Trusted by

businesses worldwide

Your cap table management

solution

Simplify investor and stock plan management with our straightforward

and intuitive experience.

Features

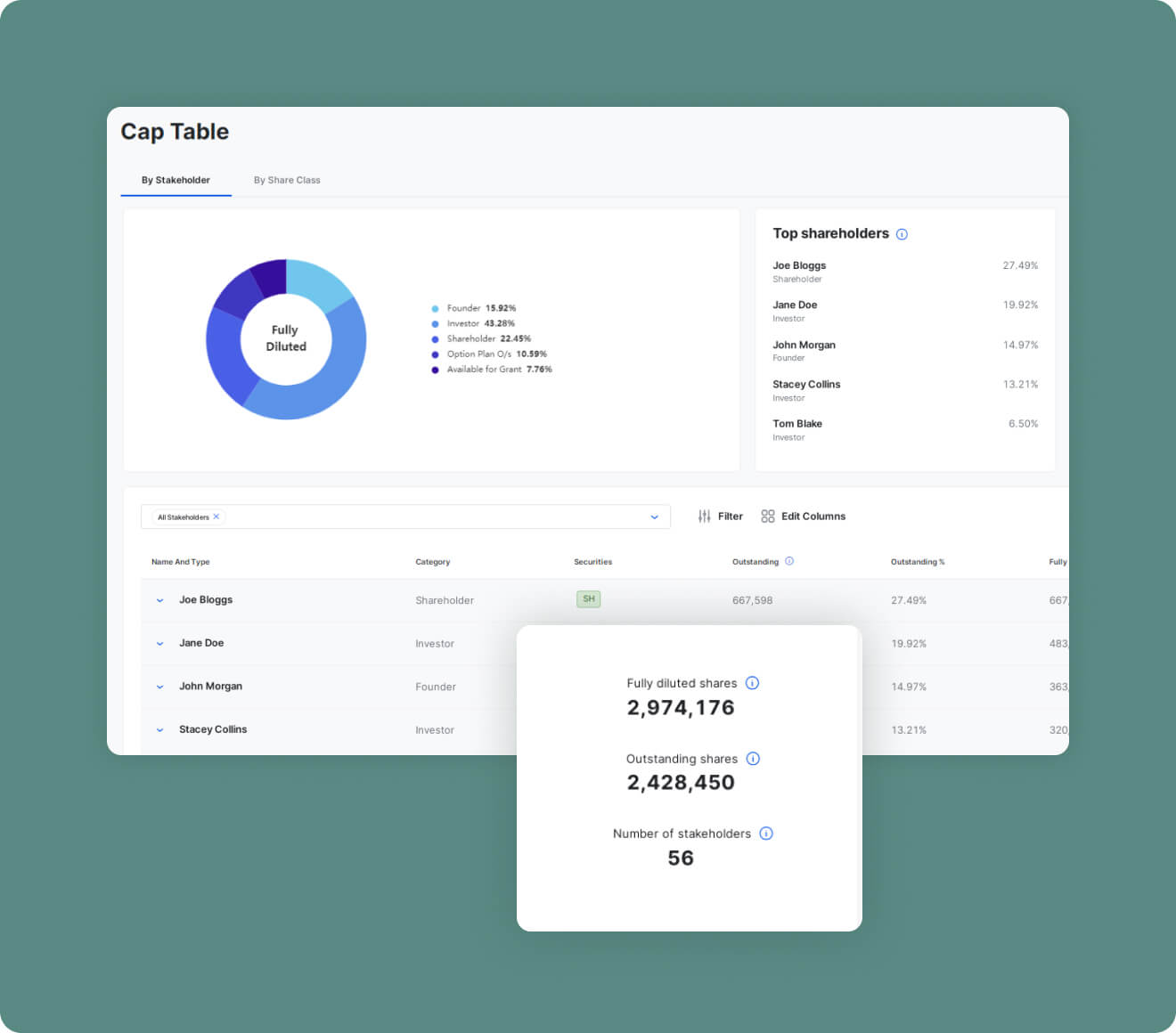

Cap table management

Streamline.

