Trusted By Businesses Worldwide

Improve retention

Employee share plans help employees save for the future or can be cashed in for rainy day scenarios. Seeing the financial benefit of their investment encourages commitment to your organisation and an increased likelihood of staying invested in the company in the long run.

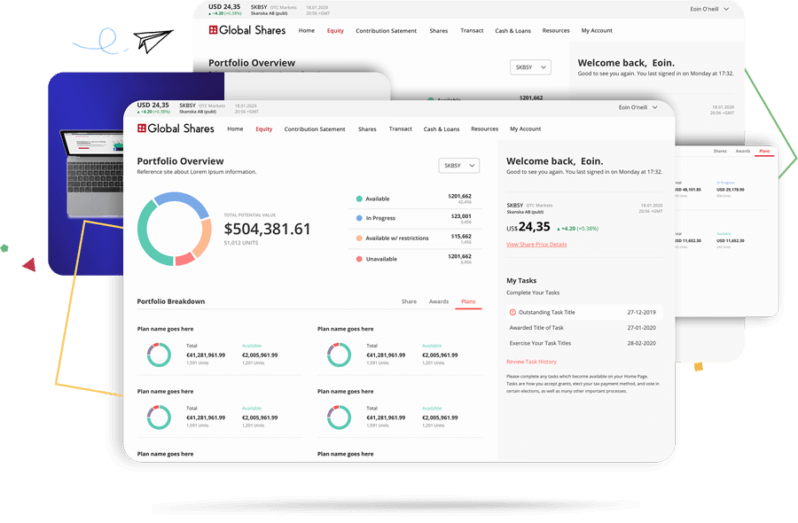

Share Plans with ease

Let us help you design a plan that allows employees to reap the benefits of employee ownership. We can also administer and manage your existing share plan, whether it’s an Approved Profit Sharing Scheme (APSS), a Restricted Share Scheme (Clog), Unapproved Share Option Scheme or Save As You Earn (SAYE). Your plan can involve discounted share prices, contribution limits or company matching, dividends and more. Here at Global Shares we will ensure your programs are fully compliant. From tax rates between regions, employee mobility and transfers or an international workforce – we take away the hassle of managing your share plan.

Ready to learn more?

Get in touch today for a no-obligation demo with one of our experts.