A non-qualified stock option is a form of equity compensation, given to employees as part of their compensation package. It allows them to become shareholders in a company and therefore to share in its profit and growth.

What is a non-qualified stock option?

A non-qualified stock option (NSO) is a type of employee stock option with simpler tax implications and fewer restrictions but doesn’t qualify for favorable tax treatment.

It provides its holder with the right to buy a company’s shares at a preset price (called the exercise or strike price) at a future date. As the stock value rises over time, the exercise price stays the same. So, you buy the stock for a lower price and sell it for a future higher price.

NSOs are usually issued by publicly-traded companies, or private companies planning to go public at a future date. They’re a popular choice of stock-based compensation.

NSOs have simple tax events and do not follow special IRS rules that govern Incentive Stock Options (like a $100,000 grant limit each year and rules for shareholders). Their simple design can help reduce a stock administrators’ burden in equity management and equity education.

Chris Dohrmann, FGE, Global Shares’ SVP Of Strategic Partnerships.

Who can get NSOs?

Unlike ISOs that can only be given to employees, NSOs can be offered to employees and non-employees such as directors, consultants, contractors, vendors, and even other third parties.

NSOs are normally given to senior management or executives of a company. They behave as ‘golden handcuffs’ to retain key staff. NSOs are especially important for companies that are in the early stage to compete with established firms for talent.

How do non-qualified stock options work?

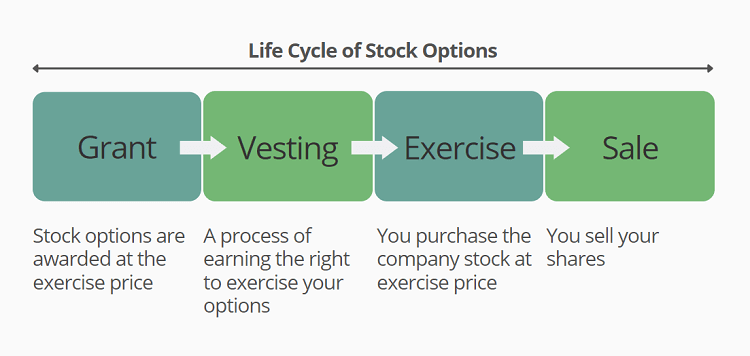

Non-qualified stock options go through four major stages of employee stock options: Grant, Vesting, Exercise and Sale.

1. Grant:

At the grant date, NSOs are offered at a set price (called the exercise or strike price). The price usually is the fair market value (FMV) of the stock at the grant date. No tax is due.

2. Vesting:

Stock option vesting is a process of earning the right to exercise (i.e. purchase) your options. The vesting criteria can be time-based (e.g. staying with the company for certain years), or milestone-based (e.g. the company reaches IPO). No tax is due.

3. Exercise:

Once the vesting period has passed, you’ll have the right (but not the obligation) to exercise (i.e. purchase) your options at the exercise price until they expire. Note: Some companies allow for early exercise, meaning you can exercise your NSOs before they’re fully vested.

With NSOs, you pay ordinary income tax when you exercise your options. Check how to exercise stock options here.

4. Sale:

When you sell your NSOs after holding them for at least a year of exercising, the gains will be considered long-term and taxed at a lower rate. Otherwise, you’ll likely pay short-term CGT on the gain.

To simplify the process of managing NSOs at each stage of their life cycle, our automated cloud-based software reduces all past administrative complexities, saving your team time and effort and at the same time improving accuracy. Speak with us now

Contact Us

What happens to your NSOs if you leave the company?

If you leave the company with vested but unexercised NSOs, you’ll typically have some length of time to exercise your options. Don’t forget you’ll be taxed at the time of exercise, meaning you’re on the clock and need to consider when to submit an exercise request.

If you quit with vested and exercised NSOs, those shares are yours. But, there’s a thing to watch out for – your employer may have the right to repurchase the shares from you.

Before leaving your company, read your plan documents carefully to understand what might happen with your stock options.

How are non-qualified stock options taxed?

NSO tax treatment at exercise:

When you exercise this type of stock option, the NSO spread – the difference between the exercise price and the FMV at exercise – is taxed as compensation. It means you’ll pay ordinary income tax on the spread and will be subject to federal, state and local income taxes as well as payroll taxes. So, NSOs don’t qualify for the more-favorable tax treatment given to ISOs where no ordinary income tax is charged at exercise.

The compensation will also result in a tax deduction for the company.

NSO tax treatment at sale:

At sale, you’ll need to pay CGT on the additional gains – Sale price minus cost basis (i.e. exercise price plus NSO spread)

As mentioned, there’re two types of NSO sales – 1) holding shares for at least 1 year of exercising and 2) holding shares within less than 1 year of exercising. Type 1) has a favorable tax treatment because the rate of long-term CGT is typically lower.

Why do people still want to sell their assets sooner if that doesn’t result in favorable CGT? Because they may want to secure the profit, cover the exercise costs with the immediate sale proceeds, and/or diversify their financial portfolio.

Chris concluded that NSOs don’t qualify for the favorable tax treatment given to ISOs but it doesn’t mean they should be undervalued. Their simplicity and flexibility with fewer restrictions can make them a popular equity award.

Request a free demo

NSOs are a type of equity compensation that Global Shares manage for companies all over the world. Request a free demo to find out more about how to plan and administer employee stock options and our other products and services.

Please Note: This publication contains general information only and Global Shares is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. The Global Shares Academy is not a substitute for professional advice and should not be used as such. Global Shares does not assume any liability for reliance on the information provided herein.