.1. The Company’s Risk Strategy

2.2. The Board’s role in Risk Management and Governance

2.3. Risk Management Processes

2.4. Current Risk Assessment Position

2.5. Risk Management Framework

2.6. Risk Appetite

2.7. Risk Profile

2.7.1. Risk to Market

2.7.2. Risk to Firm

2.7.3. Risk to Client - INTERNAL CAPITAL ADEQUACY AND RISK ASSESSMENT PROCESS

- GOVERNANCE

4.1. Board of Directors

4.2. Number of Directorships held by members of the Board

4.3. Policy on Recruitment

4.4. Policy on Diversity

4.5. Social Responsibility Entrepreneurship - OWN FUNDS

5.1. Tier 1 and Tier 2 Regulatory Capital

5.2. Main features of CET1, AT1 and T2 instruments

5.3. Balance Sheet Reconciliation - OWN FUNDS REQUIREMENTS

6.1. Initial Capital Requirement

6.2. Fixed Overhead requirement

6.3. K-Factor Requirement

6.3.1. K-Factor Requirement Result

6.4. Own Funds Composition and Capital Ratios

6.5. Liquidity Requirement - REMUNERATION POLICIES AND PRACTICES

7.1. Link between pay and performance

7.2. Financial Remuneration Information - ENVIROMENTAL, SOCIAL AND GOVERNANCE RISKS

1. INTRODUCTION

1.1. Company information

Global Shares Execution Services Limited (the “Company”) is a private limited liability company incorporated and registered pursuant to the laws of Malta, with company registration number C86113 and registered office situated at 171, Old Bakery Street, Valletta VLT1455, Malta.

The Company has been authorized by the Malta Financial Services Authority (the “MFSA”) as an investment firm in terms of the Investment Services Act (Chapter 370, Laws of Malta) (the “ISAct”) to provide the following investment services to Retail Clients, Professional Clients (excluding collective investment schemes) and Eligible Counterparties:

i) Reception and transmission of orders in relation to one or more instruments; and

ii) Trustee, Custodian or Nominee services.

The said investment services are being provided in relation to transferable securities.

The Company forms part of the JP Morgan group of companies (the “Group”)

1.2. Classification and prudential requirements

The Investment Firms Directive (EU) 2019/2034 (“IFD”) and the Investment Firm Regulation, Regulation (EU) 2019/2033 (“IFR”) entered into force on 26 July 2021, introducing a new classification system for investment firms, based on their activities, systemic importance, size and interconnectedness. All investment firms are classified as Class 1, 2 or 3 Investment Firms.

Class 1 Investment Firms are the largest and most interconnected investment firms, with risk profiles similar to those of significant credit institutions, have equal treatment with credit institutions in the sense of a level playing field accordingly and they will fall entirely under the CRR.

Investment Firms categorized as Class 2 and Class 3 will have the most impact from the new prudential framework as the capital requirements, reporting requirements and internal governance policies are subject to the provisions of IFR/IFD. Firms that meet all of the criteria below are categorised as Class 3 Investment Firms.

| Capital Instruments Main Feature | Thresholds | |

|---|---|---|

| 1. | Assets under management | < EUR1.2 billion |

| 2. | Client orders handled – cash trades | < EUR100 million per day |

| 3. | Client orders handled – derivative trades | < EUR1 billion per day |

| 4. | Assets safeguarded and administered | Zero |

| 5. | Client money held | Zero |

| 6. | On- and off- balance sheet total | < EUR100 million |

| 7. | Total annual gross revenue from investment services and activities | < EUR30 million |

However, in the event that firms exceed any of the following specific size thresholds, they are categorised as Class 2 Investment Firms.

Further to the above, the Company is categorized as a Class 2 Investment Firm since it does not meet all of the above criteria and as such it should maintain own funds of at least the higher between the:

a) Permanent minimum capital requirement;

b) Fixed overhead requirement; or

c) K-Factor requirement.

a) Permanent minimum capital requirement: The permanent minimum capital requirement of the Company is EUR150,000.

b) Fixed overhead requirement: The Fixed Overhead Requirement is calculated as one quarter of the previous year fixed expenses (based on audited figures)

c) Permanent minimum capital requirement: The new K-Factors are quantitative indicators that reflect the risk that the new prudential regime intends to address. Specifically, capital requirements from applying the K-Factor formula is the sum of K-ASA, K-CMH and K-COH.

