Equity is widely considered an effective means of aligning the financial interests of executives with those of the company and other stakeholders. If the company is successful, the company stock’s value can potentially grow exponentially to enhance one’s financial well-being. This financial benefit is more significant than a fixed cash bonus.

Besides serving as a stronger incentive to ensure that the company continues to be high-performing, equity can effectively retain executives.

In this article, we’ll discuss executive equity prevalence, how executive equity compensation works with tax implications, and 10b5-1 trading plans.

How significant is equity in executive compensation?

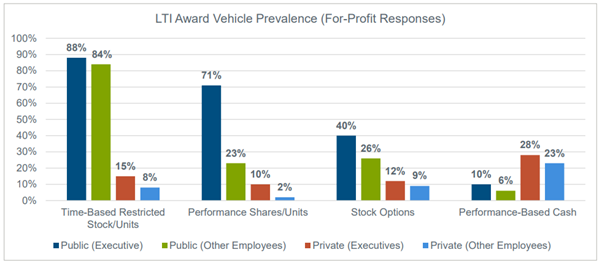

Almost all publicly traded companies offer their senior executives long-term incentive awards that consist of minimal cash (10%), while heavily relying on equity-based components such as restricted stock (88%), performance stock (71%), and stock options (40%).

Although traditionally it’s not common for privately held companies to offer equity awards, around one-third of private companies grant equity awards to their executives.

So, to understand the total value of your executive compensation package, you need to carefully consider your equity component which can carry significant importance.

How does executive equity compensation work?

Equity compensation operates quite differently from a cash-based one. You don’t fully own an equity award until the vesting period has passed.

Vesting is the process by which you gradually earn full ownership of your equity through satisfying certain requirements – time-based and/or milestone-based. Understanding your vesting period is essential for planning sales and tax events for your equity. Check out different vesting schedule examples here.

Once you’ve vested, you can exercise (i.e. purchase) and/or sell your shares. Depending on the type of equity you hold, you may be liable for taxes at various stages of an equity award’s life cycle.

At J.P. Morgan Workplace Solutions, our equity management software offers functionality to fit virtually all time-based and performance-based awards, and track their vesting via a vesting schedule – whether it’s cliff vesting or graded vesting.

Top three executive equity grants

1. Restricted Stock/ Units:

Two variations on restricted stock are restricted stock units (RSUs) and restricted stock awards (RSAs).

For RSAs, you are ‘awarded’ stock when you join the company and immediately become a shareholder with voting rights but restrictions, such as a vesting schedule, still apply. An RSU is a promise from your employer to give you shares of the company’s stock (or the cash equivalent) on a future date—as soon as you meet certain conditions. So you don’t own them or become a stockholder with voting rights at the start.

An example of restricted stock/units:

Your company grants you 2,000 RSUs when the market price of its stock is $18. By the time the grant vests, the stock price has risen to $20. The grant is then worth $40,000 ($20 x 2000) before taxes. You can sell/hold onto them once they’ve vested.

Taxes on restricted stock/units:

With RSUs, you’ll be charged income tax at vesting and CGT (if any) at sale. With RSAs, you’ll be taxed at the time of grant and sale under section 83b election rules.

2. Performance Shares/Units:

Performance shares/units are less frequently granted to other employees but are significant for executives (see the chart above). It’s because they’re effective to align you with company performance, incentivizing you to focus on achieving strategic objectives and creating shareholder value.

There’s a trend whereby large US companies are increasingly linking Environmental, Social, and Governance (ESG) goals to compensation, with 73% of S&P 500 companies reporting moving in this direction up from 66% in 2020. The UK market has also seen this trend.

An example of performance shares/ units:

Your company grants you 2,000 performance shares that will result in 2,000 shares if the EPS of your company grows by 10% per year.

Taxes on performance shares/ units:

Performance stock units (PSUs) have similar tax events to RSUs while performance stock awards (PSAs) have similar tax events to RSAs.

“

As the name suggests, performance shares/units vest based on your performance targets that usually relate to one or more of the following: 1. stock market, 2. total shareholder return (TSR), 3. earnings per share (EPS), total sales/revenues, or levels of customer satisfaction. Additionally, companies can use performance awards to drive the goals of the overall business. As an example, companies may link executive equity’s vesting provision to ESG performance targets and metrics, resulting in the executive receiving a greater portion of the equity awards if the company meets or exceeds specific ESG targets.

3. Stock Options

Stock options provide you with the right to purchase a certain number of shares at an initially agreed price (i.e. exercise price) at a future date after vesting. ISOs and NSOs are the two common forms of employee stock options. ISOs are more tax favorable than NSOs but are more restrictive such as grant and eligibility limitations.

An example of stock options:

Your company grants you 2,000 shares of stock options. If your exercise price is $20 per share and the current share price is $40, then your shares are worth $20 per share ($40 – $20). The total value of your stock options is now $40,000 ($20 x 2,000). Once they’ve vested, you can exercise (i.e. purchase) your share and sell/hold onto them.

Taxes on stock options:

For NSOs (with a fair market value that cannot be readily determined), the tax implications are simpler – ordinary income tax at exercise and CGT at sale.

For ISOs, no income is recognized for the regular tax at exercise but you may have to pay an Alternative Minimum Tax (AMT). If you satisfy the holding period requirement, you only have to pay long-term CGT at sale. Otherwise, you’ll pay ordinary tax and short-term capital

Despite effectively rewarding and retaining executives, equity vehicles may lose a significant amount of value irrespective of executive performance if the market goes down.

Understanding Rule 105b-1

When selling your executive equity, your status can potentially expose you to insider trading liability as you may have access to material non-public information (MNPI) about the company’s business.

Rule 105b-1 allows company insiders – such as board members, C-suite executives and others who might potentially possess MNPI – to sell and buy their company’s stock, provided they establish a predetermined plan and certify that they do not have access to MNPI about the company or its securities.

This plan provides an affirmative defense for companies and the insiders transacting in the relevant company’s securities without violating insider trading laws. To establish an affirmative defense against insider trading, a 10b5-1 plan must fulfil some criteria. For example, the share amount, price and timing of the sale(s), as well as the duration of the plan must be specified.

Let our advanced equity management software and certified equity professionals design, set up and manage your plan to suit your needs and goals. Contact us today

By visiting a third-party site, you may be entering an unsecured website that may have a different privacy policy and security practices from J.P. Morgan standards. J.P. Morgan is not responsible for, and does not control, endorse or guarantee, any aspect of any linked third-party site. J.P. Morgan accepts no direct or consequential losses arising from the use of such sites.

This publication contains general information only and J.P. Morgan Workplace Solutions is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. J.P. Morgan Workplace Solutions’ Insights is not a substitute for professional advice and should not be used as such. J.P. Morgan Workplace Solutions does not assume any liability for reliance on the information provided herein.