What are performance stock units?

Performance Stock Units (PSUs) are a form of stock-based compensation, which is a promise given by the company to issue stock to employees in the future when certain performance and service conditions have been met. No shares are issued when a PSU is granted.

Those performance conditions/targets are commonly based on stock market performance or other company goals such as earnings per share (EPS), total sales/revenues or levels of customer satisfaction. There’s also a trend whereby large US companies are increasingly linking Environmental, Social, and Governance (ESG) goals to their executive’s equity compensation rewards.

Why would companies grant executives performance-based awards?

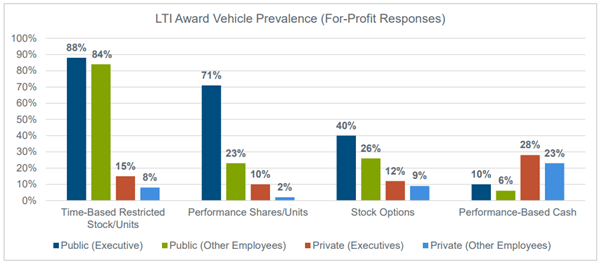

According to a recent study by Pearl Meyer, performance-based awards hold significant importance for executives, but they are granted less frequently to other employees. In public companies, 71% of executives receive performance shares/units, while only 23% of other employees receive them.

These awards allow companies to establish specific and relevant targets for executives, thereby aligning their efforts with company performance and shareholder goals.

By tying these targets to executive compensation, companies can incentivize their key employees to use their skills and experience to drive organizational success.

How do PSUs work?

Here’s the basic lifecycle of a performance award:

Grant ➜ Performance period & service period ends ➜ Vest ➜ Payout/Release

When you’re granted PSUs, you’ll first need to accept the grant which is usually free. At the end of the performance and service period, the performance results are certified (to confirm the performance goals are met) and then the award vests. Once vested, you’ll have the unrestricted right to receive the underlying stock.

Depending on your plan’s rules, the vesting date of your PSU may be

- The end of the performance period

- When the performance results are certified

- The date your award is paid out

- Some other date

As explained, the payout of shares and vesting can occur simultaneously. It can be deferred as well for a PSU. At payout, you’ll be delivered a targeted number of shares or cash equivalent depending on the achievement of certain performance goals.

You now can also sell, transfer or simply hold onto the shares.

Example:

Your company grants you 2,000 PSUs that will result in 2,000 shares if the earnings per share (EPS) of your company grows by 30% cumulatively after three years. If the EPS growth meets or exceeds the maximum, you’ll receive 200% of the target which is 4,000 PSU. If the minimum threshold is not reached, no PSU will be awarded.

| – | EPS | Payout % | PSU awarded |

|---|---|---|---|

| Minimum | 10% | 50% | 1,000 |

| Target | 30% | 100% | 2,000 |

| Maximum | 50% | 200% | 4,000 |

How are PSUs taxed in the US?

Taxes at grant:

When you’re granted PSUs, there’s no taxable event.

Taxes upon release of shares:

PSUs are taxable for income tax purposes on the release date. The fair market value (FMV) of the grant (minus the amount paid for the grant, if any) is taxable as ordinary income. Your company is also required to withhold federal, state, local and FICA taxes on this same taxable amount.

Example:

Sticking with the same payout example, let’s assume the awards were granted to you for free, and you achieved a performance payout of 100% after three years, resulting in 2,000 shares. When these shares are delivered, the FMV of the grant is $50.

Taxable Ordinary Income: $50 x 2,000 shares = $100,000

Taxes at sale:

When you sell your shares later, any appreciation of shares you receive from vested PSUs may be eligible to be taxed at capital gains rates (i.e., FMV at sale minus the stock price at vest, multiplied by the number of shares sold).

If you held your shares for more than a year after the vesting date, the capital gains should be eligible to be treated as long-term capital gains, which are typically taxed at a lower rate compared to ordinary income.

Example:

You decide to sell 1,000 shares when the FMV of the grant is $60

Capital gains: ($60-$50) x 1,000 shares = $10,000

Watch out for Rule 10b5-1 (US only)

When selling your PSU, your status within the company could potentially expose you to insider trading liability as you may have been identified as having access to material non-public information (MNPI) about the company’s business.

Thanks to the 10b5-1 plan, it provides an affirmative defense, allowing company insiders – such as board members, C-suite executives and others who might potentially possess MNPI – to sell and buy their company’s stock without violating insider trading laws. Head over to our 105b-1 article to learn more.

Contact Workplace Solutions

Employees may find PSUs operate quite differently from other types of equity compensation, so the best practice is to communicate with them throughout the entire life cycle of the plan. Some key aspects they may require information on include how the payout is calculated, when to expect to receive the stock, how and when the award will be taxed, etc.

We offer performance stock administration solutions, as well as engaging employee communications.

All case studies are shown for illustrative purposes only, and are hypothetical. Any name referenced is fictional. Information is not a guarantee of future results.

This publication contains general information only and J.P. Morgan Workplace Solutions is not, through this article, issuing any advice, be it legal, financial, tax-related, business-related, professional or other. J.P. Morgan Workplace Solutions’ Insights is not a substitute for professional advice and should not be used as such. J.P. Morgan Workplace Solutions does not assume any liability for reliance on the information provided herein.