Digitize. Grow

The Capitalization ‘Cap’ Table is the very DNA of your company and contains everything a potential investor needs to know about the ownership. The more your company grows, the more complicated this becomes. An accurate cap table means a solid foundation for growth.

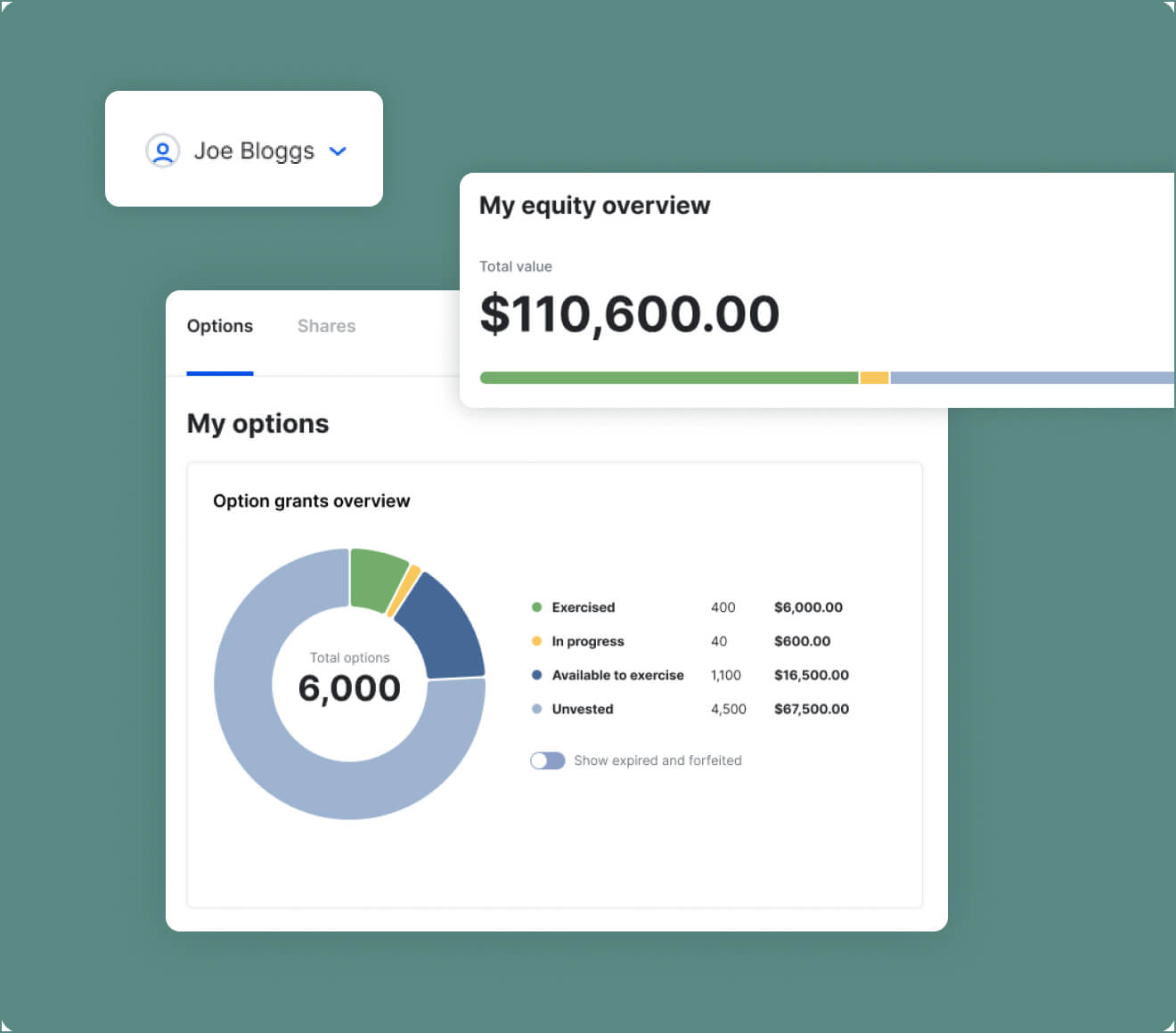

Stock plan management

Employee stock options simplified

Whether you issue stock options, restricted stock or other equity awards, we have you covered. Our stock plan functionality provides everything you need to incentivize your team.