1.3. Scope of application

The Pillar III Disclosures Report (the “Report”) is prepared on a solo basis in accordance with the disclosure requirements as laid out in Part Six of the IFR. Investment firms are required to disclose their capital resources, capital requirements, remuneration policies, practices and governance standards.

1.4. Pillar III Regulatory framework

The Report has been prepared in accordance with the new regulatory regime for investment firms, namely the IFR and the IFD, as well as the relevant ESMA and EBA Guidelines issued in relation to the same. The Report has also taken into consideration the relevant sections as outlined in Part BI of the Investment Services Rulebook applicable to MiFID Firms as issued and updated by the MFSA.

The IFR establishes the prudential requirements in terms of own funds, level of minimum capital, concentration risk, liquidity requirements and level of activity with respect to small and non- interconnected investment firms. Furthermore, the IFR introduced significant changes in the prudential regulatory regime applicable to investment firms including a new classification system, an amended minimum initial capital and minimum capital ratios, changes to the calculation of the capital requirements, the reporting requirements and the internal governance policies and the introduction of the K-Factors methodology and new measures relating to liquidity requirements, large exposures and consolidation requirements.

The updated regulatory framework consists of a three “Pillar” approach:

- Pillar I – Covers the basic capital and liquidity requirements;

- Pillar II – Regulates the investment firm’s accountability to the regulator for capital and liquidity adequacy. If the regulator deems the capital to be insufficient, a corrective requirement can be imposed on the company in the form of what is known as a “SREP decision”; and

- Pillar III – Market Discipline requires the disclosure of information regarding the prudential requirements, risk management and principles of the remuneration policy.

‘Materiality’ is based on the criterion that the omission or misstatement of information would be likely to change or influence the decision of a reader relying on that information for the purpose of making economic decisions. Where the Company has considered a disclosure to be immaterial, this was not included in the document.

1.5. Frequency

The Company’s policy is to publish the disclosures required on an annual basis. The frequency of disclosure will be reviewed should there be a material change in approach used for the calculation of capital, business structure or regulatory requirements.

1.6. Location of publication

The Company’s Pillar III disclosures are published on the Global Shares group website www.globalshares.com.

1.7. Verification

The Company’s Pillar III disclosures are subject to internal review and validation prior to being submitted to the Board for approval. The Company’s Pillar III disclosures have been reviewed and approved by the Board and will be updated from time to time.

2. RISK MANAGEMENT OBJECTIVES AND POLICIES

2.1. The Company’s Risk Strategy

Risk Management is a continuous and developing process which runs through the implementation of the Company’s strategy. The Company’s risk strategy is to methodically address and profile all the risks surrounding the organisation’s activities, past, present, and particularly in the future. The Board of Directors of the Company recognises its obligations and responsibility for protecting the organisation, its people, assets, and profits against the (adverse) consequences of risk and to encourage risk awareness among all staff members.

Currently, the Company has a derogation in place from having an independent risk function from the operational responsibilities. However, it has internal reporting submitted to the Company’s board of directors at the quarterly board meetings by its group risk function.

2.2. The Board’s role in Risk Management and Governance

The ultimate responsibility for the management of risk for the Company resides with the Board of Directors. As detailed above, the Company’s group risk function assist in identifying key risks to the business, determining which are primary risks and monitors them through management information and reporting. The board receives quarterly updates in the risk framework. The Board also ensures that financial and other basic controls are working effectively. Nevertheless, the Company’s Board and its risk management sit within the overall Global Shares plc group risk management structure and process.

The Company will report errors to the Board of Directors and this will help in identifying new possible risks or re-evaluating the controls around already identified risks.

2.3. Risk Management Processes

The formulation of risk processes involves the Board, the Compliance Officer, the Group Company’s Head of Finance and group senior executive management. The group risk function utilise the ERM COSO model which then drives the Pillar 2 calculation around enterprise risk.

2.4. Current Risk Assessment Position

Currently the Company utilises the Group’s risk register to identify the top risks. The risk register utilises the process of working through with each functional area a list of risks with appropriate controls. Identifying the scores and the controls in place from an assessment of the register, the Company can then evaluate the risks attributable to it.

