An employee stock purchase plan (ESPP) allows employees to purchase company shares at a discount. In the S&P 500, over 85% of tech companies offer an ESPP to attract talent.

Skip to the relevant section below:

What is an employee stock purchase plan?

An employee stock purchase plan (ESPP) is a broad-based stock plan that allows participating employees to purchase stock in their company at a discount – often 5%-15% off the fair market value (FMV).

They make contributions via payroll deductions. The accumulated contributions are then used to buy company shares at the purchase date.

Qualified ESPP & non-qualified ESPP

There are two types of ESPPs that can be offered – Qualified & Non-Qualified ESPPs.

A qualified plan is treated more favorably on taxation but there is more flexibility in how a non-qualified plan can be designed.

| Qualified ESPP | Non-Qualified ESPP |

|---|---|

| Designed and operates acc. to Internal Revenue Section (IRS) 423 regulations | Does not meet IRS criteria |

| Discount ranges from 0% to 15%, with 15% most used | May offer a discount of more than 15% from the current FMV of the stock |

| Approved by shareholders | Not required |

| More favorably on taxation | Less favorably on taxation |

| Less Flexible | Flexible |

How does an ESPP work?

An ESPP works by purchasing shares for participants using their post-tax salary through a sequence of events:

- Enroll in the plan: Once you enroll in the plan, you’ll be eligible to participate in the upcoming offering period and will be able to purchase company shares at an agreed discount for the length of that offering period.

- Set aside money each month: Within an offering period, your accumulated contributions from your paychecks (post-tax) are set aside to purchase shares at the purchase date.

- Purchase shares: Typically at the end of the purchase period (i.e. purchase date), you officially purchase the shares.

- Sell shares: You can sell your ESPP shares right after you purchase them or hold onto them.

Terms associated with ESPPs:

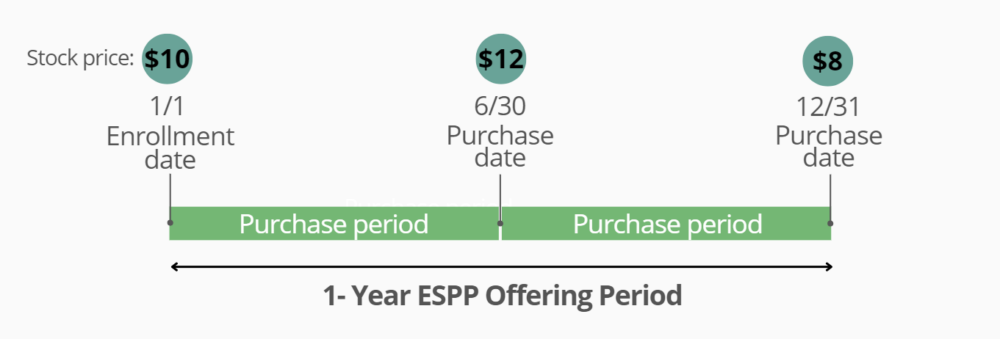

- Offering period: You’ll be able to purchase company shares at an agreed discount (5-15% off) for the length of the offering period that you enroll. In the example below, it’s a 12-month offering period.

- Enrollment date: The date that you enroll, e.g. 1 Jan in this example.

- Purchase period: Within an offering period, there can be a series of purchase periods in which you set aside money to purchase the shares. The length of a purchase period is usually 6 months. So, there are 2 purchase periods each year in this case.

- Purchase date: The date you purchase the shares, i.e. 30 Jun and 31 Dec in this case.

- Purchase price: The price you purchase the shares on the purchase date.

Download Now: ESPP: Explained. A quick guide

ESPP lookback allows you to buy shares at a lower price point

An ESPP lookback allows you to purchase the share price of either A: the enrollment date (1 Jan) or B: the purchase date (30 Jun), whichever is lower.

An ESPP example with/without a lookback

Price on Enrollment Date: $10

Price on Purchase Date: $12

ESPP Discount: 15%

| With Lookback | Without Lookback |

|---|---|

| Purchase Price: $10 x (1-15%) = $8.5 / share | Purchase Price: $12 x (1-15%) = $10.2 / share |

Explanation:

With a lookback, you will be able to purchase the shares at a discount off a lower price, i.e. $10 instead of $12. Offering a lookback in addition to an ESPP discount is likely to boost your enrollment rates. Plans offering a 15% discount with a lookback have a participation rate of 44%, well above the rates for plans offering a lower discount or no lookback. (Source: Fidelity)

Who can be eligible for ESPP?

An ESPP is an all-employee program, but employers can exclude certain employee groups like those who have been employed for less than two years and those whose employment is twenty hours or less each week.