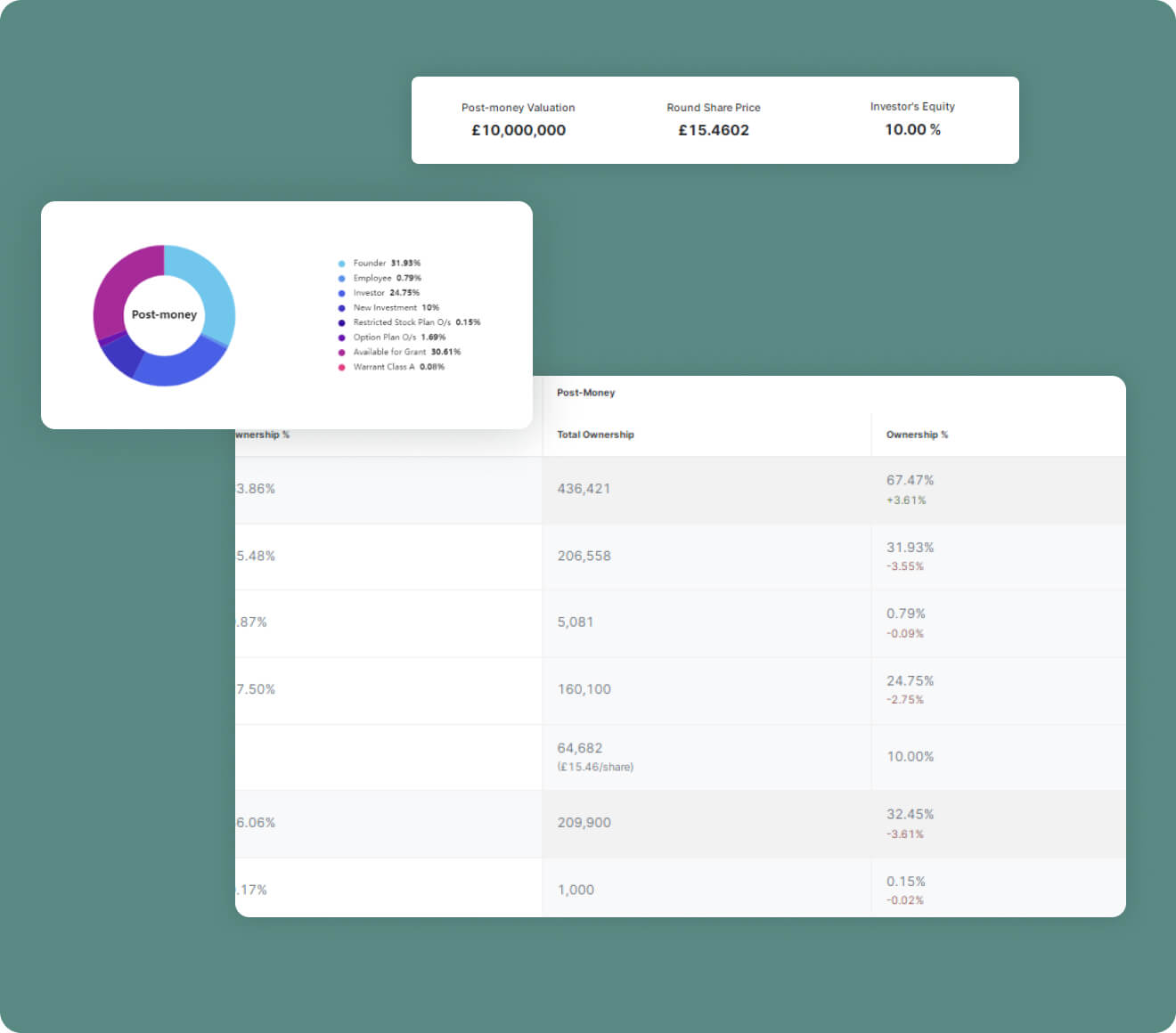

Round modeling

Facilitating your fundraising needs

Run multiple investment scenarios simultaneously, to understand the impact of dilution on all your stakeholders. Bring transparency to the conversion of Convertible Notes or SAFEs, and model top-ups to your option pool.

