The new year is off with a bang as we welcome January’s top product enhancements. On the participant side, we have added new functionality that provides greater insight into cash awards, while Corporate Admin, on the other hand, will enjoy further flexibility with setting up share restrictions. We also use this opportunity to tease an exciting auto-linking bank feature that will be coming soon. You can read all about them below.

The Participant Experience

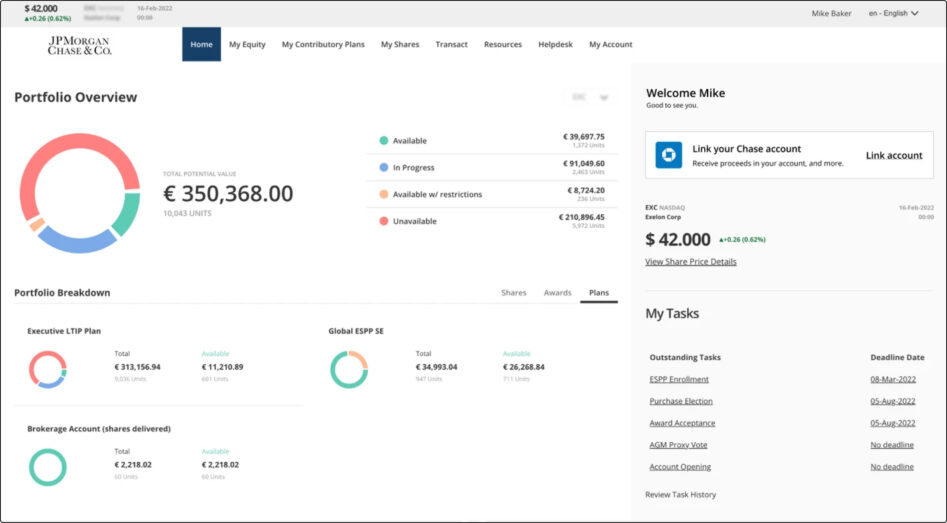

Auto-Linking Bank Account Feature for US Participants

(Coming Soon) – US tax residents who bank with Chase will soon be able to auto-link their bank accounts with their Global Shares’ account. This will allow participants to use their Chase bank account to receive their cash proceeds.

This will create a seamless cash payments process for participants banking with Chase. Given that roughly 35 million adults bank with Chase in the US, this integration is designed to reach a large portion of share plan participants residing in the US.

With the new auto-linking feature, banking information will be coming directly through Chase, which removes the need for manually adding bank account details. This assures participants that their banking information has been validated and populated correctly, cutting down on opportunities for error.

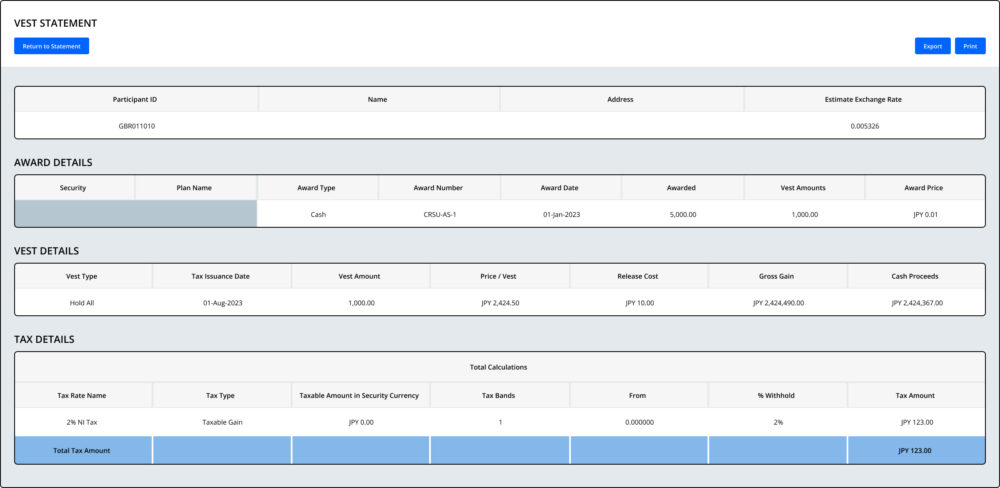

Cash Proceeds Displayed on Restricted Stock Release Statements

Participants can now view the net cash proceeds for a Cash Restricted Stock Units (CRSU) release or Cash Performance Stock Units (CPSU) release, following the addition of the ‘Cash Proceeds’ column on their Detailed Release Statement. This new addition provides participants with full transparency of the cash they can expect to receive following a release.

The Admin Experience

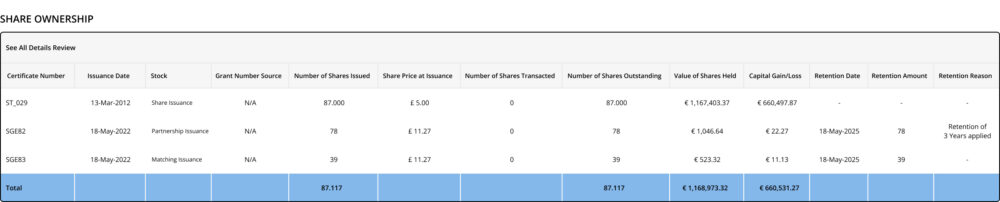

Share Restrictions: Enhanced Functionality

Did you know that Global Shares offers Companies the ability to restrict participants from transacting their shares by applying retentions at a participant or share certificate level? With our latest enhancement, it is now possible to set up share retentions at the plan level, using the grant date as the start date. This facilitates companies who manage retentions by plan rather than by issuance type.

Please Note: This publication contains general information only and J.P. Morgan Workplace Solutions is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. J.P. Morgan Workplace Solutions’ Insights is not a substitute for professional advice and should not be used as such. J.P. Morgan Workplace Solutions does not assume any liability for reliance on the information provided herein.