Additionally, ESPPs do not allow employees owning more than 5% of company stock to participate.

How are ESPP stocks taxed?

ESPP taxation depends on whether it’s non-qualified or qualified — and when you sell your shares.

Non-qualified ESPP

Non-qualified ESPPs have simpler tax implications. Income tax (i.e. FMV on the purchase date minus the purchase price) is chargeable at the time of purchase. Tax on capital gain/loss (i.e. Sale price minus FMV on the purchase date) is chargeable at the time of sale.

Qualified ESPP

There are two classifications of sales for qualified ESPPs: Qualifying Disposition(QD) – holding shares over 1 year after the purchase date and over 2 years after the offering date and Disqualifying Disposition (DD) – holding shares less than 1 year after the purchase date or less than 2 years after the offering date.

No tax is chargeable at purchase in both QD and DD cases.

At the sale, ordinary income and capital gains are taxed. If a QD occurs, gains are considered long-term where the tax rate is typically lower than ordinary income. If a DD occurs, gains are considered short-term and are taxed higher. To learn more, read our ESPP tax rule article.

What is the best time to sell ESPP shares?

The timing of sales depends on your personal and financial goals, e.g. Do you need cash urgently? Do you want to pay off your debt soon? Are you confident in your company stock?

“

The objective of a 423b plan, is to encourage employees to “hold” shares longer to receive a favorable tax rate with Long Term Capital Gains. To portray all possible scenarios, while holding the stock, the price may fall and eliminating any possible gain to be taxed. Selling your shares immediately or soon after you purchase them could possibly secure the gain generated by the company discount (up to 15%) and minimize the risks of holding the stock for long. However, the sale of shares soon after purchase prevents the employee from taking advantage of the tax benefit. It is a balance and really comes down to a choice the individual has to make based on circumstances – to lock in gain or save a little in tax. In reality – that choice may be different for the same employee, based on circumstances present from one purchase to another.

Is an ESPP worth it?

For employees

An ESPP can help increase your savings. It’s also flexible to enable you to withdraw. If you hold onto your shares, you can experience the potential tax benefits. To learn more about its benefits, read our ESPP’s pros and cons article.

However, there is a limit on ESPP maximum contribution. Under a Section 423 plan, the IRS limits purchases to $25,000 worth of stock value (based on the FMV on the offering date) for each calendar year.

For employers

An ESPP can help employee retention, attract and recruit talent and create an ownership culture in your company.

Despite its benefits, managing a plan can increase HR, accounting and administrative workload. You also need a communications plan to let your employees know about ESPP benefits and keep them engaged.

We, Global Shares, can help you navigate through the difficulties of managing your ESPPs from participant enrollment to trading and above board thanks to our advanced software and our team of 300 equity professionals. We’re trusted by hundreds of companies across a multitude of industries in more than 100 countries.

Contact us today to learn more about how we can help design and manage your ESPP to make the most of it.

FAQs about ESPPs

How does an ESPP work?

An ESPP (employee stock purchase plan) allows employees to use after-tax wages to acquire their company’s shares, usually at a discount of up to 15%. Quite commonly, companies offer a ‘’lookback’’ feature in addition to the discount offered to make the plan more attractive. The lookback feature allows you to purchase the share price of EITHER the initial date of the offering period OR the purchase date, whichever is lower, to further increase the return. Check out our ESPP infographic.

Is an ESPP worth it?

The plan can be valuable for both employers and employees. For employers, the plan can help attract and retain top talent. For employees, it is a valuable tool for accumulating wealth with a discount and a lookback feature. However, it is not 100% profit guaranteed. We can still lose money on ESPP if the stock price goes down. Check out our ‘ESPP Pros & Cons’ guide.

Is an ESPP pre tax or post tax?

ESPP shares are post-tax. It means your shares are purchased with money that you’ve already paid taxes.

What happens to my ESPP when I leave a company?

When you quit, you won’t be able to buy shares in the plan anymore. Unused paycheck deductions will typically be refunded to you.

All companies referenced are shown for illustrative purposes only, and are not intended as a recommendation or endorsement by J.P. Morgan in this context.

By visiting a third-party site, you may be entering an unsecured website that may have a different privacy policy and security practices from J.P. Morgan standards. J.P. Morgan is not responsible for, and does not control, endorse or guarantee, any aspect of any linked third-party site. J.P. Morgan accepts no direct or consequential losses arising from the use of such sites

Please Note: This publication contains general information only and Global Shares is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. The Global Shares Academy is not a substitute for professional advice and should not be used as such. Global Shares does not assume any liability for reliance on the information provided herein.