2.5. Risk Management Framework

Managing risk effectively in a company operating in a continuously changing risk environment requires a strong risk management culture. As a result, the Company has established an effective risk oversight structure and the necessary internal organisational controls to ensure that the Company undertakes the following:

- The adequate risk identification and management;

- The establishment of the necessary policies and procedures;

- The setting and monitoring of the relevant limits; and

- Compliance with the applicable legislation.

As part of its business activities, the Company faces a variety of risks, the most significant of which are described further below. The Company holds regulatory capital against three all-encompassing main types of risk: credit risk, market risk and operational risk.

2.6. Risk Appetite

The Board of Directors of the Company have defined their risk appetite as the level of risk that they are willing to take in order to execute the Company’s strategy. The purposes which capital serves revolve around protection against uncertain events, avoidance of regulatory intervention and shareholder returns. The Company seeks to maintain its capital and has a low tolerance for losses. The risk appetites for various categories is assessed on an on-going basis.

The Risk Governance structure helps to ensure that risk appetites/tolerances are consistently applied across the Company, using the appropriate metrics for each level and it provides boundaries regarding what is and is not acceptable to the Company.

2.7. Risk Profile

The components of the Company’s risk profile are informed by the risk register. These risks are grouped under the risk categories set out in the IFD and IFD adoption of the K-factors in the calculation of capital requirements. The firms K-factors are a series of risk parameters/indicators representing the specific risks investment firms face and the risks they pose to customers/markets. The IFR uses nine K-factors, which fall into three categories: Risk-to-Customer (‘RtC’) K-factors, Risk-to-Market (‘RtM’) K-factors and Risk-to-Firm (‘RtF’) K-factors are detailed in below

2.7.1. Risk to Market

From a definition perspective the k-factors under risk to market do not apply as the Company does not have net position risk (K-NPR) nor does it provide clearing margins (K-CMG) activities. However, on a broader approach we have the following risks that could impact the market; trade errors and market abuse risk.

2.7.2. Risk to Firm

The Company has potential elements to risk which are categorised as risk to firm. These include (i) economic risk (ii) legal risk (iii) compliance and regulatory risks (iv) IT and Cyber Security Risk (v) Operational Risk (vi) Trading, Payments & Settlements Risk (vii) Counterparty & Custodian Risk and (viii) Supplier and Contractor Risk.

These are all operational risk in nature. The Company has robust operational policies, procedures and controls in place to mitigate these risks to mitigate these risk such as an established governance and oversight structure, insurances, business continuity, disaster recovery and succession plans, HR management, due diligence processes for internal and external activities, documented procedures for operations.

2.7.3. Risk to Client

Best execution – The risk to the client is that the Company does not obtain best execution on receipt and transmission of orders. The Company has a best execution policy, undertakes due diligence of chosen brokers, undertakes on-going oversight of brokers along with monitoring trading of brokers to ensure best execution is achieved.

Client Asset – The Company is responsible for the safekeeping of client assets and there is a risk that assets may not be sufficiently safeguarded. The Company will identify chosen custodians after a due diligence process and it will reconcile assets on a daily basis to ensure assets are accounted for.

3. INTERNAL CAPITAL ADEQUACY AND RISK ASSESSMENT PROCESS

The purpose of capital is to provide sufficient resources to absorb unexpected losses over and above the ones that are expected in the normal course of business. The Company aims to maintain a ‘minimum risk asset ratio’ which will ensure there is sufficient capital to support the Company during stressed conditions.

The Company has established sound, effective and comprehensive arrangements, strategies and processes to assess and maintain on an ongoing basis the amounts, types and distribution of internal capital and liquid assets that it considers adequate to cover the nature and level of risks which may be posed to others and to which the firm itself is, or might be exposed. These arrangements, strategies and processes shall be appropriate and proportionate to the nature, scale and complexity of the activities of the Company and they shall be subject to regular internal review.

In light of the above, the ICARA report will present the main business background aspects and developments of the Company, a summary of the Company’s business economic environment, the Company’s financial summary for the previous and upcoming years, the business and strategic goals, organisational structure and the risk management framework, the overall assessment of the material risks as well as a forward-looking capital and liquidity planning.

