While ESPPs (employee stock purchase plans) are a popular way to share company ownership after IPO, the best time to think about it is before an IPO.

So, if offering an ESPP to your employees is something that appeals to you, make sure you put it in place pre-IPO. Why not take advantage of the relative freedom that being a privately held company gives you… while you still can!

Benefits of an ESPP to a Company

An ESPP gives employees the opportunity to purchase shares in the company they work for. It is a simple way to pursue a disciplined savings plan and build financial wealth. Under this plan, an agreed figure is deducted directly from employees’ payroll overtime, and after a predetermined period – usually, six months – that money is then used to purchase shares.

If you want to know more about ESPP, head over to our What is an ESPP guide.

Offering ESPPs during the lead-up to an IPO is an ideal way to ensure the IPO excitement is felt by your employees and helps to maintain a culture of ownership for years to come. Jump to this section to learn more about why you should get your ESPP ready before IPO.

What else can you expect to gain from offering an attractive ESPP to employees?

- Reduced turnover

- Greater work effort

- More hours worked

- Reduced absenteeism

- Less tolerance of colleagues perceived to be slacking

Sound great! But what can you do to ensure that your plan will be sufficiently appealing to achieve such a good level of uptake? Here are five ESPP design considerations.

Contact Global Shares Now

We have an established track record in ESPP and will be more than happy to help to get your plan ready for IPO.

Contact Us

Get your ESPP ready: 5 things you need to consider

IPO is a particularly hectic period so we want to help you run a smooth ESPP design process with the following 5 considerations.

1. Choose a plan: qualified vs non-qualified ESPP

The most common design in the US is a qualified ESPP (also known as a 423 plan) as there’s no taxable event when shares are purchased, so it’s treated more favorably on taxation. However, a non-qualified plan offers more flexibility in design.

Let’s see their main features:

Read more: Qualified vs Non-Qualified ESPP

So, when deciding between a qualified or a non-qualified ESPP, it’s important to identify the objectives your company is trying to meet.

| Qualified ESPP | Non-Qualified ESPP |

|---|---|

| Contribution made with after-tax dollars | Contribution made with after-tax dollars |

| Discount ranges from 0% to 15%, with 15% most used | May offer a discount of more than 15% from the current FMV of the stock |

| Approved by shareholders | Not required |

| More favorably on taxation | Less favorably on taxation |

| Less Flexible | Flexible |

2. Offer a discount

For most cases, the discount range is between 5% and 15% and most companies offer a discount at 15% to help boost participation rates.

3. Consider a lookback provision

Quite commonly, to make an ESPP more attractive, companies offer a ‘’lookback’’ feature in addition to the discount offered. The ESPP lookback feature allows employees to purchase the shares at a price on either A: the initial date of the offering period or B: the purchase date, whichever is lower.

This ensures participants will not be disadvantaged in the event of the share price increasing over time. To see how this would play out, let’s say company shares were valued at $10 on day one and $12 on the purchase date.

Initial Price: $10

Price on Purchase Date: $12

Company Discount: 15%

The actual purchase price was reduced to $8.5 from $10.2 with a lookback.

| With Lookback | Without Lookback |

|---|---|

| Purchase Price: $10 | Purchase Price: $12 |

| Actual Purchase Price: $10 – $1.5 (discount) = $8.5 / share | Actual Purchase Price: $12 – $1.8 (discount) = $10.2 / share |

Non-qualified Plans: 35% have a look-back

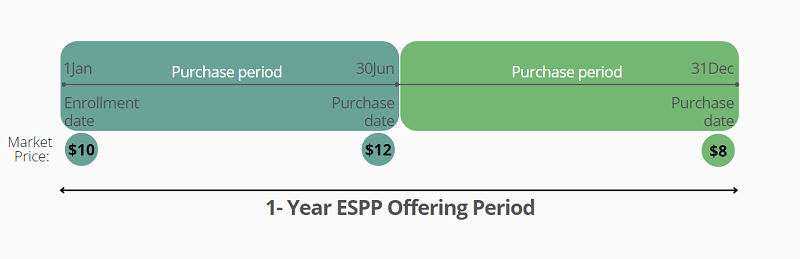

4. Set up offering period & purchase periods

When considering your ESPP design, you need to think about how long the ESPP offering period would be. Most qualified ESPPs have an offering period of either 6 months or some multiple thereof (12 months or 24 months).

Those longer than 6 months typically include interim purchase periods as illustrated below. The purchase date is at the end of each purchase period, on which the shares are officially purchased.

You need to consider purchase dates carefully because you may want to avoid month- or quarter-end, annual grant dates, holidays, or other peak times.

5. Communicate Early & Often

Employee communications can have an important impact on participation. You can achieve high participation rates with a robust comms strategy regardless of the ESPP design.

So, when you first attempt to pitch an ESPP to your employees, make no assumptions around their understanding of what is being proposed. Spell everything out, state explicitly how it works, and do so using clear, everyday language. If you lapse into jargon and business-ese and start to sound as if you are speaking in bullet points, you will lose at least a portion of your audience.

Occasional communications aren’t enough. It could lead to the perception among employees that participation isn’t the company’s priority.

It’s a good idea to use a variety of channels to reach your employees such as an intranet, blogs, town hall meetings, and lunch-and-learns.

Items you want to include in your comms plan:

- ESPP Basics

- Key Plan Features: Discount, Lookback

- Plan Benefits: Build wealth and achieve personal financial goals.

- Lifecycle of the program from enrollment to purchase to the eventual sale of stock

- Max. contribution

- Taxation

Why should you get the ESPP approved & ready before IPO?

Again, offering ESPPs at IPO is an ideal way to ensure the IPO excitement is felt by your essential broad-based workers.

It’s okay not to launch the ESPP before an IPO, but you would miss some attractive benefits if you did it post-IPO as shareholder approval is easier when you’re still private.

Tax-qualified ESPPs require shareholder approval. Shareholders nearly universally approve ESPPs, but approval is even easier for private companies because approval usually only requires the support of a closely held group of founders and venture capital investors. It will likely save you time and effort.

Also, obtaining shareholder approval doesn’t require waiting for the next annual meeting.

If your ESPP is approved while your company is private, you can also include an evergreen provision to automatically replenish shares every year (for rewarding employees in the future) without requiring further shareholder approval. Without such a provision in advance, increases in plan reserves after an IPO require shareholder approval via a proxy vote and they may not vote for it.

So, if you can do it before going public, why wouldn’t you?

So, make a smart move: Start your ESPP journey now…before your IPO

If you want expert advice on how to set up your ESPP, contact Global Shares now. We have an established track record in equity compensation and will be more than happy to help.

Please Note: This publication contains general information only and Global Shares is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. The Global Shares Academy is not a substitute for professional advice and should not be used as such. Global Shares does not assume any liability for reliance on the information provided herein.