Whether you’re looking to switch equity compensation providers or outsource your plan management for the first time, your accounting team will most likely have clear ideas on what features they want to see in any software-based solution.

When considering possible partners it’s important to consider what key concerns you are looking for the platform to address, such as basic grant management, having a user-friendly interface, customer service and support, security of data, scalability, access to communication tools and API integration with existing systems.

Here are five things your accounting team may want to see in any equity compensation administration software:

1. Financial reporting: A robust reporting suite will help you to secure the insights you need on the various financial aspects of your equity plan. The capacity to generate real-time reports can offer vital assistance as it relates to, for example, Fair Value, Earnings Per Share, Treatment of Forfeitures and Disclosures. More broadly, a solution with a sufficiently sophisticated reporting tool will help your company meet its obligations around ASC 718 accounting guidelines.

2. Business intelligence (BI) reporting: When you have access to a BI suite, it can be of major assistance in simplifying the analysis and visualization of complex data relating to your equity compensation plan. BI reporting helps you to highlight information on, for example total number of grants (issued versus outstanding) and drill-down into useful information like participation rates by region, gender and department, while also enabling you to view at a glance how tax laws vary between jurisdictions and alerting you to differences on regulatory rules and privacy laws where applicable.

3. Compliance across jurisdictions: Operating a global stock plan means you will be obliged to comply with the legal and tax requirements of each jurisdiction in which you have employee participants. Different countries will have their own sets of rules and regulations, some requirements will vary depending upon the type of plan and relevant legislation can be updated in any country at any time. The more countries you are present in, the more there will be to keep track of and failure to meet your obligations in a timely manner could potentially lead to fines and other penalties. Against that backdrop, it is therefore vital to choose a provider who is in a position to offer you the support you need to manage a global or multi-jurisdictional plan.

4. Audit trail: From the accounting perspective, it will be vital that your employee equity compensation software provider offers a software solution with the capacity to provide a full and detailed record of all equity-related transactions over time and associated changes flowing from that. As well as keeping track of key grant details for all participants, an audit trail should also log whatever changes are made to the plan agreement over time, e.g., alterations to the vesting schedules, along with details around the rationale behind the decision. The net outcome of a rigorous audit trail is that it facilitates transparency and accountability.

5. Reliability: You need to be able to trust that all plan-related figures and information are accurate, across the short-, medium- and long-term. One of the main reasons companies transition from spreadsheets to software as they grow is to minimize the risk of human error polluting their plan records. If you can’t trust that the data is reliable, then that will impact adversely on your confidence in it, which will partially defeat the purpose of making the change in the first place.

What’s next?

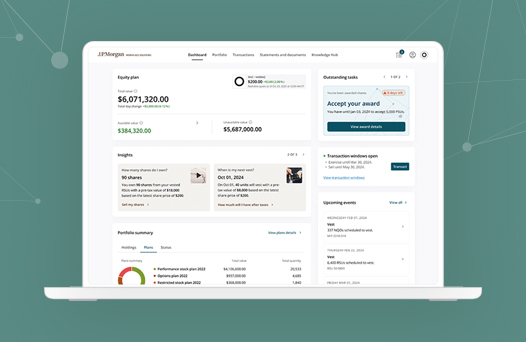

At J.P. Morgan Workplace Solutions, we provide employee equity management solutions for businesses of all sizes throughout the world. You not only get the benefit of our all-in-one automated platform to handle the day-to-day administration, but you also get access to a robust team of equity specialists and support team who can work with you to develop an employee stock option plan designed to meet your needs. Contact us today.

This publication contains general information only and J.P. Morgan Workplace Solutions is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. J.P. Morgan Workplace Solutions’ Insights is not a substitute for professional advice and should not be used as such. J.P. Morgan Workplace Solutions does not assume any liability for reliance on the information provided herein.