Following the implementation of the new prudential regulatory framework, the Company has replaced its existing RMICAAP with the new ICARA by establishing new assessments with respect to the liquidity adequacy of the Company, designing new financial projections and stress tests to reflect the new K-Factors requirement and drafting a new report which reflects all provisions under the new regulation. The new methodologies of K-Factors and liquidity stress tests have been incorporated into the new ICARA process, as well as the updated risk register which will focus on a harm-pose approach, identifying different potential risk events that may affect the Company’s overall capital adequacy position.

4. GOVERNANCE

Through its internal governance structure, the Company incorporates a strict internal governance framework. Furthermore, the organisational structure incorporates the various organisational and functional reporting lines, as well as the different roles and responsibilities therein, while it also facilitates the compliance of the Company with the principle of segregation of duties and helps in the avoidance and control of possible conflicts of interest situations within the Company.

Moreover, the Company implements and maintains adequate risk management policies and procedures which identify the risks relating to the Company’s activities, processes and systems, and where appropriate, sets the level of risk tolerated by the Company. The Company adopts effective arrangements, processes and systems, in light of that level of risk tolerance, where applicable.

4.1. Board of Directors

The management body has the ultimate and overall responsibility for the investment firm and defines, oversees and is accountable for the implementation of the governance arrangements.

The Board is responsible for ensuring that the Company complies at all times with its obligations under the applicable law. In doing so, the Board approves and periodically reviews the effectiveness of the policies, arrangements and procedures put in place, whilst if needed, takes appropriate measures to address any deficiencies.

The Board has the overall responsibility for the establishment and oversight of the Company’s Risk Management Framework. The Board satisfies itself that financial controls and systems of risk management are robust. The Board comprises of two executive directors and one non-executive directors.

4.2. Number of Directorships held by members of the Board

All members of the Board commit sufficient time to perform their functions in the Company. The number of directorships which may be held by a member of the Board at the same time shall take into account individual circumstances and the nature, scale and complexity of the Company’s activities.

In line with Article 48 of IFR to disclose information regarding internal governance arrangements, the Company can confirm that as at December 2022, the members of the management body held the following directorships:

| Director | Function | Number of Executive Directorships | Number of Non-Executive Directorships |

|---|---|---|---|

| Joseph Portelli | Non-Executive | 1 | 11 |

| Stuart Sloan | Executive | 2 | |

| Tim Houstoun | Executive | 2 |

For the purpose of the above, Executive or Non-Executive directorships held within the same group shall count as a single directorship.

4.3. Policy on Recruitment

Recruitment into the Board combines an assessment of both technical capability and competency skills referenced against the Company’s framework. Members of the Board possess sufficient knowledge, skills and experience to perform their duties. The overall composition of the Board reflects an adequately broad range of experiences to be able to understand the investment firm’s activities, including the main risks to ensure the sound and prudent management of the Company as well as sufficient knowledge, of the legal framework governing the operations of an investment firm.

4.4. Policy on Diversity

The Company is committed to promote a diverse and inclusive workplace at all levels, reflective of the communities in which it does business. It approaches diversity in the broadest sense, recognizing that successful businesses flourish through embracing diversity into their business strategy, and developing talent at every level in the organisation. For this purpose, the Company takes into consideration various aspects such as broad industry experience, knowledge, independence, gender, age and cultural and educational background for the board appointments.

4.5. Social Responsibility Entrepreneurship

The Company and the Group are committed to maintaining the highest standards of governance and corporate citizenship and to pursuing growth in a responsible and sustainable manner. The Company’s sustainable principles are an integral part of its strategic priorities and represent the inextricable connection between financial performance and corporate responsibility. The Company monitors its impact on the climate and tries to reduce it in a number of areas including the reduction of waste, utilities and emissions.

5. OWN FUNDS

Own Funds is the type and level of regulatory capital that must be held to enable the Company to absorb losses.

During the year under review, the primary objective of the Company with respect to capital management was to ensure that it complied with the imposed capital requirements with respect to its own funds and that the Company maintained healthy capital ratios in order to support its business.

The Company throughout the year under review managed its capital structure and made adjustments to it in light of the changes in the economic and business conditions and the risk characteristics of its activities.

5.1. Tier 1 and Tier 2 Regulatory Capital

Investment firms shall disclose information relating to their own funds. Furthermore, investment firms shall disclose a description of the main features of the Common Equity Tier 1 (CET1) and Additional Tier 1 (AT1) instruments and Tier 2 (T2) instruments issued by the institution.

