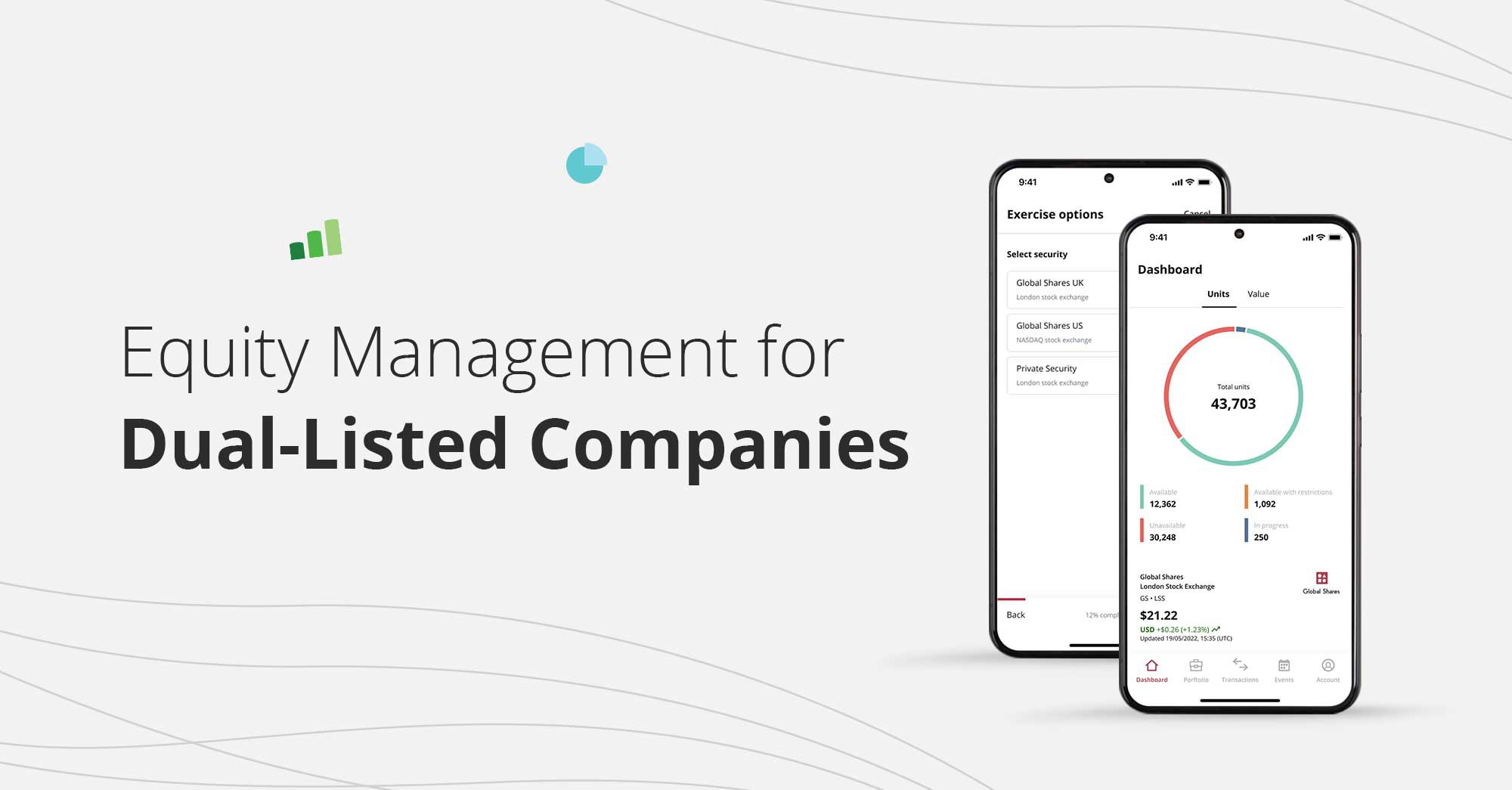

Global Shares is excited to announce that it now has enhanced the custody and execution services for clients listed on more than one stock exchange (e.g., dual-listed). This means that Global Shares can now facilitate dual-listed companies with different commission and account structures. For example, if you grant shares to employees on both exchanges (i.e., Canadian employees granted in Canadian dollars on the Toronto Stock Exchange and US employees granted in US dollars on the New York Stock Exchange) we can now streamline this process for you.

