Integrated financial reporting

Stay compliant with ASC 718 and IFRS 2 guidelines. Our financial reporting tool integrates all your stock plan data. Get access to a team of accounting professionals with knowledge and experience of share-based and deferred cash compensation plans.

Features

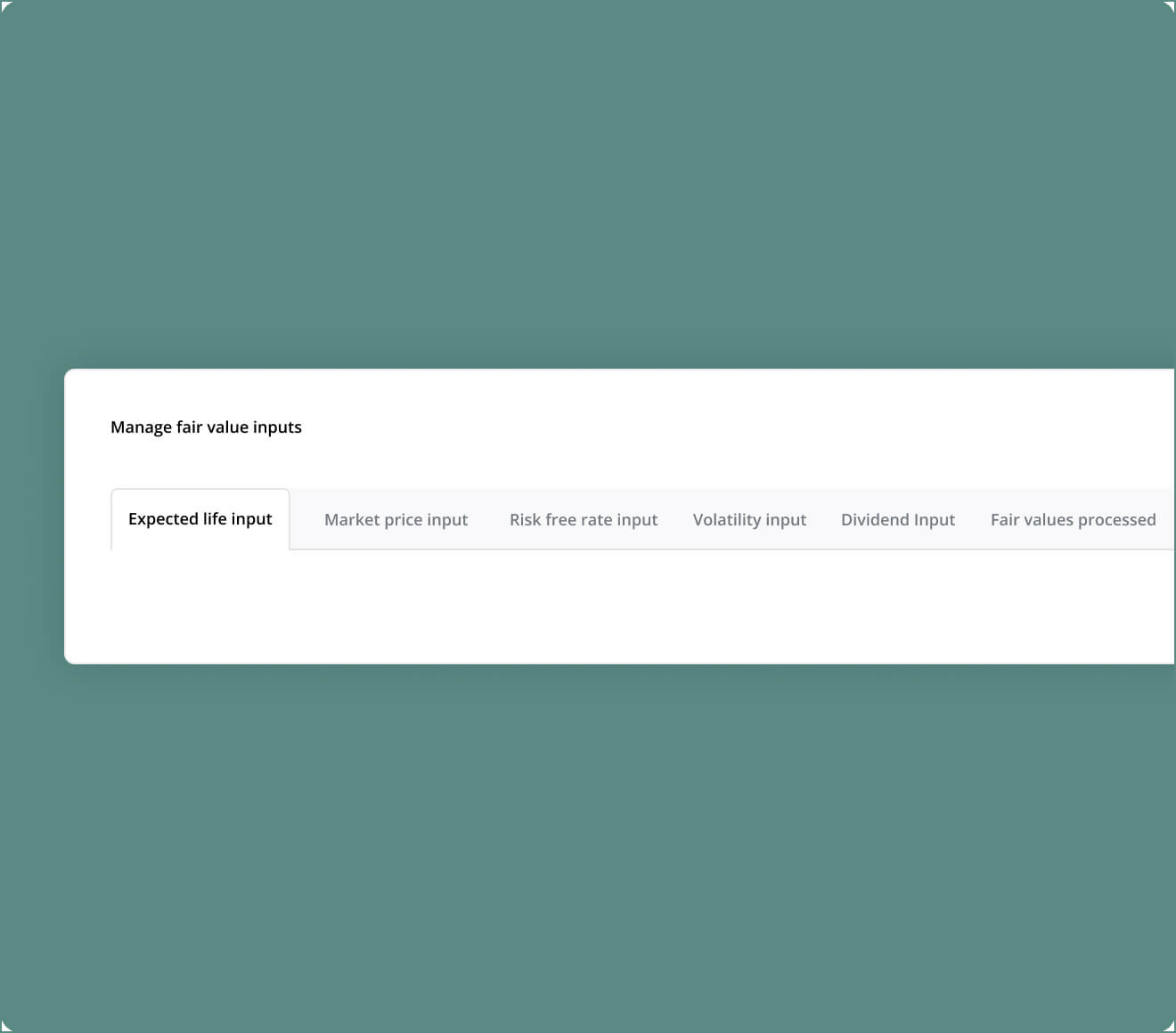

Fair Value Calculation

Choose how you want to calculate fair value

- Use the system’s built-in Black-Scholes calculator or add an external value to calculate fair values.

- Auto-calculate the expected term, risk-free rate, and volatility percentage using a company’s share price data or peer group share price data.

Expense Reporting

Get an overview of your expense accrual information

- Manage ‘out of period’ transactions, such as forfeitures and grant information, entered after the close of a reporting period.

- Apply the system’s flexible reporting to localize expense at the grant, plan, or vesting period level.

