Company executives make important strategic decisions and goals, and coordinate organizational operations. Having your key employees head-hunted by another organization can be a nightmare for your business, whether you’re a privately-held company or a publicly-traded company.

Traditional executive compensation packages aren’t enough anymore. It is important to look for new ways to keep them happy and motivated.

In this post, we’ll discuss executive compensation and introduce a non-cash method of rewarding valuable employees – executive equity compensation or executive stock compensation.

What is executive compensation?

Executive compensation, also known as executive pay, is the combination of salary, benefits, and bonuses offered to executives or other top management positions at a company in return for their work.

As they are experienced and skilled professionals at the top of their respective industries, companies often compensate them with a more valuable and complex compensation package.

Why is it important to discuss executive pay?

Executive compensation structure has been widely discussed because it’s important to get it right due to :

- War for executive talent: Approximately 60% of private firms polled compete against public companies for executive talent according to the compensation policy surveys completed by several consulting firms.

- Talent retention: Executives or senior management, as mentioned, are key to a company so a well-designed structure helps maintain staff stability and thus grows the company and business profit.

- Public sentiment: All public companies are required to disclose how much they are paying their executives and how this amount is derived. Not getting it right can bring a lot of public attention.

- Regulatory: An executive compensation policy of publicly traded companies is overseen by governmental regulations.

- Board of directors: Boards may have concerns about their role in the approval of compensation packages.

What are the components of a typical executive compensation package?

A typical executive compensation package has financial and non-financial components. They are salary, benefits, bonuses and equity. Commonly, an executive would get more amount of equity than a normal worker and a normal worker quite often wouldn’t get any equity in a private company.

- Salary: A fixed yearly salary, also known as a base salary

- Benefits: They may include insurance (e.g. health insurance and life insurance) and perquisites (e.g. club/gym membership and other company mobile phones)

- Bonuses: Considered short-term or annual incentives, they’re usually non-fixed, one-off sums of money, based on KIPs

- Equity: Considered a long-term incentive (over 3 years), equity compensation represents a form of ownership in the company and motivates employees to work harder – the better the company performs, the better their own shares get! It also provides a way to significantly grow an individual wealth compared to fixed cash bonuses.

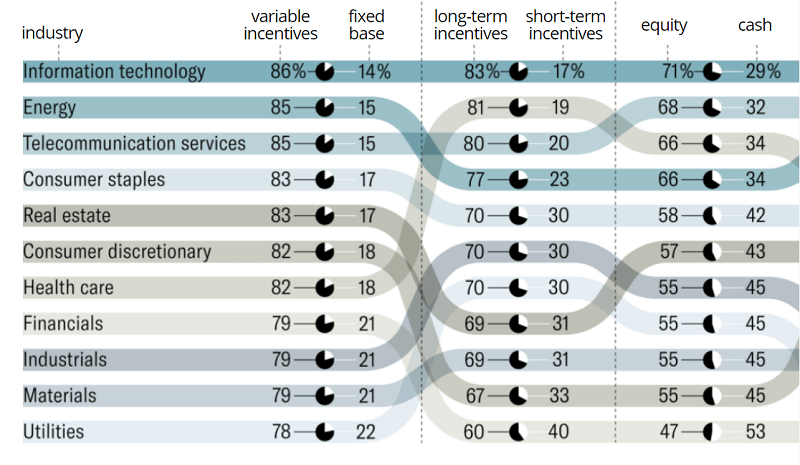

This approach has been used broadly among technology, energy and telecommunication companies. (Source: FW Cook proprietary research)

Executive compensation structure: Salary constitutes 30% of total compensation, bonuses another 20%, benefits about 10%, and long-term incentives (equity) of the compensation about 40%. (Source: Deloitte)

How does executive equity compensation work?

Salary, benefits, and bonuses are easy to understand. But, when it comes to equity-based compensation, it isn’t as straightforward as the rest because there are multiple ways to give equity compensation, e.g. through stock options, restricted stock units, and stock appreciation rights.

But similarly, these equity awards have a built-in retention function as they’re usually fully owned by employees over a period of three or more years.

- Stock Options: Stock options provide an employee with the right to purchase a certain number of shares at an initially agreed price after vesting. (i.e. meeting some requirements – service-based or performance-based or both).

