Equity compensation, also known as share-based compensation, is a type of non-cash pay that a company offers to employees to partake in ownership of the firm.

In this post, we’re going to discuss:

- Why equity compensation?

- Different types of equity compensation

- How does equity compensation work?

- How much equity to give employees?

- What happens to employee equity on termination?

- Potential problems with employee equity

Why equity compensation?

The major advantage of equity-based compensation is the financial considerations both for the employer and the employee. It allows employers to offer their employees more – which is great for the employees – while not affecting their bottom line – which is great for the employer. More equity compensation benefits:

- Helps attract and retain talent: It is particularly useful for smaller companies that are just starting out, allowing them to offer employees a portion of their potential when they don’t have much cash to hand. So, they can remain on solid financial ground.

- Attains greater alignment: Employers benefit from the alignment of their employees’ values with the company’s missions.

- Achieves lower absenteeism: Employees work harder and are more productive as their performance impact how much they can earn.

- Builds employee engagement: Employees likely generate a feeling of team spirit – they’re not just employees, they’re employee-owners and can often make valuable contributions to the company’s direction through shareholder voting.

Types of employee equity

Employee equity compensation comes in a wide variety of forms and plans – Stock options, Restricted stock, Employee share schemes and more. This post will discuss the following 4 types.

- Unapproved stock options

- Restricted stock – RSU & RSA

- Cash deferred bonus plans – SARs & Phantom stock

- Tax-advantaged employee share schemes

Check how each works in the next section.

How does equity compensation work?

Equity compensation works by offering employees equity right away when they join the company or after a vesting period where employees have to stay with the company for a certain amount of time to have full ownership of the stock.

Let’s see how the following types of equity-based compensation work:

1. Unapproved stock options:

Stock options provide an employee with the right to purchase a certain number of shares at an initially agreed price after a vesting period (service-based or performance-based or both). Income tax, the Universal Social Charge (“USC”) and employee PRSI are charged on the

difference between the option price and the market price when the option is exercised.

Financing methods:

1. Cash from the employee’s pocket to purchase the options

2. Money made from the sale to cover the exercise costs in an exercise-and-sell-transaction

Suitable for many companies – early stage, high growth startups and publicly traded companies – who want to issue equity broadly or with a group of selected employees as a way to attract, retain, and/or motivate them.

Learn more stock options here

2. Restricted stock – RSU & RSA:

Restricted stock is a grant of shares to an employee. He/she can receive them only if a vesting requirement is met (service-based or performance-based or both). Participants may need to pay for the grants under RSA plans while they typically receive the grants for free under RSU plans.

Financing methods:

1. Cash from the employee’s pocket to purchase the grants

2. Stock from the company’s equity incentive pool

Suitable for many companies who want to offer equity broadly or with a group of selected employees as a way to attract, retain, and/or motivate them without requiring payment upfront. (RSA is commonly used by startups while RSU is by established companies)

3. (Cash) deferred bonus plans – SARs & Phantom stock:

They’re the two types of stock plans that don’t really use stock but still reward employees with compensation that is tied to the company’s stock performance. So, participants are not shareholders and don’t have voting rights.

Once the vesting period is over, participants can get a cash equivalent or the actual stock. If you’re looking to offer plans with minimal risks for employees, they’re ideal because there is no purchase required, unlike stock options.

Suitable for many companies who want to offer employees compensation without requiring employees’ upfront payment and issuing a large number of extra shares.

Learn more about deferred bonuses here

4. Approved employee share schemes:

Unlike unapproved stock options, approved employee share schemes are tax-advantageous schemes in operation in many Irish companies for rewarding and retaining employees. They’re Save As You Earn (SAYE), Approved Profit Sharing Scheme (ASPP), Key Employee Engagement Program (KEEP) and Employee Share Ownership Trust (ESOT).