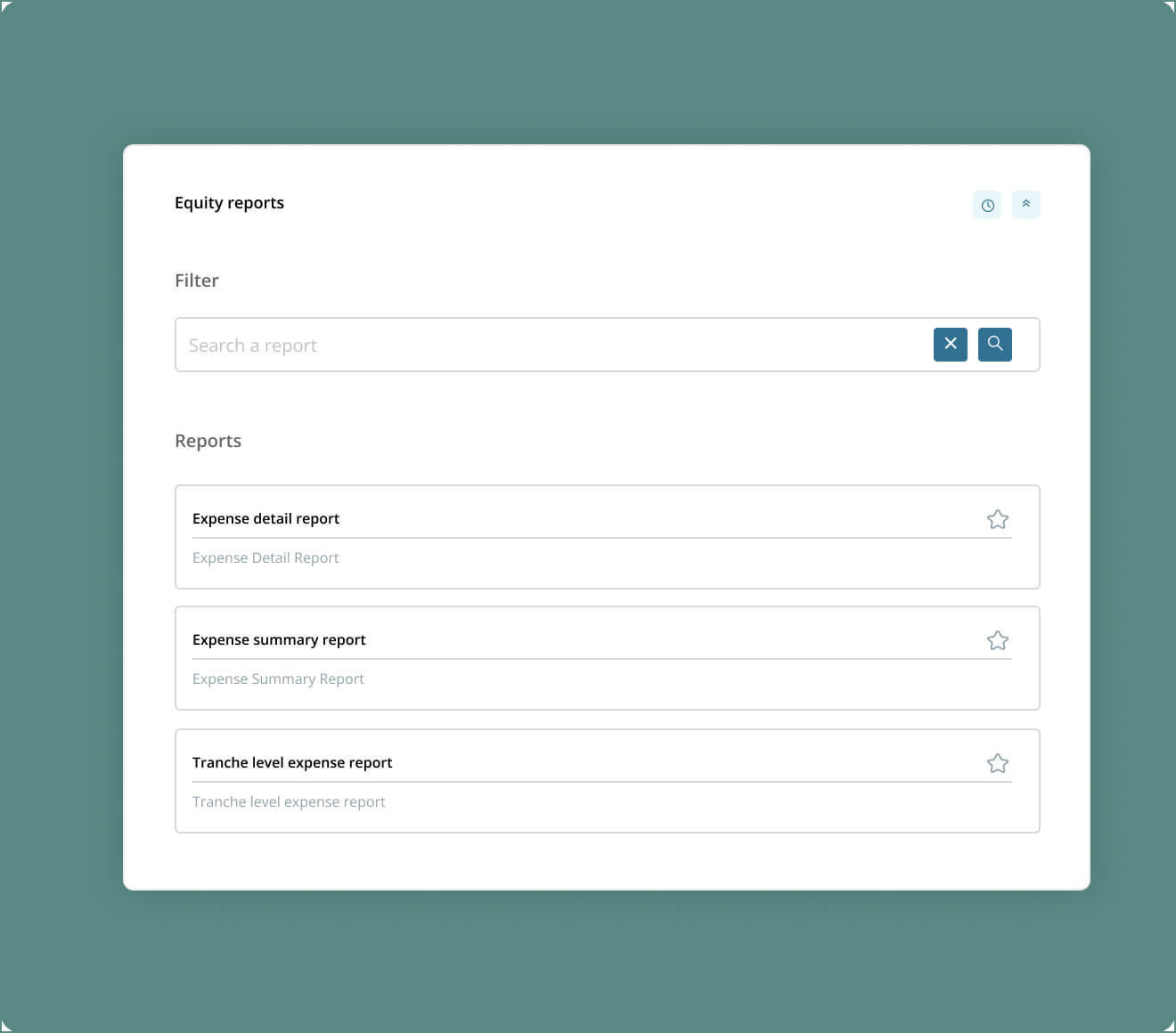

Financial Reports

Real-time reports

Pulled directly from your stock plan information.

- Dilution and Earnings Per Share (EPS).

- Deferred Tax Reporting.

- Disclosures.

- Annualized Forfeiture Rate Report.

Product FAQ

-

Does the accounting tool fulfill US GAAP and IFRS 2 requirements?

Yes, the tool allows users to create reports under ASC 718 and IFRS 2.

-

What type of amortization methods does the system allow for?

The system allows for front-loaded or straight-line amortization for US GAAP and by default uses the front-loaded method for IFRS reporting. For straight-line amortization, the system will automatically calculate both Pure Straight Line and Modified Straight Line percentage expense for each reporting period as expense is being amortized for the grant and apply the period expense based on the higher percentage.

-

How are forfeitures accounted for in the system?

Forfeitures can be accounted for as they occur, or by applying an annual forfeiture rate based on the percentage of shares expected to be forfeited in a year. This rate is compounded annually over each tranche vesting period within the system.

-

How are forfeiture rates assigned?

Forfeiture rates can be assigned to separate groups of participants such as executives versus employees or by grant date or vesting schedule.

-

Does the system consider expected performance for performance awards?

Yes, if you have performance awards, the system allows for the expected performance to be applied with as-of dates throughout the service period of the award until the final measurement has been captured. The reports will true-up expense to the expected performance where required.

-

Can the reports be downloaded from the system?

Yes, you can download reports from the system in Excel CSV format.

-

How long will it take for our transactions to appear in the reports?

As the financial reporting functionality is integrated into the corporate admin system, updates to participant or grant information, which are all effective dated, transaction events such as vesting, forfeitures and settlements are recognized as they occur within the administration area and the resulting impact on valuation, expense accrual and other financial reports will be immediate.

Ready to learn more?

Get in touch today for a no-obligation demo with one of our professionals.

Related insights

-

Financial wellness and equity compensation

June 24, 2024