While it’s generally true that something is only as valuable as someone is willing to pay for it, valuing a company is a pretty defined process in most countries. If you’ve never had to do it yourself before, it involves plenty of questions from your accountant and lots of mathematical equations you’ve forgotten how to do since school.

The real questions come not about the value of the company, but around who owns it. Or maybe, more accurately, who owns how much.

While this may seem a crazy thing not to know, it’s much more common than you may think. Complicated financial deals and negotiations can be hard to track accurately, especially if they can change over time based on achieving (or not achieving) movable targets. On top of that, as businesses go through more funding rounds and the number of investors grows the complications grow with it.

Suddenly, it’s very easy to find yourself in a position in front of a new investor asking who owns your company and you have to respond, ‘I’m not exactly sure’.

The importance of a Cap Table

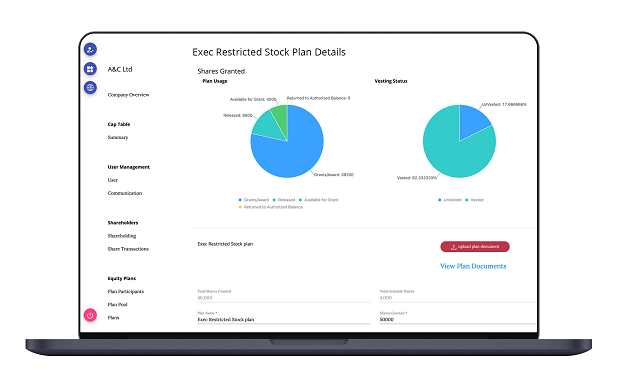

Screenshot from Global Shares’ Enterprise platform

For any business owner, the Cap Table is one of the foundation stones of your business. It’s the document that shows the owners and the breakdown of ownership in a company.

When someone invests in your company, that investment is captured in the Cap Table. Simply put, they give you money, and you give them shares. Without a solid Cap Table though, it won’t be entirely clear to anybody how much these shares are worth, making it next to impossible to attract further investment (and can cause all sorts of other problems).

So, the Cap Table captures who owns the company in one place, giving all investors clarity. At least, that’s the theory.

Often, Cap Tables come in the form of an Excel spreadsheet, sometimes just saved on the CFO’s or CEO’s desktop. Unless it is meticulously tracked, things can quickly go wrong in this scenario, from the mundane to the spectacular. Version control is always an issue, files can be corrupted, people can make mistakes, and of course, the CEO can leave their laptop in the back of a taxi.

If you have a great idea, but your cap table is poorly constructed or is incomprehensible, then the investor is more than likely going to pass. Because if your cap table is poorly designed, there is a much greater chance that you have made a serious mistake or missed something in your ownership.

You can have the best idea in the world, but if an investor can’t trust your cap table (or even read it), then you won’t get funded.

Investors also need to understand how diluted the company is. If they’re receiving 10,000 shares, is that 10% of the company or .01%? It directly impacts their return on investment, and therefore their decision making.

All your resources, all your talent, all your leadership, grit, drive, ingenuity, purpose… all hanging on whether someone doesn’t mess up a formula in Excel.

Getting value from your Cap Table

But just knowing the basic facts is not enough these days – you need to get insights that you can then apply in the real world, which is where the Cap Table excels.

Let’s take a look at round modelling.

Imagine your fundraising round with investors went great. So great in fact that you have an incredible amount of term sheets, offers and terms of investment. The choices you make in investors can directly impact the sustainability and success of your company and even having a choice of two or three can be overwhelming.

Our Cap Table round modelling feature can help facilitate your fundraising needs by letting you run, name, duplicate, and save multiple scenarios simultaneously. You can break up proposed investments among new and existing investors and use it to display the percentage changes in equity ownership across each shareholder line. Basically it allows you to model potential scenarios.

Do you know who owns your company?

It’s not as easy a question as it first sounds, is it? A business in any stage of their lifecycle can suddenly find themselves in all sorts of trouble if their Cap Table isn’t the solid foundation stone it needs to be.

For those businesses looking to leverage their Cap Table for growth, it’s a must that they move from spreadsheets to digital platforms. Without this upgrade, there may be a few sleepless nights ahead filled with unanswerable questions.

Contact us today and we’ll show you how to simplify your cap table management equity administration.

This publication contains general information only and J.P. Morgan Workplace Solutions is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. J.P. Morgan Workplace Solutions’ Insights is not a substitute for professional advice and should not be used as such. J.P. Morgan Workplace Solutions does not assume any liability for reliance on the information provided herein.