The Company’s regulatory capital comprises fully of CET1 capital while it has not issued any AT1 or T2 capital. The composition of the capital base and capital ratios of the Company are shown in the following table:

| Own Funds Composition | EUR |

|---|---|

| CET 1 capital before regulatory adjustments | |

| Capital instruments and the related share premium accounts | 825,000 |

| Retained earnings | 681,721 |

| CET1 capital: regulatory adjustments | |

| Additional deductions of CET1 Capital | 0 |

| CET1 capital | |

| AT1 capital | 0 |

| Tier 1 capital (T1 = CET1 + AT1) | 1,506,721 |

| Tier 2 (T2) capital | 0 |

| Total capital | 1,506,721 |

5.2. Main features of CET1, AT1 and T2 instruments

In order to meet the requirements for disclosure of the main features of CET1, AT1 and T2 instruments, the Company discloses the capital instruments’ main features as outlined in Annex A.

5.3. Balance Sheet Reconciliation

Investment firms shall disclose a full reconciliation of CET1 items, AT1 items, T2 items and filters and deductions and the balance sheet in the Financial Statements* of the institution as follows:

| Equity | EUR |

|---|---|

| Share capital | 125,000 |

| Capital Contribution | 700,000 |

| Share premium | |

| Retained earnings | 681,721 |

| Total Equity as per Financial Statements* | 1,506,721 |

| . | |

| CET1 capital: regulatory adjustments | |

| Additional deductions of CET1 capital | 0 |

| Total Own Funds | 1,506,721 |

6. OWN FUNDS REQUIREMENTS

As a Class 2 investment firm, the Company shall, at all times, have at least the highest of the following:

i) Permanent minimum capital requirement;

ii) Fixed overhead requirement; and

iii) K-Factor requirement.

6.1. Initial Capital Requirement

The initial capital of an investment firm which is authorized to provide any of the investment services listed in points (3) and (6) of Section A of Annex I to Directive 2014/65/EU shall be EUR750,000, while an investment firm which is authorized to provide any of the investment services listed in points (1), (2), (4), (5) and (7) and which is not permitted to hold client money or assets, the initial capital shall be EUR75,000. For all other investment firms, the initial capital shall be EUR150,000.

Therefore, on the basis of its current authorization, the Company’s initial capital is EUR150,000.

6.2. Fixed Overhead Requirement

The fixed overhead requirement (“FOR”) applies to all investment firms. The FOR is intended to calculate the minimum amount of capital that an investment firm would need available to absorb losses if it has cause to wind-down or exit the market.

The FOR should be calculated as one fourth of the fixed overheads of the preceding year (or business plan where the audited Financial Statements are not available) in accordance with the provision of Article 13 of IFR.

Further to the above, the following variable expenses can be excluded from the calculation of the fixed overheads:

| Deductible variable expenses from Fixed Overheads | |

|---|---|

| a) | staff bonuses and other remuneration, to the extent that they depend on the net profit of the investment firm in the respective year |

| b) | employees’, directors’ and partners’ shares in profits |

| c) | other appropriations of profits and other variable remuneration, to the extent that they are fully discretionary |

| d) | shared commission and fees payable which are directly related to commission and fees receivable, which are included within total revenue, and where the payment of the commission and fees payable is contingent on the actual receipt of the commission and fees receivable |

| e) | fees to tied agents; |

| f) | non‐recurring expenses from non‐ordinary activities. |

| g) | fees, brokerage and other charges paid to central counterparties, exchanges and other trading venues and intermediate brokers for the purposes of executing, registering or clearing transactions, only where they are directly passed on and charged to customers. These shall not include fees and other charges necessary to maintain membership or otherwise meet loss-sharing financial obligations to central counterparties, exchanges and other trading venues |

| h) | interest paid to customers on client money, where there is no obligation of any kind to pay such interest |

| i) | expenditures from taxes where they fall due in relation to the annual profits of the investment firm |

| j) | losses from trading on own account in financial instruments |

| k) | payments related to contract-based profit and loss transfer agreements according to which the investment firm is obliged to transfer, following the preparation of its annual financial statements, its annual result to the parent undertaking |

| l) | payments into a fund for general banking risk in accordance with Article 26(1)(f) of Regulation (EU) 2013/575 |

| m) | expenses related to items that have already been deducted from own funds in accordance with Article 36(1) of Regulation (EU) 2013/575 |

