An ESPP (employee stock purchase plan) is a company-run program, which allows employees to use their after-tax wages to acquire shares in the company, usually at a discount of up to 15%. While ESPPs have proven to be beneficial for both employers and employees, designing an ESPP can be overwhelming sometimes.

Together with one of our Certified Equity Professionals (CEP), John Bagdonas, we’ll take you through some of the considerations associated with designing an ESPP as well as research studies, so you can determine how to best design your ESPP to attract the employees you want and help you to achieve your goals.

Define your ESPP goals

In the design phase, you should first of all always define your ESPP goals by factoring in your business objectives. For instance, if you aim to attract talent using ESPP, offering a low plan discount is unlikely to attract prospects. That said, there should be a lot of research involved when it comes to ESPP design to allow you to understand the industry practices and employees’ needs.

Here are 10 ESPP design components you should consider:

Plan type: Qualified and non-qualified

There are generally two classes of ESPPs – Qualified and Non-Qualified ESPPs.

A qualified plan is designed and operates according to Internal Revenue Section (IRS) 423 regulations. It is treated more favorably on taxation, meaning no income tax is due at the time of purchase until the ESPP stock is sold. However, it comes with more restrictions, e.g.

- All participants must be given the same rights and privileges

- The plan must be approved by the shareholders

- Employees cannot purchase more than $25,000 worth of stock in a calendar year

- Their offering periods cannot exceed 27 months

- The plan discount on the stock price may not exceed 15%

A non-qualified plan is not subject to the rules that pertain to qualified plans, so it’s more flexible in design – e.g. you can offer a plan discount beyond 15% etc. But, it is not as tax-advantaged as a qualified plan so income tax may be due at the time of purchase.

While qualified ESPPs are more popular in the US, companies that select to implement a non-qualified ESPP mostly do so to avoid the design constraints imposed by Section 423.

Read more: Qualified vs non-qualified ESPP

Employee eligibility

Although an ESPP can be designed as an all-employee program for a qualified plan, you can choose to exclude certain employee groups, e.g., part-time workers and newly joined staff.

Additionally, qualified ESPPs do not allow employees owning more than 5% of company stock to participate.

Length of offering period & purchase period

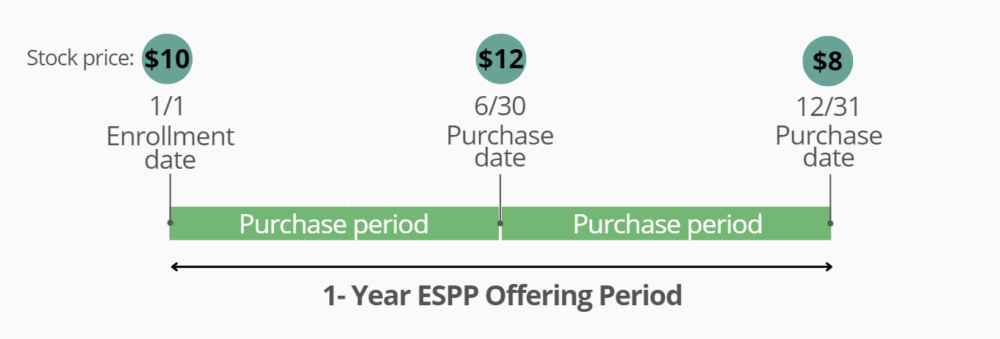

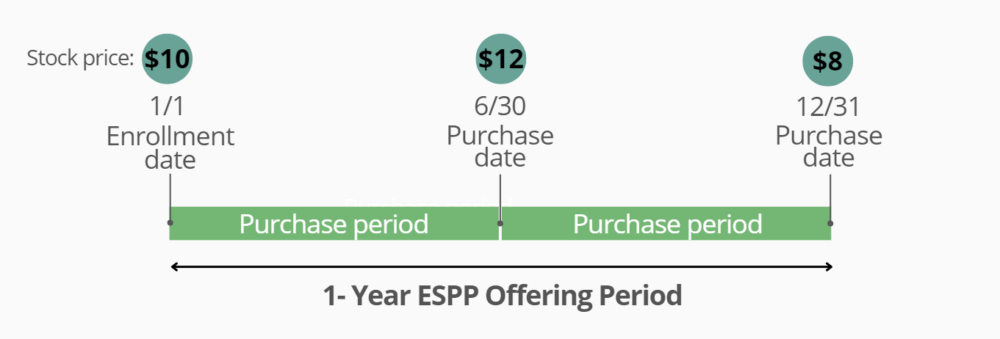

The length of an ESPP offering period is where you’ll be able to purchase company shares at an agreed discount for your participating employees. In the example below, it’s a 12-month offering period. The common length of an offering period is usually 6 months or 12 months. While the maximum offering period under a qualified plan is 27 months. A longer offering period can result in a larger accounting expense.

