Stock options are a type of equity compensation that companies can offer to employees as part of their benefits packages. As equity awards can provide financial benefits beyond basic salary they can help company’s stay competitive in hiring, motivating and retaining employees, but they do come with an increased administration burden. With the right tools and vendor onside however the process of managing your employee stock options can be simplified.

Workplace Solutions has managed equity plans for companies large and small, private and public, whose locations and employees are spread across the globe. We are experienced in dealing with all types of stock option and their global tax, regulatory and compliance implications.

Workplace Solutions is more than just an equity compensation provider. We believe in the importance of your elevating employees’ experience. We can help you offer equity globally, automate admin and simplify reporting, tax and payroll – from grant to vesting, exercise and sale – all through one robust software solution. We can help to enhance your offering with solutions designed to empower your employees and bring your reward strategy to life.

1. Granting stock option awards

Since there are multiple types of employee equity and management incentive programs available it’s important that you choose the one that best fits your company’s needs We can handle a huge range of stock option grants, allowing you to choose the right option type that fits your business best.

USA Option Grant Types:

- NQO – Non-Qualified Stock Option

- ISO – Incentive Stock Option

- PNQO – Performance Non-Qualified Option

- PISO – Performance Incentive Stock Option

UK Option Grant Types:

- EMI – Enterprise Management Incentive

- CSOP – Company Share Option Plan

- SAYE – Save-As-You-Earn Option plan

- UKUSO – UK Unapproved Share Option

Rest of World Option Grant Types:

- OTCO – Over the Counter Option

- PO – Premium Option

- ESO – Employee Stock Option

- CGO – Capital Gains Option

2. Setting vesting schedule & weighting

Stock option vesting is the process by which your employees, the plan’s participants, gain ownership of their award over time. Employees are granted stock options on day one, but they don’t have full control over it until the vesting period has passed.

Our system allows you to define the vesting schedule and rules for your stock option grant. Whether it’s a simple 3-year 100% cliff vest or a more complex 48-month 2.08% vest with associated rounding, we can set it up for you. Looking for a more complex offering? You can also define vesting weighting – the amount (%) of the award to vest each year. It’s worth mentioning that we also support vesting setup based on performance metrics.

Most importantly for your equity plan administrators once the vesting settings are in place the process will run automatically to ensure accurate, real-time progress for each grant at all times, cutting out all the time-consuming manual elements that impact on non-automated plans.

3. Setting exercise methods for stock options

An exercise of stock options occurs when a participant actions their rights to buy the vested stocks at the pre-set exercise price, also called the strike price, at the end of the vesting period. Employees will hope that the overall price of the stock will have risen in the interim so that they are paying less than the current market value.

At the time of exercise there are some costs participants will need to pay:

- Exercise price (strike price)

- Fees and commissions: e.g. Broker fees and wire fees

- Tax

Our equity team can work with you to define exercise windows (the period when participants can exercise their awards through the employee portal) and blackout periods (the period when the company’s employees are prohibited from trading its securities). As you can imagine, being able to manage these tasks within the system will help you cut down on the admin workload.

You might choose to have multiple exercise methods enabled within the system to facilitate your employees when exercising their options grants, including:

1. Monetary payment (Hold all)

Employees use their personal funds to cover the associated costs (exercise price, fees and applicable taxes). They pay the costs by check, wire transfer or payroll and then receive their company stocks.

2. Sell to Cover (STC)

The goal here is to cover the costs associated with exercise, fees and other applicable taxes by selling stocks equal to these costs. The remaining stock balance will then be issued to the employee. In this way employees aren’t required to pay for the stocks upfront like they would in the first approach.

3. Exercise & Sell All

The goal here is to hopefully generate an immediate cash balance. Like the STC approach above, there is no requirement to make an upfront payment as the associated costs (exercise, tax, fees etc) are paid with the proceeds of the sale of stocks. The net proceeds in cash are then distributed to the employee.

4. Withhold to Cover Exercise

Typically used by private companies this exercise method is similar to STC except that the company keeps the number of stocks equal to the associated costs prior to award issuance.

4. Automating tax calculation

Everyone should know how important it is to accurately file income tax returns – but it’s not always a straightforward process. Our employee stock option software simplifies the process by automatically calculating accurate transaction taxes for participants.

The system can be set up to apply different tax rates and codes assigned to participants or participant groupings.