Further to the above, the Company’s fixed overheads requirement based on the latest audited Financial Statements of 2022, is EUR 442,409 (applicable for 2023) as per the table below ( EUR 364,378 applicable for 2022):

| Item | EUR |

|---|---|

| Total Expenses | 9,306,061 |

| Variable Expenses | 7,536,423 |

| Annual Fixed Overheads | 1,769,638 |

| Fixed Overheads requirement (25%) | 442,409 |

6.3. K-Factor Requirement

The K-factor capital requirements are essentially a mixture of activity and exposure-based requirements. K-factors apply to an individual investment firm depending on the MiFID investment services and activities it undertakes.

Capital requirement from applying the K-factors requirement is the sum of Risk to Client (“RtC”), Risk to Market (“RtM”) and Risk to Firm (“RtF”).

Further to the above and since the Company is Class 2 investment firm, (RtC / RtM / RtF) proxies are applicable for the Company.

6.3.1. K-Factor Requirement Result

As at 31 December 2022, the Company’s K-Factor Requirement is EUR1,108,481 as shown in the table below:

| Item | Factor Amount EUR | K-Factor Requirement EUR |

|---|---|---|

| Total K-Factor Requirement | ||

| Risk to Client- Client money held Segregated | 76,836,232 | 307,345 |

| Risk to Client-Assets Safeguarded & Administered | 1,993,983,740 | 797,593 |

| Risk to Client- Client Orders Handled –Cash Trades | 3,542,817 | 3,543 |

| Risk to Market | NIL | NIL |

| Risk to Firm | NIL | NIL |

6.4. Own Funds Composition and Capital Ratios

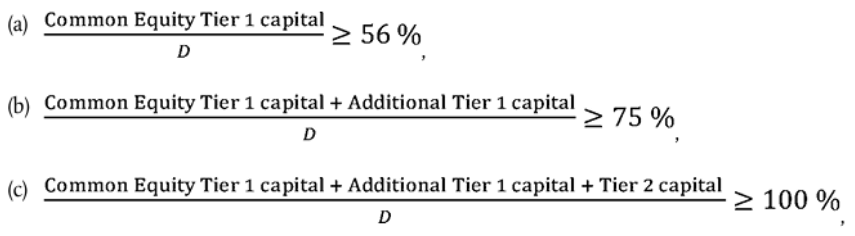

The K-factor capital requirements are essentially a mixture of activity and exposure-based requirements. K-factors apply to an individual investment firm depending on the MiFID investment services and activities it undertakes.

where:

i) Common Equity Tier 1 capital is defined in accordance with Chapter 2 of Title I of Part Two of Regulation (EU) No 575/2013, Additional Tier 1 capital is defined in accordance with Chapter 3 of Title I of Part Two of Regulation (EU) No 575/2013, and Tier 2 capital is defined in accordance with Chapter 4 of Title I of Part Two of Regulation (EU) No 575/2013; and

ii) D is defined in Article 11 of IFR.

The Company’s own funds, own funds requirement and capital ratio reported as at 31 December 2022, were the following:

| Own Funds Composition | EUR |

|---|---|

| Share Capital | 125,000 |

| Share Premium | 0 |

| Capital Contribution | 700,000 |

| Retained Earnings | 681,721 |

| Investor Compensation Scheme | 0 |

| CET 1 Capital | 1,506,721 |

| Additional Tier 1 | 0 |

| Tier 1 Capital | 1,506,721 |

| Tier 2 Capital | 0 |

| Own Funds | 1,506,721 |

| . | |

| Own Funds Requirements | EUR |

| Initial Capital | 150,000 |

| Fixed Overheads Requirement | 364,378 |

| K-Factor Requirement | 1,108,481 |

| Own Funds Requirement | 1,108,481 |

| . | |

| Capital Ratios | EUR |

| CET1 (minimum 56%) | 620,749 |

| Surplus / Deficit of CET1 Capital | 885,972 |

| Tier 1 (minimum 75%) | 831,361 |

| Surplus / Deficit of Tier 1 Capital | 675,360 |

| Total (minimum 100%) | 1,108,481 |

| Surplus / Deficit | 398,240 |

Further to the results outlined above, the Company maintains adequate own funds to cover its capital requirements as at 31 December 2022.