Within an offering period, there may be a series of purchase periods in which you set aside money to purchase the shares. In this example, there are two purchase periods.

According to the 2023 ESPP survey conducted by NASPP and Deloitte, 57% of companies offer a 6-month offering period (up from 49% in 2020), and 13% of companies offer a 12-month offering period (up from 8%)

Plan discount

Up to a 15% discount can be offered under a qualified plan while a non-qualified plan allows for an even higher discount or matching shares. The greater the plan discount, the more attractive it will likely become to employees.

The same survey reveals that 85% of companies offer a 15% discount (up from 70% in 2020). If you only offer a 5% or 10% discount, your plan is unlikely to be attractive to your current employees or prospective employees, particularly in a market environment with higher interest rates.

Lookback provision

If your plan has a lookback provision, it means the plan discount can be applied to the stock price either at the purchase date or the grant date, whichever is lower. (Read more: ESPP explained)

With a lookback feature, your purchase price on 30 June would be $10 x (1-15%) = $8.5 per share for instance. That’s because the stock price on the grant date is lower than that on the purchase date. This feature can further lower the purchase price and is proven to boost a plan enrollment rate together with a 15% discount.

The longer the offering period, the greater the potential benefit is to employees where the plan has a lookback feature.

According to the same survey, 83% of companies offer a lookback provision (up from 64% in 2020).

Automatic rollover

Automatic rollover occurs in a plan with a long offering period.

If the stock price decreases on a purchase date, a rollover cancels the remaining purchase periods in the offering period and re-enrolls everyone in a new offering based on the lower price.

Plan contributions

Your employees make contributions to their ESPP via convenient payroll deductions using their after-tax wages. You’ll need to consider the percentage of pay or set a fixed amount that your employees can contribute to the plan.

Also, you will need to consider if you will allow your participating employees to change their contributions or withdraw/suspend the plan during the offering period?

Annual contribution limit: $25,000

While most plans allow employees to elect a payroll deduction between 1% and 15%, you need to watch out for the annual contribution limit.

Under a Section 423 plan, the IRS limits purchases by employees to $25,000 worth of stock value (based on the fair market value on the offering date) for each calendar year in which the offering period is effective.

For example, the maximum number of shares to purchase would be 2,500 if the stock price on the offering date was $10 ($25,000 ÷ $10).

Full shares or fractional shares

Allowing employees to purchase fractional shares (i.e., less than one full share of company stock) could be beneficial to your plan’s success. Don’t overlook this feature because fractional shares add up over time and your employees will eventually own whole shares by consistently purchasing them.

For instance, lower-income employees may not be able to contribute enough to buy a single share of stock if their companies have a high stock price. Introducing fractional share purchases could provide a greater economic benefit to employees.

Holding period

Will you have any plan or share restrictions, e.g. holding periods to prevent employees from selling the shares immediately after their purchase?

Adding a holding period to your plan could encourage employees to participate in the longer-term growth of the company, which is good from shareholder’s perspectives. However, that may lower your participation rates because employees might prefer to sell their shares quickly.

Again, companies should consider their goals when contemplating a holding period — balancing the impact on participation rates, shareholder perspective etc.

Contact us

We’ve covered 10 ESPP design features and rules to help you design yours.

Take your time to do research, understand your industry practices and your employees’ needs because implementing an ESPP with non-competitive design features can be a costly mistake.

Still have some doubts or questions about ESPP design? Contact Global Shares today – one of our equity professionals can walk you through different design components based on your needs.

By visiting a third-party site, you may be entering an unsecured website that may have a different privacy policy and security practices from J.P. Morgan standards. J.P. Morgan is not responsible for, and does not control, endorse or guarantee, any aspect of any linked third-party site. J.P. Morgan accepts no direct or consequential losses arising from the use of such sites.

Please Note: This publication contains general information only and Global Shares is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. The Global Shares Academy is not a substitute for professional advice and should not be used as such. Global Shares does not assume any liability for reliance on the information provided herein.