Employee Access

Engage your

employees

Your employees get access to see what they own, when it vests and any actions that are required from them.

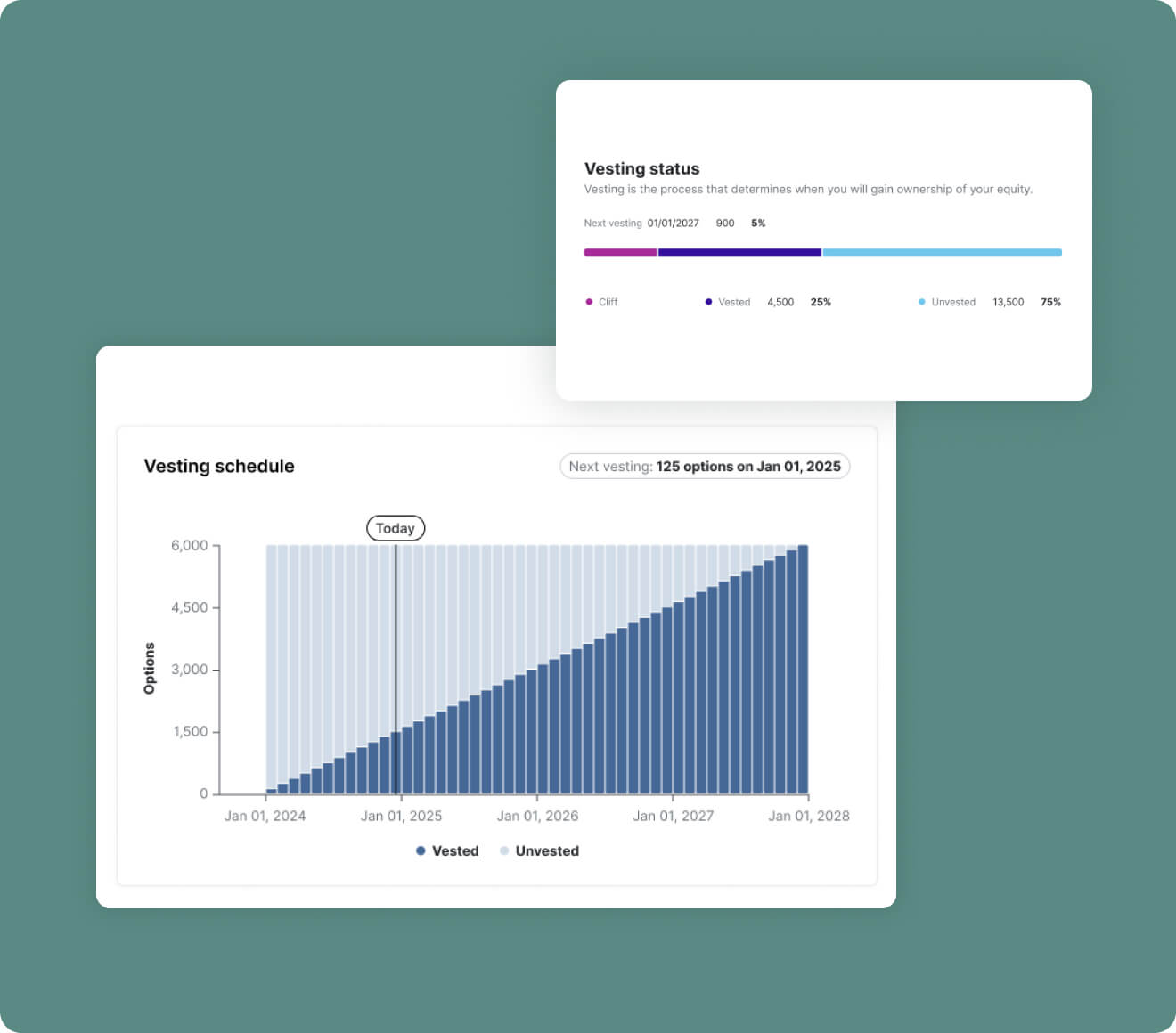

Vesting

The complex, simplified

Manage the vesting schedules across all your plans, grants and share issuances with a simple interface. View at a plan level, grant level and from an employee perspective, giving you full control over all your vesting requirements.