However, the Company should monitor the above ratios in order to ensure compliance with the capital adequacy requirements at all times.

Further to the above, the Company has implemented a capital adequacy monthly monitoring program in order to ensure compliance with the IFR requirements at all times. In this respect, the Company calculates the capital requirement on a monthly basis in order to assess the capital adequacy ratio for the respective month.

6.5. Liquidity Requirement

As a Class 2 investment firm, the Company is required to hold an amount of liquid assets equivalent to at least one third of the fixed overheads requirement. The purpose is to ensure that the investment firms have an adequate stock of unencumbered high-quality liquid assets that can be converted easily and immediately in private markets in cash to meet their liquidity needs for a 30-calendar day liquidity stress scenario.

In this regard and in line with the Company’s latest Financial Statements*, the Company has the following liquid assets which is well above the one third of the fixed overheads requirement.

| Item | EUR in 000s |

|---|---|

| Liquid Assets | 4,987,113 |

| . | |

| Total | 4,987,113 |

| . | |

| Requirement (1/3 of Fixed Overheads Requirement) | 120,245 |

| Surplus | 4,866,868 |

Furthermore, the Company maintains adequate liquid assets to cover the said requirement. However, the Company should monitor the above in order to ensure compliance at all times.

7. REMUNERATION POLICIES AND PRACTICES

The Company has risk-focused remuneration policies and practices that are consistent with the objectives of the Company’s business and risk strategy, including ESG risk-related objectives, corporate culture and values, risk culture and the measures used to avoid conflicts of interest, encourage prudent risk taking and responsible business conduct. By aligning its remuneration policy with effective risk management, it is less likely that the Company’s employees will have incentives to act in a manner that is inconsistent with the business and risk-strategy of the Company, engage in product mis-selling or excessive risk taking.

This remuneration policy is gender neutral in accordance with the IFD and respects the principle of equal pay for male and female workers for equal work or work of equal value.

The design of the remuneration policy is approved by the Board, after taking advice from the compliance function, and implemented by appropriate functions to promote effective corporate governance. The Board is responsible for the implementation of remuneration policies and practices and for preventing and dealing with any relevant risks, that remuneration policies and practices can create and discusses remuneration policy matters at least annually. Furthermore, the policy also benefits from the full support of senior management or, where appropriate, the supervisory function, so that necessary steps can be taken to ensure that relevant persons effectively comply with the conflicts of interest and conduct of business policies and procedures.

7.1. Link between pay and performance

The Company recognises the responsibility that staff has in driving its future success and delivering value for the Company and that remuneration is a key component in motivating and compensating its employees. Furthermore, the overall remuneration policy incorporates an annual variable incentive compensation reflecting individual performance and overall performance.

Further to the above, the Company implements a performance appraisal method, which is based on a set of key performance indicators, developed for each business unit and its target is to promote the healthy competition amongst personnel, analysis of weak and strong sides of each employee performance-based and give feedback to the staff member in order to motive them to improve.

7.2. Financial Remuneration Information

The remuneration policy of the Company is intended to ensure that the Company will attract and retain the most qualified personnel. As stated above, the criteria used for determining the remuneration of the Company’s directors are segregated into quantitative and qualitative criteria.

The quantitative remuneration criteria mostly rely on numeric and financial data such as the Company’s performance and the individual performance evaluation and ratings of each member of the staff whose professional activities affect the risk profile of the firm. In addition to the quantitative criteria, the Company has put in place qualitative criteria which include compliance with regulatory requirements and internal procedures, fair treatment of clients and client satisfaction.

The remuneration of the Company for year end December 2022 is being shown in the following tables:

| Item | No of eligible beneficiaries | Fixed Remuneration | Variable Remuneration |

|---|---|---|---|

| Senior Management (including Executive and Non-Executive Directors) | 7 | €141,073.15 | €6,306.80 |

Companies are required to disclose the number of natural persons that are remunerated EUR1 million or more per financial year, in pay brackets of EUR 1 million, including their job responsibilities, the business area involved and the main elements of salary, bonus, long-term award and pension contribution. In this regard, there are currently no natural persons at the Company that are remunerated EUR 1 million or more per financial year and as such the above disclosure are not applicable to the Company. No sign-on payments have been awarded during 2021, while no severance payments were paid during the year.

