Trusted By Businesses Worldwide

ESOs made simple

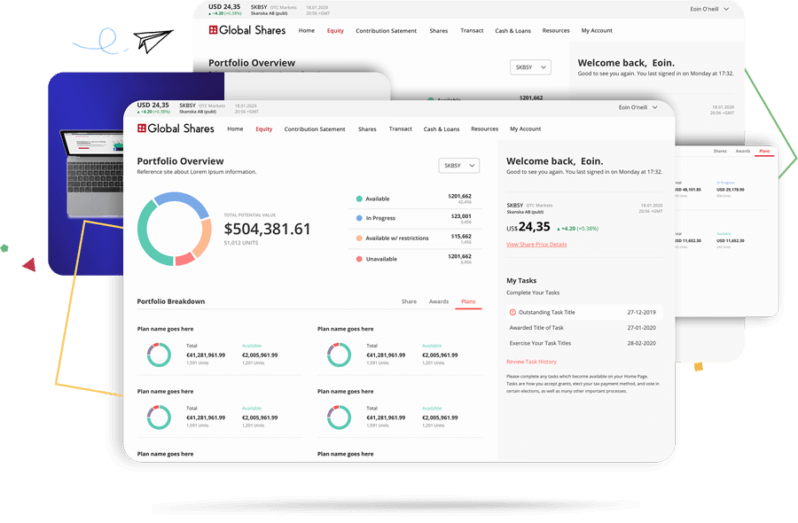

Our employee stock option administration solution combines extensive expertise with system functionality, operational processing and participant management .

Incentive stock options (ISOs) & Non-qualified stock options (NSOs)

Incentive stock options – reserved for employees only – qualify for favorable tax treatments while non-qualified stock options do not. Whether it’s an incentive stock option (ISO) or a non-qualified stock option plan (NSO), we can help you design and administer a stock option plan that allows employees to reap the benefits of employee ownership.

Tailored for you, administered by us

Employee stock options are flexible in their design and so can be created specifically for your company’s needs, goals and existing capabilities. Establishing an option plan that fits with your business’s philosophy from the get-go is key. From plan rules, tax rates between States, employee mobility and transfers or an international workforce – we take away the hassle of managing your stock option plan.

Ready to learn more?

Get in touch today for a no-obligation demo with one of our experts.

Read More

Get the inside edge on employee ownership.

-

Predictions for 2024

January 18, 2024