Tailored legal and tax

support for stock plans

in

any country

From navigating securities and labor laws to understanding tax withholding and

reporting obligations, we provide a comprehensive global view of the regulatory

landscape to help you make informed decisions.

Features

Legal information reports

Understand the

constantly evolving

regulatory landscape

Clients receive a report outlining information on relevant issues including securities laws, regulatory filings, translation and communication requirements, foreign asset reporting, foreign exchange, data protection, labor laws, shareholder requirements, company laws, salary deductions, malus and clawback provisions, and nominee arrangements.

Tax information reports

Detailed information at

your fingertips

Tax considerations are increasingly complex. Get access to reports showing tax requirements in different jurisdictions globally, designed to help you better understand the tax obligations when operating your stock plans.

Country-specific information supplements

Maintain alignment

with country-specific

legal requirements

A supplement is prepared for clients’ participants that contains wording required in each jurisdiction to comply with local laws (e.g. securities laws) and an explanation of any foreign asset reporting obligations.

Employee tax information sheets

Provide your

employees with relevant

tax information

Explain the tax treatment of your company’s stock plans to your employees in an easy-to-understand Q&A format. Employees receive details of each tax, including important dates, tax rates, and an overview of reporting and withholding obligations. The sheets are housed in the participant portal for easy access by your employees.

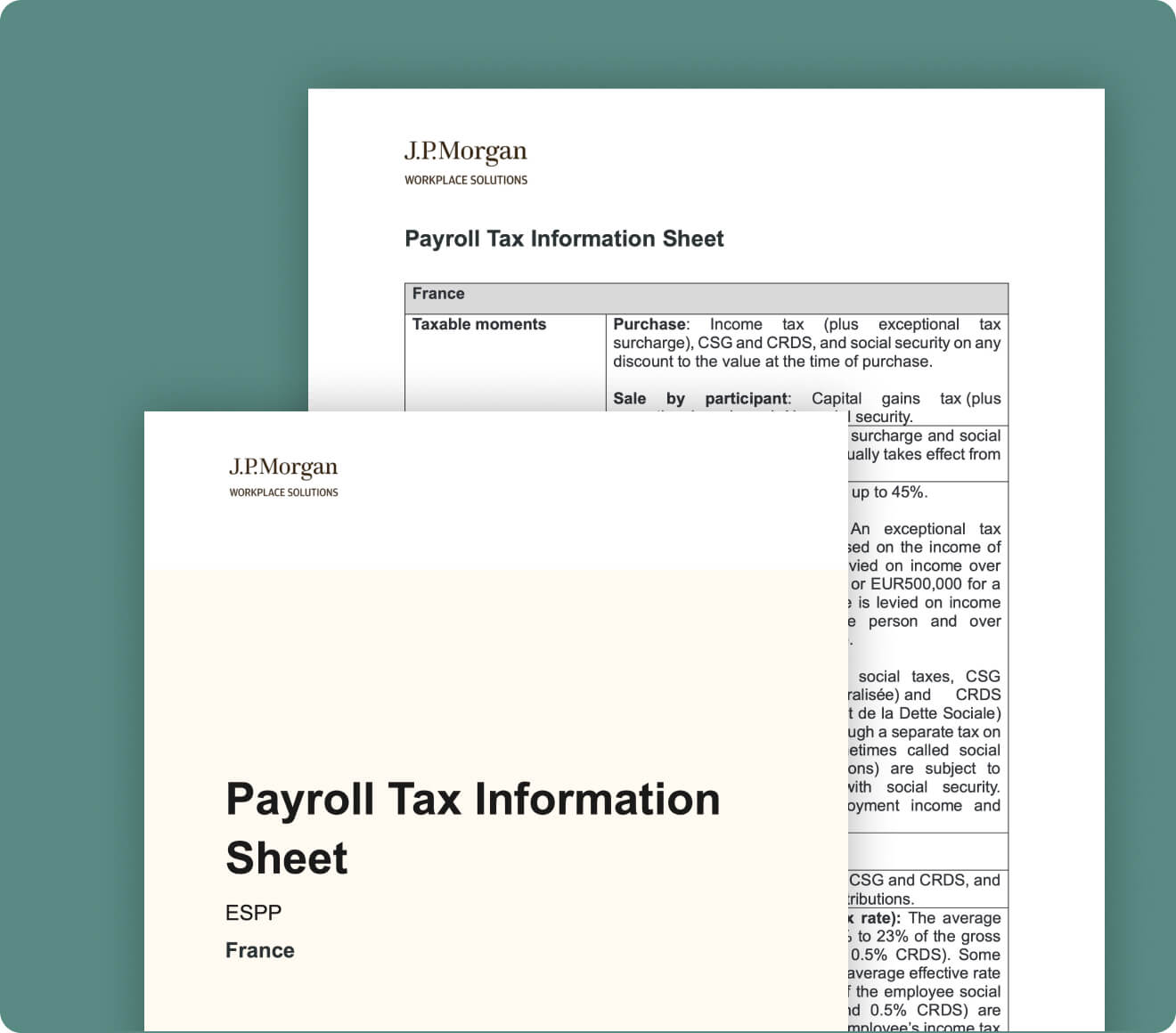

Payroll tax information sheets

Equip your global

payroll teams with local

tax knowledge

Neatly breakdown the specifics of your stock plan’s tax treatment for your local payroll teams. The information sheets include details on each tax including important dates and rates and the withholding and reporting obligations. The reporting information includes links to the relevant forms to submit and the corresponding deadlines.

Benefits

-

Full access and transparency

We collaborate with our clients to procure access to market-leading legal, regulatory and tax information provided by Tapestry Insight Ltd in its proprietary digital database, OnTap.

-

Aligned to fit your needs

We provide a tailored service based on information that is sourced from the OnTap database. Our team specializes in conducting comprehensive reviews of targeted countries, delivering crucial analyses tailored to each jurisdiction.

-

Professional support

Regular meetings with our team, covering any country queries or specific topic requests and discussion of market practice. We aim to demystify equity compensation and give you the tools you need to support your global workforce.

Product FAQ

-

Are you providing legal and tax advice?

No. Workplace Solutions is not a licensed law or tax advisory firm and all of the services provided will be based upon best practices as established by professionals in the employee equity compensation industry. The services provided do not constitute legal or tax advice and are not intended to replace such advice. Clients should consult with an independent legal and/or tax advisor at any time they require legal and/or tax advice.

-

How does this service help my company?

Our clients can use the information provided in their global compliance process. An annual review is typically arranged to keep clients aware of any changes in the regulatory landscape.

-

How does this help my participants and payroll teams?

Our tax information sheets explain the tax treatment of stock plans to participants and payroll teams. This aims to increase their understanding of, and engagement with, your stock plan and their associated tax obligations.

-

How up to date is the information?

We work closely with our trusted global compliance partners Tapestry Insight Ltd to make sure our equity incentives information is reviewed regularly and updated when necessary.

Discover how our Equity Intelligence services can support your global equity compensation plans

Related insights

-

Financial wellness and equity compensation

June 24, 2024