Financing methods:

1. Employee’s income (SAYE/KEEP) / Employee’s cash bonuses (ASPP)

2. Payments made by a company (for ESOT)

Suitable for many companies who want to offer employees equity with tax benefits while enjoying corporation tax relief themselves. (KEEP is ideal for SMEs)

Learn more about employee share schemes here

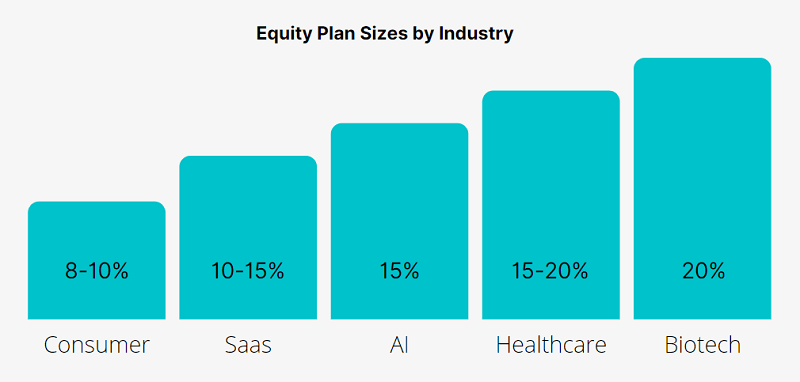

How much equity to give employees?

Startups typically create employee equity plans that comprise 10–20% of the total equity of the company (50% for the founder(s) and 30-40% for investors). It’s similar to what David Steinberg – the founder of Zeta International, a strategic marketing company – recommended to us:

Steinberg recommends establishing a pool of about 10% for early key hires and 10% for future employees.

Let’s do some maths here now:

Generally speaking, if a startup business has a team of 10 people, the average equity given to employees is 1-2%. It’s not uncommon for first hires to get a greater equity share.

But.. don’t forget about share dilution

When calculating the magic numbers for offering shares to employees, you may need to consider the dilution issue which occurs when you issue new shares. With more shares in the hands of more people, each existing shareholder owns a smaller or diluted percentage of the company.

So, if you give away too much to attract new hires, you’ll end up diluting yourself and your investors who of course want to own as much as they can.

And.. think about unissued shares

If your startup is initially formed, consider leaving some of your shares unissued. You can increase the number of unissued shares if you plan to recruit more co-founders or expand your team at some stage.

Leaving some unissued for the future can save your time and effort as it helps avoid acquiring corporate approvals. It also means you may not need to amend your company’s formation documents to authorize more shares in the future.

What happens to employee equity on termination

We get that.. the working relationship between you and your employee can get sour and you can no longer work together. That’s why a shareholder agreement comes into play.

The agreement should spell out the triggers, timing, and price for the repurchase of an employee’s stock. Let’s see some typical treatments when an employee leaves the company:

Stock Options: Typically, stock options expire within 90 days of leaving the company, so you could lose them if you don’t exercise your options. You may have a chance to exercise (i.e. purchase) them within the period or before you leave.

RSA / RSU: If your employees quit with vested RSA/RSU, typically the vested RSUs will stay theirs as they own company stock after vesting. For the unvested stock treatment, the unvested RSA shares are subjected to repurchase upon termination and the unvested RSU shares are likely forfeited.

Potential problems with employee equity

Although equity-based compensation is getting popular and is widely used by different industries, the main disadvantage that we usually hear from companies hesitating to implement one is the matter of complexity.

- Equity compensation brings with it a lot of reporting and regulations to follow, as well as entire areas of jurisdiction and tax laws

- There is also a tremendous amount of work and thought that needs to be put into the design of the plan, e.g. how much equity to give away, participant eligibility, vesting schedule, period of the plan

- It may also cause extra workload to your existing departments due to tedious processes – everything from tracking and reporting changes in ownership to updating documents/policies/procedures, communicating with stakeholders, consulting your board of directors, and staying compliant.

Luckily, there’s an incredibly easy fix to this: Employee equity plan, simplified.

Looking to launch an equity compensation plan? Contact Global Shares today

With Global Shares’ award-winning combination of software and support, we take on all of the complexity and the hard work required for your equity compensation plan.

Our teams of experts will take you through Implementation, where we work with you to design and launch your plan, as well as the day-to-day business of maintaining and improving your plan after launch.

Our dynamic, customizable equity compensation software makes it easy for participants to view and manage their equity, but just in case, our multi-lingual Support Desk is always ready to answer any questions.

Contact Global Shares for a free demo today.

This publication contains general information only and J.P. Morgan Workplace Solutions is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. J.P. Morgan Workplace Solutions’ Insights is not a substitute for professional advice and should not be used as such. J.P. Morgan Workplace Solutions does not assume any liability for reliance on the information provided herein.