8. ENVIRONMENTAL, SOCIAL AND GOVERNANCE RISKS

Environmental, social, and corporate governance is an approach to evaluating the extent to which a corporation works on behalf of social goals that go beyond the role of a corporation to maximize profits on behalf of the corporation’s shareholders. The Company is committed to improving environmental and social causes.

Further to the report issued by the EBA in October 2022, the Company eagerly awaits further guidelines on the criteria relating to ESG risks for the supervisory review and evaluation process, as described in Article 35 of IFD, which will provide the introduction of technical criteria related to exposures to activities associated substantially with environmental, social, and governance objectives, with a view to assessing the possible sources and effects of risks on investment firms.

Annex A – Description of main features of capital instruments

| Capital Instruments Main Feature | ||||

|---|---|---|---|---|

| 1. | Issuer | Global Shares Execution Services Limited | Global Shares Execution Services Limited | Global Shares Execution Services Limited |

| 2. | Unique identifier (e.g. CUSIP, ISIN or Bloomberg identifier for private placement) | N/A | N/A | N/A |

| 3. | Public or private placement | Private | Private | Private |

| 4. | Governing law(s) of the instrument | Malta | Malta | Malta |

| 5. | Instrument type (types to be specified by each jurisdiction) | Ordinary Shares | Retained Earnings | Capital Contribution |

| 6. | Amount recognised in regulatory capital (Currency in million, as of most recent reporting date) | EUR125,000 | EUR692,482 | EUR700,000 |

| 7. | Nominal amount of instrument | EUR1 | N/A | N/A |

| 8. | Issue price | EUR1 | N/A | N/A |

| 9. | Redemption price | N/A | N/A | N/A |

| 10. | Accounting classification | Equity | Retained Earnings | Contribution Reserve |

| 11. | Original date of issuance | 11/01/2019 | 31/12/2022 | 16/06/2021 |

| 12. | Perpetual or dated | Perpetual | Perpetual | Perpetual |

| 13. | Original maturity date | No maturity | No maturity | No maturity |

| 14. | Issuer call subject to prior supervisory approval | N/A | N/A | N/A |

| 15. | Optional call date, contingent call dates and redemption amount | N/A | N/A | N/A |

| 16. | Subsequent call dates, if applicable | N/A | N/A | N/A |

| Coupons / dividends | ||||

| 17. | Fixed or floating dividend/coupon | N/A | N/A | N/A |

| 18. | Coupon rate and any related index | N/A | N/A | N/A |

| 19. | Existence of a dividend stopper | N/A | N/A | N/A |

| 20. | Fully discretionary, partially discretionary or mandatory (in terms of timing) | N/A | N/A | N/A |

| 21. | Fully discretionary, partially discretionary or mandatory (in terms of amount) | N/A | N/A | N/A |

| 22. | Existence of step up or other incentive to redeem | N/A | N/A | N/A |

| 23. | Noncumulative or cumulative | Non-cumulative | Non-cumulative | Non-cumulative |

| 24. | Convertible or non-convertible | Non-convertible | Non-convertible | Non-convertible |

| 25. | If convertible, conversion trigger(s) | N/A | N/A | N/A |

| 26. | If convertible, fully or partially | N/A | N/A | N/A |

| 27. | If convertible, conversion rate | N/A | N/A | N/A |

| 28. | If convertible, mandatory or optional conversion | N/A | N/A | N/A |

| 29. | If convertible, specify instrument type convertible into | N/A | N/A | N/A |

| 30. | If convertible, specify issuer of instrument it converts into | N/A | N/A | N/A |

| 31. | Write-down features | No | No | No |

| 32. | If write-down, write-down trigger(s) | N/A | N/A | N/A |

| 33. | If write-down, full or partial | N/A | N/A | N/A |

| 34. | If write-down, permanent or temporary | N/A | N/A | N/A |

| 35. | If temporary write-down, description of write-up mechanism | N/A | N/A | N/A |

| 36. | Non-compliant transitioned features | N/A | N/A | N/A |

| 37. | If yes, specify non-compliant features | N/A | N/A | N/A |