When it comes to offering your employees a long-term incentive plan (LTIP), there are lots of great reasons, but one of the most appealing for employers is you’re giving your employees an incentive to remain engaged and focused in the long term.

Today, we’ll discuss how to go about creating an effective LTIP by laying out long-term incentive plan best practices.

Why is your long-term incentive plan not working?

It’s likely that an LTIP can fail if it isn’t built to fit your company and employee needs. We often hear that employees feel the goals set for them are out of reach or they don’t completely understand how by achieving them they can make a positive influence. Simultaneously plan administrators can easily get overwhelmed if they have multiple plans running in parallel, each with their own performance measurement and reporting requirements.

So, ask yourself a few questions if you think your plan isn’t working as expected:

- Is your LTIP too complicated for your employees to comprehend?

- Do you understand what each LTI award can help you achieve?

- Are your LTIP performance metrics too complex to track and monitor?

- Do your employees feel the goals are too hard or too easy to achieve?

- Have you sufficiently and clearly communicated your plan to your prospective and current employees?

Whether you’re starting out with a new plan or reviewing an existing incentive plan, in general, you can improve the performance of your LTIPs in seven ways:

Set realistic goals

Aiming to reach every goal at the same time is not practical. Meanwhile, spreading your team too thin can make them confused, less productive and burned out. Instead, you should know your top priorities and align employees to these under an LTIP.

In this process, you can also identify any limitations such as a tight budget or where you may have limited in-house resources to shape an ideal, custom-made plan to suit your business needs.

Having the goals in place enables you to make an informed decision on LTIP design and review the plan performance effectively.

Understand LTI awards

Even if you successfully identify the key goals, your plan can still go wrong if you don’t understand each LTI award and how each fits your plan.

For instance, stock options could help improve stock price while performance shares may help reach specific financial/operational goals. If you grant your employees options in the hope of incentivizing them to create shareholder values, that may only yield small results. Instead, you could consider linking their LTI awards with improving ROIC, which is directly correlated with creating shareholder value, for achieving a better alignment.

Check out our LTIP guide to learn their pros and cons.

Select the right peer group for benchmarking

The purpose of an LTIP is to incentivize employees to achieve the goals you want, so a competitive compensation offering matters. What you should consider doing is benchmark against your peers’ package and align with the market.

Having the right peer group is important in evaluating the reasonableness and effectiveness of a long-term incentive plan. When selecting a peer group, not only should you factor in size, industry, and other basic company information, but also expand criteria to create more accurate and relevant plans. Those include performance, geography, human capital and so on.

Adopt a simple LTIP design

Less is More. That also applies to an LTIP design.

We understand you may have more than one business goal, and thus need more LTI award types (i.e. vehicle). You should still be aware if there are any unnecessary vehicles that don’t help achieve your goals effectively.

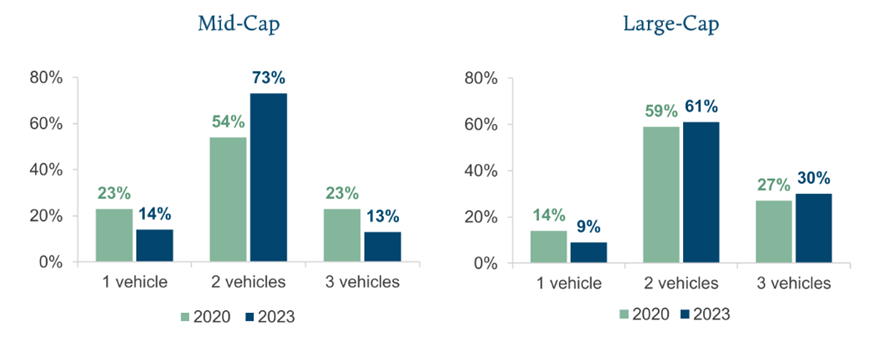

According to the ClearBridge 200 Report in 2023, the most prevalent practice was to award NEOs two vehicles (Restricted stock and performance shares being the most common). Having too many vehicles can cause complexity in LTIP administration and make it difficult for employees to track and manage.