Suitable for many companies – early stage, high growth startups and publicly traded companies – who want to issue equity broadly or with a group of selected employees. - Restricted Stock Units: It is a grant of shares to an employee. He/she usually receives them for free but doesn’t fully own them until a vesting period has passed.

Suitable for many established companies who want to offer equity broadly or with a group of selected employees without requiring payment upfront. - Stock Appreciation Rights: It is an award based on the company stock value (They are not stock but are tied to stock performance). Holders receive a bonus in cash or an equivalent number of shares based on how much the stock value increases over a set period of time.

Suitable for many companies who want to offer employees compensation without requiring employees’ upfront payment and issuing a large number of extra shares.

Latest trends in executive compensation: Long-term incentives like stock options often make up more than 60 percent of total direct compensation. (Source: SHRM)

Contact us today. Our experts will walk you through different forms of equity and the best way to design and manage your executive equity plans.

Contact Us

Equity vs cash compensation

While a high salary is attractive, it doesn’t necessarily provide strong incentives to exceed. Conversely, including equity in the company serves as a strong motivator for executives to ensure that the company continues to be high-performing. It also ensures that executives remain with the company as long as possible. More considerations for employers:

1. Cash bonus pros & cons

PRO: Cash has a guaranteed value and is highly reliable

CON: It is nice at the time but is a one-off. The motivation that comes with it soon runs out. It doesn’t serve as motivation to prevent someone from leaving for another job.

2. Equity awards pros & cons

PROs:

- Improve a business’s cash flow

- Give employees ownership of the company

- Encourage employees to stay longer in the company as they’re long-term incentives that consider future goals over a period of 3 years or more.

- Compared to cash, equity is a much better way to motivate employees to work harder to grow the business as the financial well-being of your employees links directly with that of the company.

- Provide a way to significantly grow wealth (Take a look at the early employees of Google or Meta (formerly known as Facebook) to see how their bets turned them into millionaires.)

- Long-term incentives provide the most shareholder value, which is why companies are increasingly compensating their executives according to their performance. (Source: SHRM)

CONs:

- Cause share dilution (When a company issues additional stock, the ownership proportion of a current shareholder will be reduced)

Note: It isn’t always that bad. If the company issues new stock as a means to boost revenue, then it may be positive. - Introduce complexity to your business, e.g. ownership tracking and management, tax, compliance, documentation, board approval and more.

Don’t let these issues put you off because there’s always a simplified solution to handle them. Contact Global Shares today and we can walk you through how to manage executive equity like a pro.

Executive compensation plans for private companies and public companies

Accordingly to the AON survey 2019, executives at public companies receive around 40% more compensation than those at private businesses. The driving factor behind the gap is the prevalence of long-term incentives at public companies while cash compensation is only slightly smaller for private company executives.

More differences are as below:

| Private companies | Public companies |

|---|---|

| Don’t offer equity very often (due to no or little liquidity) | Offer equity more often |

| A small number of executives receive significant equity stakes | More executives receive equity, even managers |

| Offer less competitive equity-based incentives | Usually offer more competitive equity-based incentives |

| LTIP heavily relies on cash | LTIP tends to diversify awards among at least 2 equity vehicles – restricted stock & performance shares |

| Simpler processes for obtaining approval of equity grants | More time-consuming approval processes |

| Public disclosure of executive compensation plan is not required | Concise and understandable public disclosure of executive compensation plan required |

Since there’re many differences in executive compensation between private and public companies, make sure to allow yourself sufficient time to review your compensation plan if you intend to go public. To learn more, read our ‘’IPO executive compensation’’ checklist.

So, what is the most effective executive compensation structure?

The most effective executive compensation structure should be aligned with the specific business goals and strategy, the time horizon of the investors and other factors like below:

- Business philosophy, mission and vision

- Life cycle, organizational structure and business processes

- Workforce composition and demographics

- Tax and accounting regulations

- Industry and competition

- Public sentiment

After carefully considering them, you’ll know whether you should rely more on equity-based awards or cash-based incentives. Once you’ve it sorted, don’t forget the next important step – equity management.

If you’d like to see for yourself how Global Shares can help your company, book a one-on-one, no-obligation consultation today and we’ll demonstrate our award-winning software.

Request a Demo

This publication contains general information only and J.P. Morgan Workplace Solutions is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. J.P. Morgan Workplace Solutions’ Insights is not a substitute for professional advice and should not be used as such. J.P. Morgan Workplace Solutions does not assume any liability for reliance on the information provided herein.