When you’re a first time founder there’s a lot of learning on the job. With so many priorities vying for your attention it can sometimes feel like you’re jumping from one priority to the next with little time to get stuck into the details. Equity compensation management, which comes with its own specialized language, phrases and acronyms that could leave you baffled might not seem like a top concern at this stage, but if you don’t make your Cap Table perfect you’re setting yourself up for difficulty later on.

Which is why we hope this simple guide will help you get started.

Capital Gains Tax (CGT): Tax due on any capital gain or profit made when you dispose of an asset. How it’s calculated depends on a number of factors, including the length of time the shares were held for.

Cap Table: A Capitalization Table is a document that records the answers to two simple questions: who and how much? Who has ownership in your company, and how much do they each own. It can be laid out as a spreadsheet or a table. At this stage equity ownership is often the most valuable asset you can offer new employees, and then again when fundraising. But you need to keep an accurate record of how much equity you’ve distributed, and to whom. That’s all done on your Cap Table. Read more about Cap Table.

Cliff Vesting: When an equity plan becomes fully vested on a specified date rather than partially vesting in increasing amounts over an extended period. In this type of vesting, the employee gains no right to their grant until they have stayed with the company for the full specified period at which time the options become 100% vested. Read more about Cliff Vesting.

Convertible Notes: Often used by seed investors when investing in startups. They are short-term debt instruments (security) that can be converted into equity, i.e. a specified number of shares or common stock in the issuing company. This conversion normally occurs after a predetermined target or event is met.

Deferred Stock: A form of Long Term Incentive Plan (LTIP). This is stock on which no dividend is payable until after some other contingent event.

Employee Share/Stock Ownership Plan (ESOP): A type of employee ownership plan where employees can purchase and own stocks in that company. Often facilitated through deductions made from the employee’s salary.

Equity: Equity represents the value that would be returned to a company’s stockholders if all assets were liquidated and all of the company’s debts were paid off. It is the degree of residual ownership in a firm or asset after subtracting all associated debts.

Equity Compensation: Also known as stock- or share-based compensation, is a type of non-cash compensation that a company might offer to employees. It allows participants to partake in ownership of the firm and can include options, restricted stock and performance shares. Read more about Equity Compensation.

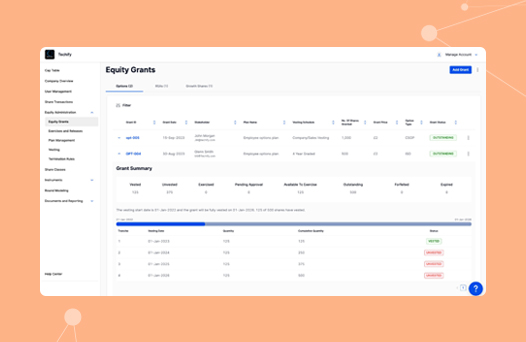

Equity Ownership Grants: A form of non-cash compensation, normally given to employees as a way of motivating and rewarding them. Popular among startups who may not have cash reserves, it gives the receiver equity or stock in the company.

Exercise: Nothing to do with hitting the gym. In the context of equity compensation this is an activity carried out for a specific purpose, e.g. selling stocks.

Fair Market Value (FMV): The price an asset would change hands for on the open market where all parties involved are aware of all the facts, acting in their own interest, free of any pressure to buy or sell, and have ample time to make the decision.

Funding Rounds: Whether it is seed funding, angel investing, or Series A, B and C, funding rounds are where you give outside investors the opportunity to invest cash in your business. This is done in exchange for either equity or partial ownership and needs to be recorded correctly in your Cap Table. After each funding round there may be dramatic changes to your Cap Table, which is where using a software solution can help.

Grants: An award, typically financial, given by one entity to another to facilitate or incentivize a goal or performance.

Initial Public Offering (IPO): Also called a stock launch, this is the first public offering in which shares of a company are sold to institutional investors and retail investors. It will typically involve the shares being listed on one or more stock exchanges. Read more about IPO.

Long Term Incentive Plan (LTIP): Usually awarded to executives or other senior employees to encourage them to remain with the company. This plan type rewards employees for reaching specific goals. Typically granted as performance shares or matching shares of the company. There are many types of LITPs and approaches to using them. Read more about Long Term Incentive Plan.

Stocks or Shares: A portion of ownership this can include company stocks or shares issued to the company’s employees or investors. What percentage have been issued and who owns them is information that will need to be recorded in your Cap Table.

Stock options: A form of equity compensation that gives the recipient the right to buy stocks in the company at a future date at a price agreed ahead of time. These are generally limited to people who are directly engaged in the business, such as employees, directors, consultants and advisors. Read more about Stock Options.

Warrants: Similar to Stock Options these are often used in early stage equity financing. They provide the option to purchase stocks at a future date at a fixed price. Warrants are usually issues to third parties such as investors.

Find Out More:

At J.P. Morgan Workplace Solutions we manage employee stock plans for some of the world’s most exciting startups, tech unicorns and enterprise brands.

When speaking to one of our equity specialists, whether that’s to help find the right plan for your company, or to uncover ways of enhancing your existing offering, we’ll always strive to use clear language, with any technical terms explained, meaning you won’t be left in the dark.

After all, employee ownership, simplified – it’s what we do.

This publication contains general information only and J.P. Morgan Workplace Solutions is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. J.P. Morgan Workplace Solutions’ Insights is not a substitute for professional advice and should not be used as such. J.P. Morgan Workplace Solutions does not assume any liability for reliance on the information provided herein.