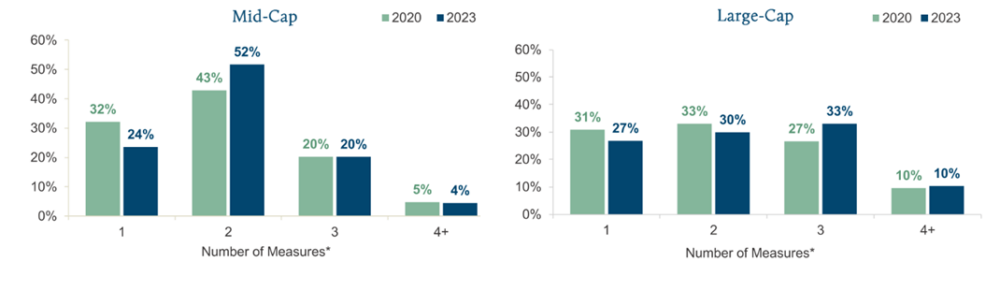

In addition, do you overly complicate the performance measurement? Do you have many types of performance measures with multiple payout levels for each? According to the same study, companies most commonly use two to three performance measures with stock price/TSR and Earning measures being the most popular.

Again, always refer back to your plan goals and focus your employees on those specific performance targets.

Some situations can compound the complexity problem and make your plan admins and employees even more confused. They may include overlapping plan performance periods or making frequent changes to plan details.

So, after drafting or revising the plan, ensure the new one is simpler and well understood, then it would be a good start.

Coordinate with internal stakeholders early

It’s good practice to involve a wider team such as the Payroll, HR, Finance, Tax and Legal departments during the LTIP development process. Earlier communication can help to refine your proposed plan and identify any roadblocks that you can’t see.

For instance, incentive arrangements have many accounting and statutory reporting implications. Your Finance/Accounting team can help you understand the tax reporting requirements (e.g., Forms W-2, Form 1099, K-1, etc.) and the accounting expense before any arrangements are implemented.

Including HR can also play an important role in improving the performance of your LTIP. They can integrate the plan into their recruitment and retention scheme, ensuring how it works and its benefits are communicated with and understood by employees.

Therefore, if you can get their support early in the process, your later LTIP implementation and administration can be smoother.

Communicate with employees regularly

Some companies solely rely on their cold annual proxy statements and plan documents to communicate their LTIPs without interactions and discussions.

It’s poor practice to assume your employees would be able to figure everything themselves. First, not everyone is familiar with an LTIP – some of your employees may not have signed up for such a plan before. Second, they won’t feel valued by the company and get motivated to reach the performance targets.

You should start by communicating your plan early and taking onboard feedback. If your employees are new to LTIP, make sure to start with the basics, e.g. the importance of LTIP and how it works. Remember you can’t forget to include these items in your communications:

- Types of vehicles

- Types of performance measures

- How do they align with business needs?

- Payout details (timing, threshold payout, maximum payout etc)

Following the first communication, remember to regularly update your employees on vesting, their performance progress, payout details and the timing during the performance period, so they will remain engaged and work hard towards their goals.

Digitalize LTIP management

A software program can simplify your LTIP management process and communication.

If you’re using spreadsheets to manually manage an LTIP, there’s a higher likelihood of human error and circulation of multiple plan versions, resulting in LTIP management chaos.

With thousands of employee datasets, multiple awards and different vesting, tax rules, regulations, and all the other moving elements in a long-term incentive plan, you should consider the benefits of using software that can help to keep the plan data accurate and administer all LTI awards effectively.

There are also more benefits you’ll notice from LTIP software:

- Automation: Unlike manual spreadsheets, LTIP management software automates the key administrative tasks to save you time and effort. Employee activities are updated in one single place automatically so you can track and monitor them efficiently, especially if you have multiple plans and jurisdictions to administer.

- Employee engagement: Your employees can accept, access, view and manage their awards 24/7 online with access to a dedicated support team. They feel empowered and at the same time your administrative workload is reduced.

- Instant reporting: You can generate different types of BI/financial reports with just a few clicks.

- Communication simplified: You can upload all communication materials and plan documents to the platform, so everything is housed under the same roof. No more email chains.

- Mobile workforce unity: With LTIP software, you can easily grant LTIs to your mobile employees and rely on the platform to administer multiple plans from the one centralized location. It can also help you stay legally compliant in each jurisdiction.

Contact Global Shares to optimize your LTIP

Here at Global Shares, a J.P. Morgan company, we spend all day coming up with ways to help our clients optimize their LTIP management processes. It’s what has made us an award-winning, trustworthy equity management company for over 15 years.

Contact us for a demo, to see how we can help your company succeed.

By visiting a third-party site, you may be entering an unsecured website that may have a different privacy policy and security practices from J.P. Morgan standards. J.P. Morgan is not responsible for, and does not control, endorse or guarantee, any aspect of any linked third-party site. J.P. Morgan accepts no direct or consequential losses arising from the use of such sites.

Please Note: This publication contains general information only and Global Shares is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. The Global Shares Academy is not a substitute for professional advice and should not be used as such. Global Shares does not assume any liability for reliance on the information provided herein.