Long-Term Incentive Plans (LTIPs) have become popular among private companies as a way to enhance compensation packages and compete for talent with public companies, which are often in an advantageous position to lure away senior executives.

Here we’ll articulate the difference between LTIPs for public and private companies and delve into three LTIP design solutions which HR and Comps & Benefits teams in private companies may consider.

Long-Term Incentive Plans: A quick introduction

Long-term incentive plans are typically structured to last three to five years, as the purpose is often to encourage employees to excel to reach long-term goals over time. The better the business fares over the life of the plan, the greater the rewards will ultimately be offered to employees. Meanwhile, this built-in retention feature motivates them to stick around longer.

How an LTI award is paid out is determined by vesting. Vesting means the waiting period the participant must complete before receiving 100% of the LTI ownership. For example, if your company’s LTI vesting period is three years, the award will be fully available to you once that 3-year period has passed.

LTIP: Private vs Public

Due to liquidity, LTIPs are more widely used in public companies than in private companies, which lack effective markets to sell shares. This detachment from the public markets does bring them some benefits, allowing private companies to operate under less scrutiny and governance bureaucracy.

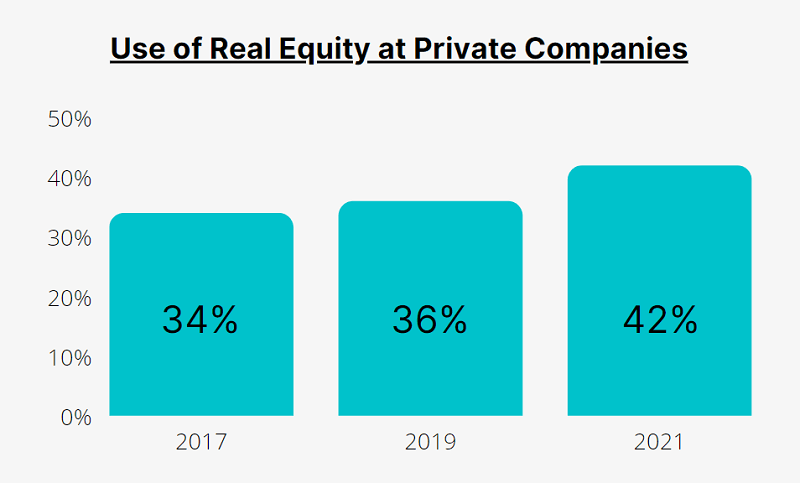

LTIP prevalence in privately-owned companies has increased to stay competitive in the talent war in the past few decades. It is also predicted that this trend will continue. In addition, the use of equity – following the pattern of public companies – is on the rise although cash is still the dominant LTIP component.

Here are the common types of equity at private companies:

- Stock options: They give participants an opportunity to exercise (i.e. purchase) a certain amount of shares in the company at an agreed price at a set future date. The award depends on the company’s share price appreciation over the term.

- Restricted stock units (RSUs): At the grant date, participants are promised to receive the company shares or the cash equivalent in the future once the restriction period (i.e. vesting period) has passed.

- Phantom stock: Without offering participants actual company stock, it works by following the value of the company’s actual stock, meaning its value rises and falls in line with the company stock’s value.

While it’s possible to have a mix of equity vehicles, privately held companies usually have one single equity award in their LTI packages rather than using multiple vehicles like their public peers.

| Long-term incentive (LTI) | Private | Public |

|---|---|---|

| Eligibility | Usually executives only | Executives and possibly employees below C-suite |

| No. of LTI vehicle | Usually one only | Multiple |

| Type of LTIs | Performance-based cash is dominant | Performance stock/units are dominant |

| Use of equity-based LTIs | Less often | More often |

| LTIP approval & administration process | May not be established clearly | Often established formally |

| Stock liquidity | Lower | Higher |

| Public scrutiny | Less | Higher |

Want to know more about which type(s) fit your business? Fill in the form today

CONTACT BLOCK

LTIP design 1: Cash bonuses only

According to the WorldatWork Report 2021, cash is the most common LTI vehicle among private companies. This solution is ideal if you have a concern about transferring stock ownership in your company to your employees or diluting earnings for the current owners.

Benefits:

- No transfer of control

- Simple and guaranteed value

- Completely avoids any disturbances created by minority security holders

- Avoid equity-related complexities such as disclosure/reporting, valuation, liquidity and the dilution of ownership

Disadvantages:

- Motivation for growing the business may stop after the payout has occurred.

- Financial awards are fixed whereas equity can link to the stock price and potentially provide employees with substantial wealth.

LTIP design 2: Equity awards

As discussed, cash alone is unlikely to generate as significant wealth as equity can, because equity has the potential for growth while cash is often set at a predetermined level. As such, companies may need to consider offering equity incentives to provide greater financial benefits.

The common types of equity at private companies include stock options, RSUs and phantom stock. The majority of these companies vest LTI awards over three to five years. Three years is the most common vesting period.

If you offer your employees stock options for company value growth, it can help to incentivize them to work harder towards achieving this goal. That’s because the higher the value grows, the better the award will be, so options are more suitable for high-growth and early-stage companies. RSUs are more common among established companies as they provide awards based on the full value of the stock rather than the appreciated portion. RSUs are often used to retain existing employees.

Benefits:

- Preserve cash flow

- Compete for talent with larger companies

- Motivate employees to perform in the best interest of the company

- Enable design flexibility, e.g. types of equity, stock-or cash-settled and vesting

- The probability that this will take away control can be minimal if you consider the number of shares issued.

Disadvantages:

- Share dilution (as discussed, this is not always a negative)

- LTIP administration complexity e.g. setting up LTI awards, granting, tracking activities like grant acceptance, exercise, vesting, release, payout and sale, reporting

LTIP design 3: Transition the ownership of the business

If you’re a private company owner and are looking to retire, one of the solutions available may be to sell your shares to your employees via ESOP over time.

ESOPs (Employee stock ownership plans) are commonly used to provide a ready market for the shares of departing owners of successful closely held or private companies. At the same time, this can motivate employees because as a business grows, so does the value of the shares allocated to employees.

When the employee’s participation in the ESOP ends, they will receive their share of the “vested” benefit. Distributions (i.e. benefits) may be made in stock or cash. Following this route with an ESOP, you will have converted your company that you owned into an employee-owned company.

Benefits:

- Tax benefits

- Allow for business continuity

- Employees being taken care of

- Greater commitment and productivity from employees

- Offer transitional flexibility to facilitate succession planning

Disadvantages:

- High cost

- Not suitable for small or non-profitable companies

So, What next?

There are many different long-term incentive plans for private companies to choose from. What LTIP makes the most sense for you will depend upon, for example, your business visions, your location, your industry, and the structure of your company, so it won’t be a one-size-fits-all solution

You should consider going through different plan designs with somebody who specializes in LTIP management like J.P. Morgan Workplace Solutions. Otherwise, you could potentially end up with the wrong plan, or at least one that is not the best fit for you and your employees.

We have helped companies of all sizes to set up and manage award-winning employee share plans at J.P. Morgan Workplace Solutions. We can take you through setting up an LTIP designed to bring out the best in your company. Contact us for a commitment-free demo today.

This publication contains general information only and J.P. Morgan Workplace Solutions is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. J.P. Morgan Workplace Solutions’ Insights is not a substitute for professional advice and should not be used as such. J.P. Morgan Workplace Solutions does not assume any liability for reliance on the information provided herein.