Trusted By Businesses Worldwide

Time is money

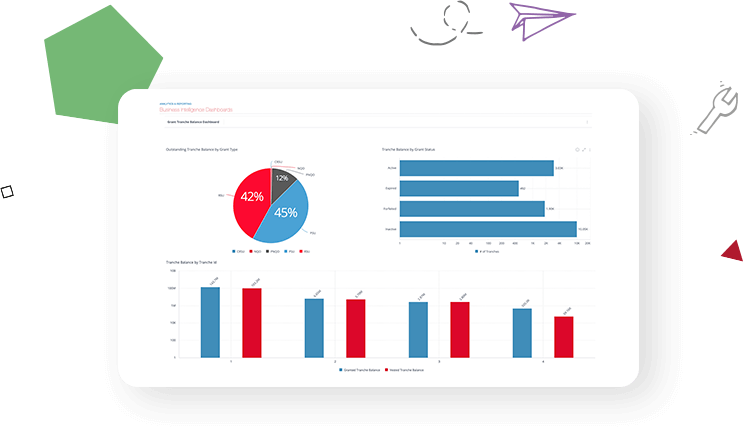

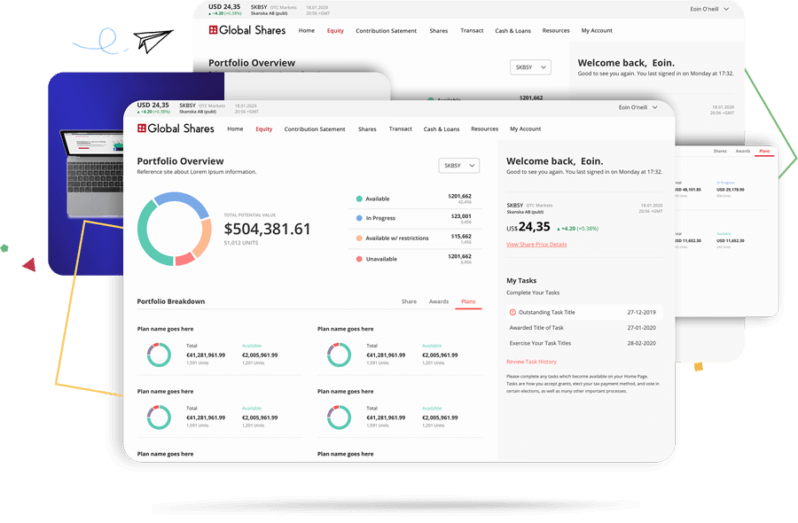

Financial reporting doesn’t have to be time consuming and complicated – we host everything under one roof for complete transparency. Keep track of your bottom line and have key tax information available at the click of a button for investors, auditors, regulators and partners alike.

Disclosure tables instantly

Our financial reporting functionality is weaved into our stock plan management system, so updates to participant or grant information are all effective dated. Vest events, forfeitures and transactions are recognized as they occur and the resulting impact on valuation, expense accrual and other financial reports will be immediate.

SIMPLIFY

Automate your equity plan and make it easy for your company

Fair Value Valuation

Measurement and Attribution of Expense

Accounting for tax effects

Earnings Per Share

Treatment of Forfeitures

Disclosures

Learn more about our Enterprise Platform

Ready to learn more?

Get in touch today for a no-obligation demo with one of our experts.

Read More

Get the inside edge on employee ownership.

-

What is equity compensation?

October 3, 2023

-

Webinar: SAYE 2023: Understanding CGT & Bonus Tax Rates with AON

September 27, 2023

-

Spain’s Share Option Plan: The Rules and The Benefits

March 29, 2023