What does dual listing mean?

Dual listings refer to companies that are listed on multiple stock exchanges. Companies that engage in dual listings benefit from the opportunity to raise more capital and increase their investment base. Usually, the process works with international companies that have a presence in multiple markets (e.g., Canada and the United States). Major Canadian companies, for example, are also listed on US exchanges because a sizeable portion of their audience tends to be American.

This example points to another tendency of dual-listed stocks. Companies tend to approach countries that overlap with their home company on either language or culture. Because English is a common language between the US and Canada, the double listing makes sense. Yet Canadian companies are also dual listed on European stock exchanges to gain exposure to the broader European market.

Commissions Update

It is common for dual-listed companies to have different commission structures for securities listed on different exchanges. Variations in commission structures are primarily due to differences in market practices, regulations, and trading conventions across various exchanges. For instance, consider a company listed on both a U.S. stock exchange and a non-U.S. stock exchange (e.g., the London Stock Exchange).

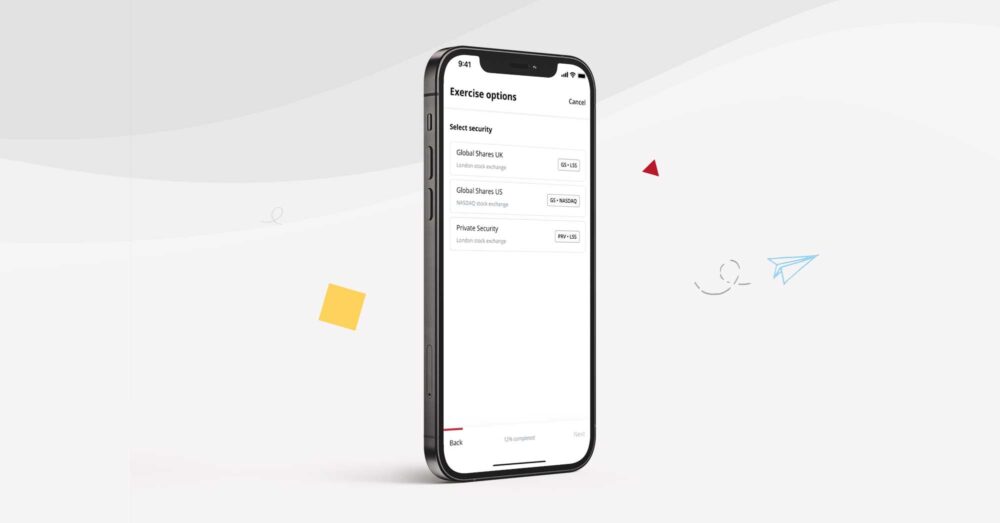

Trading commissions for U.S.-listed securities are typically quoted on a per-share basis, meaning a fixed fee is charged for each share traded. On the other hand, securities listed on the non-U.S. stock exchange often employ a basis points commission structure, where the commission is calculated as a percentage of the total value of the trade. To cater for this and other scenarios (e.g., different exchange fees), Global Shares has developed their platform and mobile app to be able to apply different commission structures based on each exchange your security is listed on.

How can this help you?

Global Shares can provide a fully integrated equity compensation management solution to employees worldwide. It means from software and administration to compliance and reporting – we can help your employees take full advantage of stock ownership.

If you would like to see for yourself how our software works, book a one-on-one consultation with us today and we’ll demonstrate how our award-winning software can help your company.

Please Note: This publication contains general information only and Global Shares is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. The Global Shares Academy is not a substitute for professional advice and should not be used as such. Global Shares does not assume any liability for reliance on the information provided herein.