Grant acceptance workflow

Customizable

to suit you

Take your grant acceptance workflow online with simple drag and drop fields. Create the approval process that works for you. Give employees the power to accept their grants online and see the benefit as your company grows.

Partner with Workplace

Solutions

We empower businesses across the world to unlock the benefits of employee

equity and access new growth opportunities, while delivering exceptional value to

your clients and network.

Product FAQ

-

What about 409a valuations?

We can support 409a valuations for determining fair market value (FMV) for stock options and other equity-based compensation. This will help you to stay complaint with IRS regulations and help your company and employees avoid potential tax penalties.

-

My company uses the Workplace Solutions cap table management product. How do I login?

To access our cap table management product for private companies as an administrator, shareholder or stock plan participant click here

-

What if I have multiple types of stakeholders?

As the administrator you can manage user access levels for your different types of stakeholders, e.g. investors, employees. This means people can only see the information that’s relevant to them.

-

How many participants can I have on one account?

The sky’s the limit. Our custom plans have unlimited participant allowances, so whether it’s a small cohort of staff or an all-employee plan we can find an option to meet your equity needs.

-

How can I find out what platform might best suit my business?

Our cap table platform is suitable for start-ups, small business and private companies only. It is a self-service plan. You get access to our platform, and your stakeholders (employees and/or investors) get role-based access so they can see their shares, exercise their options and more. We also have a platform that is suitable for private and public companies who want to fully outsource the management of their employee share plans to our certified equity professionals.

-

I have employees based in numerous countries all over the world. Is Workplace Solutions suitable?

Yes. Workplace Solutions specializes in working with global companies and we have clients from all over the world, so our platform is suitable no matter what region you’re based in.

-

Do you have modeling calculators?

Yes, the scenario modeling feature within the cap table allows you to test various scenarios so that you can explore the outcome of potential fundraising rounds. Run, name, duplicate, and save multiple scenarios simultaneously. Break up proposed investments among new and existing investors and display the percentage change in equity ownership across each stakeholder line.

Choose the best pricing for your business

Standard

free

up to 40 stakeholders *

- Features included:

- Cap Table Management

- Stock Certificates

- Convertible Notes & SAFEs

- Employee and Investor Portal

- Round Modeling

- Board Consent Management

- E-sign for Share Transactions

- Equity Plan Templates

- Custom Email Communications

- Documents Library

- Email Support

- Concierge Onboarding

- 409a Valuation**

- ASC 718 Reporting**

View full list of features

View short list of features

Premium

$2,000/yr

or $200/mo

up to 100 stakeholders *

- Features included:

- Customer Success Manager

- Cap Table Management

- Stock Certificates

- Convertible Notes & SAFEs

- Employee and Investor Portal

- Round Modeling

- Board Consent Management

- E-sign for Share Transactions

- Equity Plan Templates

- Custom Email Communications

- Documents Library

- Concierge Onboarding

- 409a Valuation**

- ASC 718 Reporting**

View full list of features

View short list of features

Custom

from

$4,500/yr

or $450/mo

over 100 stakeholders *

- Features included:

- Customer Success Manager

- Cap Table Management

- Stock Certificates

- Convertible Notes & SAFEs

- Employee and Investor Portal

- Round Modeling

- Board Consent Management

- E-sign for Share Transactions

- Equity Plan Templates

- Custom Email Communications

- Documents Library

- Concierge Onboarding

- 409a Valuation**

- ASC 718 Reporting**

View full list of features

View short list of features

* A stakeholder is considered any person/entity that holds at least one of the following: equity (common/preferred shares); outstanding equity award (options/RSUs/RSAs); terminated equity award with an active exercisable period; a convertible instrument; warrant/SAR

** offered through our partners

Related insights

-

Funding rounds and the impact on your cap table

July 16, 2025