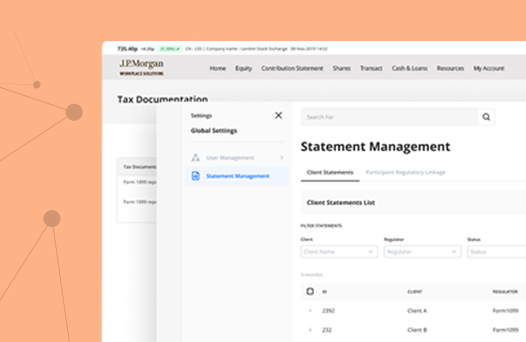

Our fully automated solution produces 1099 Composite Statements (1099-B & 1099-Div) for your participants with the click of a button and delivers them straight to their Global Shares account.

How Does it Work?

Each year ahead of the form-filling deadline, our statement publishing tool will identify which participants require a 1099 statement. Any US Tax Residences who have sold a share or been paid a dividend in that given tax year can then generate a 1099 Composite form.

The statement also gives an overview of the employee’s account activity for the tax year as well as information on common tax questions, which may assist them with their tax return preparation.

Your employees will be notified by email when the statement is available to view and download. They can then access the PDF statements from their Global Share accounts on either desktop or mobile.

Want to Know More?

Learn the specifics of the 1099-B and 1099-Div available here

This publication contains general information only and J.P. Morgan Workplace Solutions is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. J.P. Morgan Workplace Solutions’ Insights is not a substitute for professional advice and should not be used as such. J.P. Morgan Workplace Solutions does not assume any liability for reliance on the information provided herein.