If provided with applicable income and tax payment information by individuals, we can populate the system what is needed to automatically calculate transaction taxes.

5. Processing transactions

With total integration to our broker module processing transactions can be made easy.

Employees can exercise their options, sell shares and view transaction history all within in their portal. With just a few clicks, they can choose how many stocks they want to transact and how to do it. Once the transaction request has been sent, our equity team will be notified and then proceed accordingly.

In the meantime, participants will be able to monitor the progress of their order completion and the expected timeline for receiving proceeds in their portal.

6. Getting support for stock option administration

From day one, you’ll be assigned a dedicated Relationship Manager and a team of stock plan analysts.

Your Relationship Manager will know you, your requirements and your plans, and will be available to assist you at all stages from onboarding your plans onto our platform, to managing day-to-day plan admin tasks.

Your stock plan analyst team will undertake all the necessary administration and record-keeping tasks associated with the operation of your equity plans in accordance with the relevant tax legislation and regulatory body requirements. Some of the high-level services are:

- Regular liaison and support for payroll

- Management of joiners, new hires, leavers, and cancellations

- Exercise of options

- Management and administration of all payments to participants, following the sale of stocks

- Collection of income tax and any other relevant taxes or social insurances

- Assistance with tax and regulatory filings as required

At the same time, your participants will receive support via our multi-lingual service support deck once they log into their participant portal, with information available to help them understand the options they were awarded.

Within this portal, not only can they manage and transact their option grants, but also access their agreements and documents, and a wealth of educational materials such as videos, guides, FAQs and more.

Summary of our employee stock option software

How our product and services can help you with employee stock option administration.

General:

– Excellent support: Includes a dedicated client manager and stock plan analyst team for your stock plan admin and service desk for employees.

– Equity intelligence: Offers legal, regulatory and tax information to help you navigate tax and regulatory complexities across different jurisdictions and assistant with compliance when granting equity worldwide.

Administration Software:

– Proprietary software allowing full control: Modern, agile technology with a team of 300 experienced professionals to set up and manage your plans effectively

– Ease of administration: All types of grants and plans are managed online, 24/7 using a setting-based configuration so there is no steep learning curve.

– Automation of admin tasks, e.g. task notification, vesting, grant status updates

– Reporting suites: A wide range of readily available financial & Business Intelligence (BI) reports at your fingertips.

– API integration: Equity data can be connected with your HRIS systems so you can track and manage everything in one place without switching between platforms.

– Stock plans for multiple jurisdictions: Our platform supports a wide range of options plans and grants worldwide in one seamless system, helping you to remain compliant when issuing rewards to your employees globally.

– Improved functions and features: Updates are rolled out regularly at no extra cost and without any need for input.

Participant Portal:

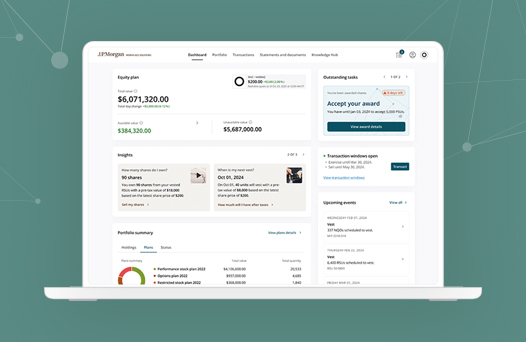

– A multi-currency user interface that allows participants to monitor, manage and transact their equity holdings 24/7, e.g. accept grants, view award balances, track vesting schedule, exercise stock options, sell their stocks etc

– Mobile app available: Manage and sell your equity on the go right in the palm of your hand

– Extensive education resources: Employee tax information sheets, FAQs, videos, how-to guides, modelling calculators

– Access to personal documents, e.g. contracts, agreements and statements

– Service helpdesk: Provide participants with multi-lingual support to free up your admin team’s time

J.P. Morgan Workplace Solutions – Your stock option management software

J.P. Morgan Workplace Solutions provide stock option management software and support for companies all over the world, helping to alleviate administrative complexities thanks to our automated, simplified software solutions.

Have questions about our stock option platform and services? Request a demo to find out more about how we can help you take your equity compensation plans to the next level.

This publication contains general information only and J.P. Morgan Workplace Solutions is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. J.P. Morgan Workplace Solutions’ Insights is not a substitute for professional advice and should not be used as such. J.P. Morgan Workplace Solutions does not assume any liability for reliance on the information provided herein.